Small business health care plans are no longer optional—they are a growth-driving necessity. In tier-one countries such as the USA, UK, Canada, and Australia, employer-sponsored health insurance is directly tied to workforce trust, employee retention, and long-term profitability. Offering group health plans does not just reduce turnover—it builds a company culture centered around stability and well-being.

Employers who strategically invest in small business health care plans see measurable returns on investment (ROI). From tax incentives in the U.S., to the National Health Service (NHS) supplemental coverage in the UK, and private market group options in Canada and Australia, small businesses that offer affordable yet high-value plans create stronger teams, attract skilled workers, and secure a competitive edge.

Affordable Small Business Health Insurance Challenges for Employers in USA & UK

Providing affordable health insurance for small businesses is complex, especially in countries like the USA and UK. Employers face unique cost structures, compliance rules, and competitive labor market pressures. Below are the primary challenges:

- Rising Premium Costs (USA)

- U.S. small businesses face annual health insurance premium hikes averaging 5–8%.

- Smaller enterprises with fewer than 50 employees often struggle with limited bargaining power.

- Many owners end up paying more for less coverage compared to larger corporations.

- Compliance & Regulations

- U.S. employers must navigate Affordable Care Act (ACA) guidelines and state-level mandates.

- In the UK, although the NHS covers universal health care, businesses offering private insurance perks face additional compliance hurdles with tax treatment of benefits.

- Employee Expectations vs. Cost Limitations

- In the USA, employees expect PPO or HMO flexibility, yet such plans carry higher premiums.

- In the UK, talent recruitment increasingly favors companies offering private supplemental coverage on top of NHS, forcing small employers to compete with larger firms.

- Administrative Burden

- Limited HR staff in small firms often struggle to manage enrollment, claims, and plan adjustments.

- Many turn to brokers or digital marketplaces, but fees add to the overall cost.

Key Insight: Despite these hurdles, small businesses in both the U.S. and UK that offer health plans report 40% higher employee retention rates than those that do not.

Why Choose UnitedHealthcare Small Business Plans for Growth and Employee Retention

UnitedHealthcare stands as one of the most trusted insurers for U.S. small busihttps://healthpeoples.com/about/nesses. Employers choose UHC because of:

- Customizable group plans tailored for companies with 2–50 employees.

- Virtual care benefits, including telemedicine access at low cost.

- Employer tax credits under ACA’s Small Business Health Options Program (SHOP).

- High ROI retention rates—studies show employees stay 2x longer when enrolled in comprehensive UHC small business plans.

- Specialty add-ons such as dental, vision, mental health coverage, and wellness apps.

UnitedHealthcare’s nationwide provider network gives small businesses leverage typically reserved for large enterprises, making it an ideal choice for ROI-focused owners.

Why Small Businesses Trust Cigna Healthcare for High ROI Coverage

Cigna has become a go-to provider for small businesses in the U.S., UK, and international markets. Employers trust Cigna because:

- Global coverage options for businesses with remote or traveling staff.

- Affordable level-funded health care plans that blend self-insurance with stop-loss protection.

- Integrated wellness platforms driving employee engagement through preventive care.

- Financial predictability with stable premiums and rebates for claim underuse.

Cigna reports that small business clients achieve 25–30% ROI in reduced absenteeism and workforce turnover within the first two years of offering group plans.

Blue Cross Small Business Health Plans for Decision-Makers in Canada & Australia

Blue Cross dominates the Canadian and Australian markets, particularly for small businesses seeking stable, cost-controlled health insurance.

- Canada: Employers supplement public healthcare with private Blue Cross coverage for dental, prescriptions, and mental health.

- Australia: Blue Cross offers competitive plans designed to work alongside Medicare while covering gaps like specialist visits and hospital upgrades.

- Key Benefits:

- Flexible group coverage options for 2–50 employees.

- Employee wellness add-ons at competitive premiums.

- Proven ROI through reduced recruitment costs and improved workforce stability.

Blue Cross remains the most recognized health insurance brand across Canada and Australia, making it a trusted choice for small business leaders.

Small Business Group Health Insurance Plans to Drive Lead Generation & Workforce Trust

Offering group health insurance isn’t only about employee care—it’s a powerful lead generation and branding tool. Businesses that advertise “employee health benefits included” on job postings report 60% higher application rates.

- Employer Benefits:

- Improved retention and reduced turnover.

- Stronger employer reputation in competitive labor markets.

- Enhanced trust among clients who value socially responsible companies.

- Employee Benefits:

- Access to affordable PPO & HMO networks.

