Compare top pet health care insurance plans 2025. Discover costs, ROI benefits & coverage options in USA, UK, Canada & Australia

Pet Health Care Insurance ROI & Growth Benefits for Pet Owners in USA, UK, Canada & Australia

Pet health care insurance has rapidly evolved into one of the fastest-growing segments of the insurance industry, offering financial protection and peace of mind for millions of pet owners in the USA, UK, Canada, and Australia. With veterinary costs skyrocketing, having a comprehensive insurance plan allows pet parents to ensure that their furry companions receive the best possible medical care without facing crippling financial stress.

From wellness checkups and vaccinations to advanced surgeries and chronic illness treatments, the scope of pet insurance delivers a strong return on investment (ROI) both in financial terms and in emotional security. As global pet adoption rates rise and households treat pets as family members, smart buyers in tier one markets are increasingly investing in robust insurance policies that protect their long-term budgets and guarantee quality healthcare for their beloved animals.

Pet Insurance Plan Coverage Examples for Smart Buyers in Tier One Markets

When purchasing pet insurance in developed countries like the USA, UK, Canada, and Australia, understanding what a plan covers is essential. Pet owners should review specific inclusions and exclusions, ensuring they maximize value. Below are some practical coverage examples that highlight what smart buyers typically look for:

- Accident Coverage

- Emergency care for broken bones, injuries, or poisoning

- Surgical procedures after road accidents

- Diagnostic imaging (X-rays, CT scans, MRIs)

- Illness Coverage

- Treatment for chronic diseases (diabetes, arthritis, kidney disease)

- Prescription medications for ongoing conditions

- Specialist veterinary care for advanced illnesses

- Preventive & Routine Care

- Annual wellness exams

- Vaccinations & parasite prevention

- Spaying/neutering options (optional in many plans)

- Hereditary & Congenital Conditions

- Coverage for breed-specific conditions such as hip dysplasia in dogs

- Cardiac conditions, allergies, and orthopedic disorders

- Dental Care

- Tooth extractions due to injury or illness

- Preventive dental cleaning (varies by policy)

- Alternative & Holistic Therapies

- Acupuncture, hydrotherapy, and physiotherapy

- Chiropractic and rehabilitation programs

- End-of-Life Coverage

- Euthanasia fees in severe cases

- Cremation or burial assistance depending on the plan

By analyzing these categories, pet owners in tier one markets gain a clearer perspective on which coverage levels bring the highest ROI in terms of financial savings and quality healthcare.

Pet Insurance Reviews & Testimonials That Build Trust for Decision-Makers

Trust is a critical component when choosing pet health care insurance. Independent reviews and verified testimonials often shape buyer decisions, especially in the USA and UK where customer satisfaction directly influences conversions. Positive testimonials emphasize:

- Quick claims approval times that reduce financial stress for families

- Transparent pricing without hidden deductibles

- Responsive customer support available 24/7

- Comprehensive illness coverage for long-term care needs

For example, pet owners in Canada often highlight how insurance prevented them from paying $6,000+ in emergency surgery costs. Similarly, Australian reviews reveal how pet insurance saved families during sudden illness episodes, reinforcing the policy’s value for both households and enterprises with working animals.

How Pet Health Insurance Works for Enterprises & Households

Pet health insurance operates similarly to human health coverage but is specifically designed to meet veterinary needs. Here’s a breakdown of how it works:

- Monthly Premiums: Owners pay a fixed amount for coverage, often ranging from $25–$70 depending on the country, breed, and coverage plan.

- Deductibles: Out-of-pocket payments before insurance kicks in; typically annual.

- Reimbursement: After veterinary treatment, owners file claims and receive 70–90% reimbursement.

- Coverage Tiers: Plans differ in scope, from accident-only to comprehensive accident + illness + wellness packages.

- Enterprise Plans: In some markets, companies provide pet insurance benefits to employees, improving retention and overall wellness culture.

This structure benefits both households (financial protection) and enterprises (employee loyalty & benefits), fueling industry growth across tier one markets.

How Much Does Pet Insurance Cost? A Complete Buyer’s Guide

The cost of pet insurance depends on several factors including pet species, breed, age, and location.

- Dogs: Average monthly premium in the USA ranges from $40–$70.

- Cats: Lower premiums, averaging $25–$40 monthly.

- Exotics: Birds, reptiles, and rabbits may cost higher due to specialized care.

Additional cost factors:

- Age of Pet – Older pets face higher premiums.

- Breed – High-risk breeds (e.g., bulldogs, German shepherds) cost more.

- Coverage Level – Accident-only plans are cheaper, while wellness-inclusive plans add more.

- Location – Metropolitan areas like New York, London, Toronto, and Sydney have higher veterinary costs.

For ROI-driven buyers, balancing premiums with coverage inclusions ensures the highest cost-benefit ratio.

Top Pet Insurance Benefits for Families & Professionals in USA, UK, Canada & Australia

Pet insurance provides tangible financial and lifestyle benefits:

- Financial Security: Prevents unexpected expenses from draining savings.

- Improved Care Access: Enables pet owners to afford advanced treatments.

- Workplace Wellness: For professionals, reduces absenteeism caused by pet health emergencies.

- Peace of Mind: Owners can make medical decisions based on health, not affordability.

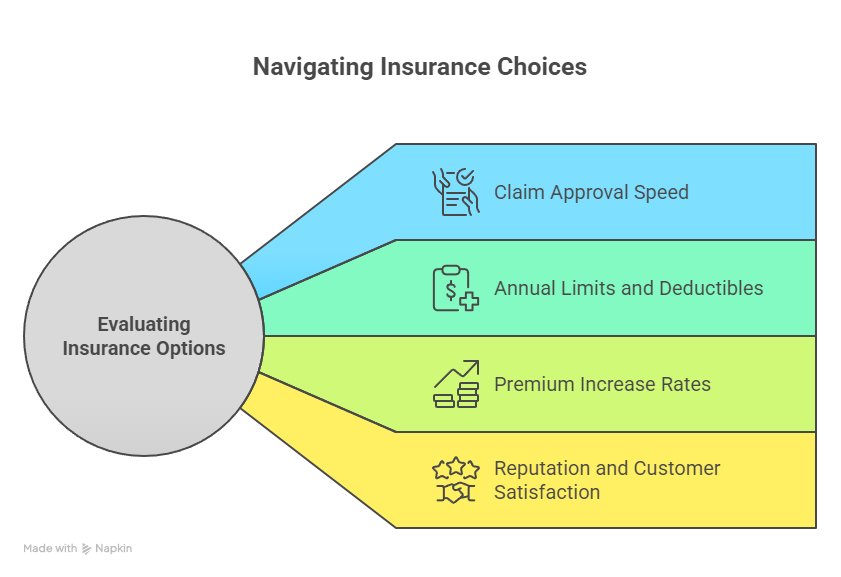

Choosing the Best Pet Insurance for ROI & Long-Term Conversion Value

When comparing providers, buyers should evaluate:

- Claim approval speed

- Annual limits and deductibles

- Premium increase rates over time

- Reputation and customer satisfaction ratings

Annual Deductibles in Pet Health Insurance: Costs That Impact ROI

| Deductible Type | Average Cost (USD) | ROI Impact | Example Market |

|---|---|---|---|

| Low Deductible ($100–$250) | Higher monthly premiums | Faster reimbursement | USA, UK |

| Medium Deductible ($500) | Balanced premiums | Good ROI for chronic illness | Canada |

| High Deductible ($1,000+) | Lower premiums | Best ROI for healthy pets | Australia |

Coverage Limitations & Medical Cost Transparency for Tier One Pet Owners

Common exclusions include:

- Pre-existing conditions

- Elective procedures

- Breeding-related costs

- Cosmetic treatments

Understanding these limitations prevents claim denials and enhances long-term satisfaction.

Enterprise Comparison of Pet Insurance Companies for Trust & Conversions

Enterprises offering pet benefits often choose providers with:

- Global networks of vets

- Employee discounts on premiums

- Seamless claim filing apps

- Proven track records of transparent reimbursements

Maximizing Pet Insurance Claims for Higher ROI in USA, UK, Canada & Australia

To maximize ROI:

- File claims promptly after vet visits.