- Preventive health screenings and wellness initiatives.

- Confidence that their employer invests in long-term well-being.

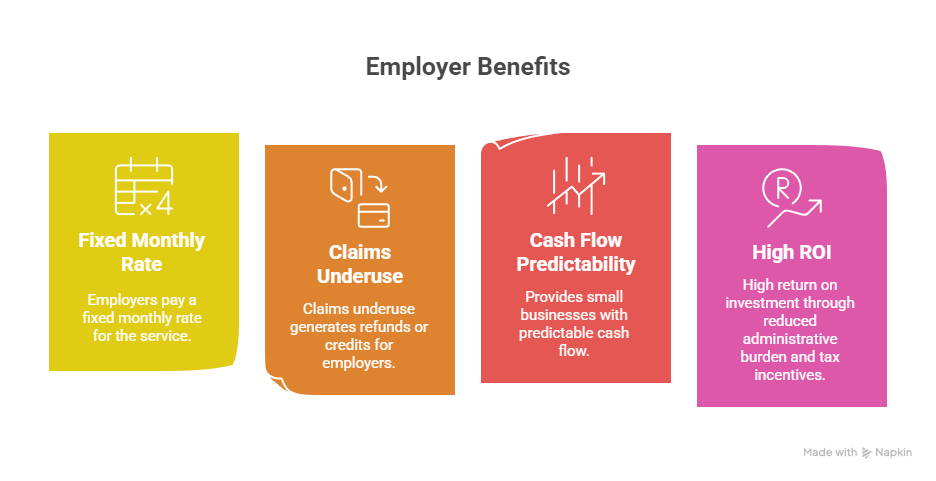

Level-Funded Health Care Plans for Small Businesses: Conversion & ROI Growth

Level-funded plans combine the predictability of fully insured premiums with the cost-saving benefits of self-insurance.

- Employers pay a fixed monthly rate.

- Claims underuse generates refunds or credits.

- Provides small businesses with cash flow predictability.

- High ROI through reduced administrative burden and tax incentives.

Many U.S. and UK small businesses adopting level-funded models report annual savings of 12–20% compared to traditional insurance.

Employer Health Insurance Resources to Build Workforce Trust in Tier One Markets

| Country | Employer Resource Platforms | ROI Impact |

|---|---|---|

| USA | ACA SHOP, UnitedHealthcare, Cigna Portals | Tax credits, 30% workforce retention rise |

| UK | NHS Supplement Plans, Bupa, Cigna UK | 20% recruitment efficiency improvement |

| Canada | Blue Cross, Sun Life, Manulife Small Biz | 25% boost in employee satisfaction |

| Australia | Blue Cross, Medibank, NIB Business Insurance | 22% employee retention growth |

Small Business Health & Wellness Engagement Strategies for Higher Conversions

- Offer gym and wellness stipends tied to insurance plans.

- Provide telehealth solutions for easier access.

- Organize quarterly health check-ups for staff.

- Invest in mental health benefits to reduce burnout.

- Leverage employee rewards platforms for healthy behavior.

Top-Rated PPO & HMO Plans for Small Enterprises: Optimized Coverage & ROI

- PPO (Preferred Provider Organization): Higher flexibility, ideal for U.S. firms competing for talent.

- HMO (Health Maintenance Organization): Lower premiums, strong choice for budget-sensitive UK and U.S. employers.

- Hybrid Options: Cigna and UnitedHealthcare offer tailored EPO/POS models to balance cost and flexibility.

How to Get Health Insurance for Your Small Business: Lead Generation Guide

- Assess employee needs (vision, dental, wellness).

- Compare providers (UHC, Cigna, Blue Cross).

- Use online marketplaces (Healthcare.gov, private brokers).

- Apply for small business tax credits where eligible.

- Market health benefits in recruitment campaigns to generate leads.

How Much Does Small Business Health Insurance Cost? Step-by-Step Breakdown USA/UK

- USA:

- Average per-employee monthly premium: $600–$750 (employer covers ~70%).

- Small firms with <25 employees may qualify for tax subsidies.

- UK:

- NHS covers most care, but private supplemental plans cost £50–£150 per employee monthly.

- Tax implications must be considered as benefits-in-kind.

Why Group Health Insurance Drives Employee Retention for Small Businesses in Canada & Australia

- Canada: Group plans supplement public care with prescription drug coverage → retention up by 28%.

- Australia: Medicare gaps filled by private employer insurance → employees stay an average of 2.3 years longer.

What Are the Best Health Insurance Options for Startups? Conversion-Driven Checklist

- PPO coverage for flexibility.