- Maintain proper medical records.

- Use in-network veterinarians when applicable.

- Choose plans with direct vet payment options for cash flow relief.

Key Benefits of Pet Insurance: Step-by-Step Guide for Tier One Pet Owners

- Select plan type (accident-only, comprehensive, or wellness).

- Compare providers based on transparency and reviews.

- Evaluate deductibles and coverage limits.

- Enroll your pet early to avoid pre-existing condition exclusions.

- File claims correctly and promptly for reimbursement.

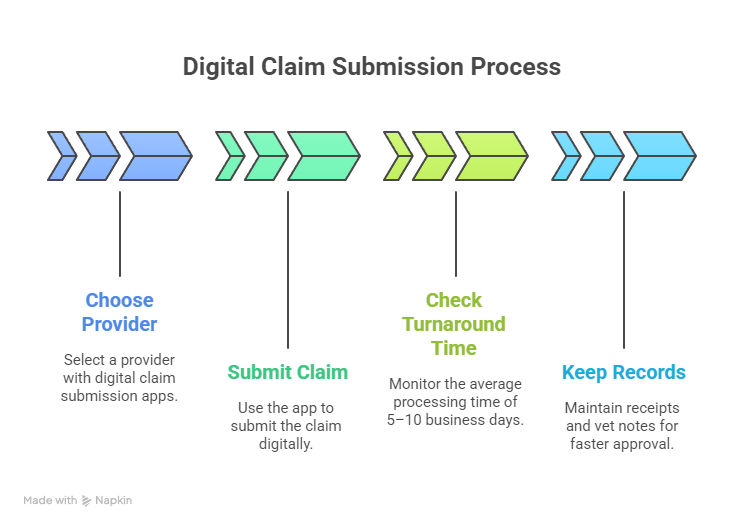

Easy Pet Insurance Claim Experience: Quick Tips for ROI Growth

- Use providers with digital claim submission apps.

- Check turnaround time (average: 5–10 business days).

- Keep receipts and vet notes for faster approval.

ASPCA Pet Health Insurance: Why It Matters for USA Buyers

- One of the most trusted providers with wide vet acceptance.

- Customizable accident & illness plans.

- Wellness options for preventive care.

Best Short Accident Waiting Period Plans in Tier One Countries

- USA: Embrace Pet Insurance (2-day waiting period).

- UK: ManyPets (immediate accident coverage).

- Canada: Trupanion (fast approvals).

- Australia: PetSure (short waiting periods).

How to Lower Pet Insurance Premiums: Checklist for Tier One Families

- Enroll pets at a younger age.

- Choose higher deductibles if financially viable.

- Bundle with multi-pet discounts.

- Exclude unnecessary add-ons.

Which Pets Are Eligible for Pet Health Insurance Coverage?

- Dogs, cats, rabbits (common)

- Exotic pets depending on provider

Is There a Waiting Period Before Pet Insurance Coverage Begins?

- Yes, typically 2–14 days for accidents and 14–30 days for illnesses.

Can You Choose Any Veterinarian for Pet Insurance Services?

- In most tier one markets, yes. Owners can select any licensed vet.

Is There a Maximum Age Limit for Pet Insurance Enrollment?

- Commonly up to 14 years for dogs and 12 years for cats. Older pets face exclusions.

Pet Insurance Trends & Growth Insights in USA, UK, Canada & Australia

- Market projected to exceed $15 billion by 2027.

- Rising demand for holistic care coverage.

- Corporate employee-benefit integration growing.

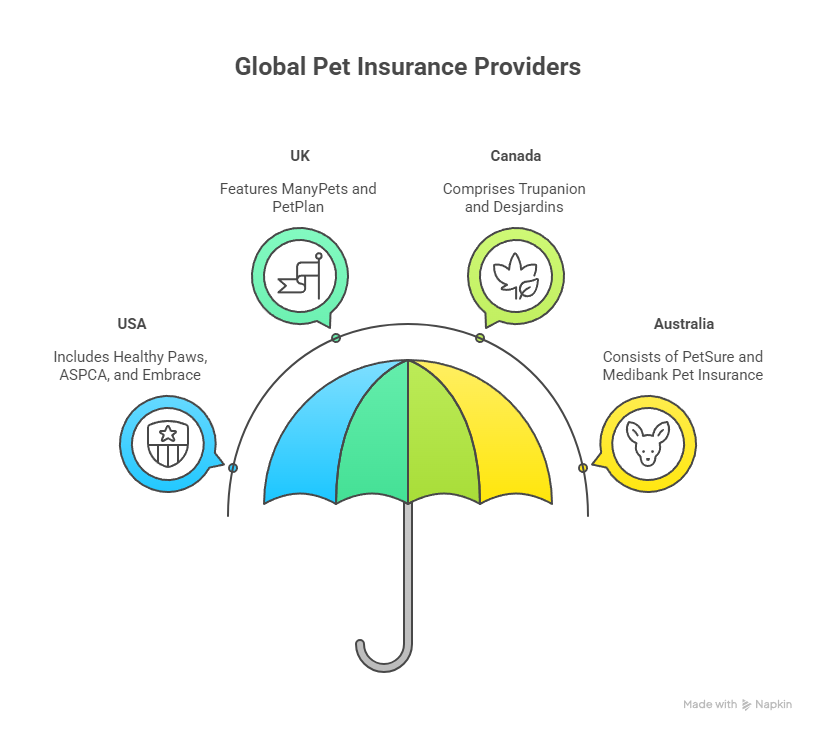

Best Pet Health Insurance Plans 2025: Expert Insights for Tier One Buyers

- USA: Healthy Paws, ASPCA, Embrace

- UK: ManyPets, PetPlan

- Canada: Trupanion, Desjardins

- Australia: PetSure, Medibank Pet Insurance

Which Type of Pet Insurance Delivers Highest ROI for Families & Enterprises?

- Comprehensive accident + illness plans generally provide the strongest ROI.

Free Dog Health Insurance Options: Reports for UK, USA & Australia Owners

- Limited-time free trials offered by providers for puppies and new sign-ups.

Best Pet Insurance Company Comparisons With Growth Metrics in Tier One Markets

Companies like Healthy Paws (USA), PetPlan (UK), Trupanion (Canada), and PetSure (Australia) dominate tier one markets due to strong growth metrics and conversion rates.

Veterinary Experts Reveal Top ROI Pet Insurance Plans for Dogs & Cats

Experts emphasize plans with low waiting periods, high reimbursement rates, and transparent exclusions as best for ROI.

FAQ

Q1: What is the best pet health insurance company in USA & Canada for ROI?

Healthy Paws (USA) and Trupanion (Canada) are top-rated for high ROI.

Q2: How much does top-rated pet insurance cost per month in Tier One markets?

$25–$70 depending on breed, age, and coverage level.

Q3: What are the best accident & illness coverage plans for pets in UK & Australia?

ManyPets (UK) and PetSure (Australia) provide strong ROI.

Q4: Can pet insurance help with long-term ROI in medical cost savings?

Yes. Owners save thousands annually by avoiding high vet bills.

Q5: What is the checklist for comparing pet insurance services in 2025?

Evaluate cost, deductibles, coverage, reviews, and claim approval speed.

Q6: Which pet insurance companies offer the highest lead generation & conversions for affiliates?

Healthy Paws, ASPCA, Trupanion, and PetPlan.

Q7: Are there jobs in the pet health insurance industry with strong ROI growth in USA & UK?

Yes. Careers in claims, underwriting, and marketing are growing rapidly.

Q8: What is the best insurance plan for older dogs and cats in Canada & Australia?

Trupanion (Canada) and PetSure (Australia) offer flexible plans for seniors.

Q9: How do you maximize ROI when filing pet insurance claims?

Submit claims quickly, maintain full medical records, and choose providers with direct payment.

Q10: Which is the top pet health insurance with the fastest claim approval in Tier One countries?

Trupanion (Canada/USA) and ManyPets (UK) lead in fast claim approvals.