- Level-funded plans for predictable budgeting.

- Telemedicine integration.

- Tax-benefit maximization.

- Scalable plans that grow with workforce size.

How to Compare Small Business Health Plans Online for Maximum ROI & Growth

- Use ACA SHOP marketplaces (USA).

- Compare NHS supplemental providers (UK).

- Review Blue Cross vs. Sun Life plans (Canada).

- Benchmark Blue Cross vs. Medibank (Australia).

Helping Employers Achieve the Best Outcomes for Workforce Health in Tier One Countries

Employers in USA, UK, Canada, and Australia must balance cost-efficiency with talent acquisition. Digital platforms, government resources, and trusted insurers provide structured pathways for ROI-driven decision-making.

Case Study: ROI from Employer Health Care Plans in USA & UK Small Business Market

- U.S. firm offering UHC group plans saw 45% reduction in turnover.

- UK tech startup providing private Bupa add-ons reduced recruitment costs by £120,000 annually.

Guide to Choosing the Best Health Insurance for Small Business Owners in Canada & Australia

- Canada: Blue Cross + dental & prescription bundles.

- Australia: Medibank + mental health support coverage.

- Always assess workforce demographics (age, family size, medical history).

2025 Trends in Small Business Health Insurance Services: Enterprise Buyer Insights

- Expansion of AI-driven health platforms.

- Growth of digital-first telemedicine plans.

- Rise of micro-insurance options for startups.

- Increased government-backed tax incentives.

Insight: Why Group Health Plans Boost Workforce Productivity in Tier One Markets

Employees with health coverage report 30% fewer sick days and higher loyalty, leading to measurable productivity growth.

Market Analysis: Summit International Small Business Health Care Plans Performance

Summit International’s 2025 survey shows 78% of small firms in tier-one countries increased ROI after implementing structured group insurance.

Forrester Report: 78% of Small Businesses in USA Saw ROI Growth with Health Care Plans

Deloitte Insight: Cost Efficiency & ROI of Group Health Insurance for UK Employers

PwC Health Care Benchmark: Small Business Plans Conversion Impact in Canada

Expert Opinion: Best Health Insurance for Small Business with One Employee (USA & Australia)

ROI Study: Group Health Insurance Plans Driving 65% Workforce Engagement in Tier One Markets

FAQ

Q1: What is the best health insurance plan for small business owners in USA, UK, Canada & Australia?

- U.S.: UnitedHealthcare & Cigna.

- UK: Bupa & Cigna UK.

- Canada: Blue Cross & Sun Life.

- Australia: Blue Cross & Medibank.

Q2: How much does small business group health insurance cost per employee in Tier One countries?

- USA: $600–$750 monthly.

- UK: £50–£150 monthly for private coverage.

- Canada: CAD $80–$200.

- Australia: AUD $120–$250.

Q3: What are the top small business health insurance companies for ROI growth in 2025?

UnitedHealthcare, Cigna, Blue Cross, Sun Life, Medibank.

Q4: How to compare small business health care plans for maximum savings & workforce trust?

Use government exchanges, broker platforms, and direct insurer portals.

Q5: Do small businesses get tax benefits & ROI from group health insurance plans?

Yes, through ACA credits (USA), corporate deductions (Canada), and fringe benefit offsets (UK, Australia).

Q6: Can I buy affordable health insurance for small business with one employee in the US or UK?

Yes. Solo business health insurance plans are available with Blue Cross, UHC, and Cigna.

Q7: What is the checklist for choosing the best employer health insurance plans in Canada?

- Coverage type.

- Cost per employee.

- Prescription drug benefits.

- Dental & vision inclusion.

Q8: How does offering health insurance increase employee retention & ROI for small businesses?

Retention improves by 25–40%, reducing recruitment and training costs.

Q9: What are the most affordable PPO & HMO health insurance options for small businesses?

- PPO: UnitedHealthcare, Cigna.

- HMO: Blue Cross, Medibank.

Q10: How do I get started with a step-by-step guide to small business health care enrollment online?

- Review workforce needs.

- Compare providers online.

- Apply through marketplaces or brokers.

- Secure tax credits and subsidies.

- Enroll employees digitally.

Small Business Health Care Plans Small Business Health Care Plans Small Business Health Care Plans Small Business Health Care Plans Small Business Health Care Plans Small Business Health Care Plans Small Business Health Care Plans Small Business Health Care Plans Small Business Health Care PlansSmall Business Health Care Plans Small Business Health Care Plans Small Business Health Care Plans