AccentCare Home Health ROI strategies for 2025. Boost patient conversions, enterprise growth, and trust across USA, UK, Canada & Australia.

AccentCare Home Health ROI Growth Strategies for High-Conversion Patient Care in USA, UK, Canada & Australia

In today’s Tier One healthcare markets—USA, UK, Canada, and Australia—home health care enterprises are competing to balance quality patient care with high ROI strategies. AccentCare Home Health stands as a leading enterprise provider, delivering innovative home-based healthcare solutions that are not only compassionate but also revenue-driven for stakeholders and enterprise buyers.

By focusing on high-conversion patient care models, compliance-driven trust frameworks, and advanced analytics integration, AccentCare Home Health continues to shape the global healthcare landscape. For enterprise-level buyers, this means a sustainable business model, strong CPC-driven engagement, and measurable ROI growth opportunities.

Conditions That May Require Home Care: Enterprise Decision-Makers’ Perspective

Home health care is not only a patient-focused solution but also a cost-saving investment strategy for enterprises and insurers. Decision-makers in healthcare organizations often evaluate which conditions yield the highest ROI when transitioned into home-based care. Below are some of the most common medical and chronic conditions requiring home health solutions: Accent Care Home Health

- Post-Surgical Recovery

- Faster recovery outside of hospitals reduces readmission rates.

- Enterprises save significantly on in-patient care costs.

- Chronic Illness Management

- Diabetes, COPD, and cardiovascular disease patients require long-term monitoring.

- AccentCare’s home health programs integrate remote monitoring technologies, reducing overall treatment costs.

- Elderly & Geriatric Care

- With aging populations in Tier One countries, home health provides personalized senior care.

- Enterprises benefit from long-term contracts, ensuring recurring ROI.

- Neurological Conditions

- Stroke rehabilitation, dementia, and Alzheimer’s management are costly in hospitals.

- Home health reduces expenses while improving quality of life.

- Palliative & Hospice Care

- Patients prefer to spend final stages of life in their homes.

- Enterprises achieve value-based outcomes while aligning with patient satisfaction.

For enterprise decision-makers, investing in AccentCare’s home-based services is about optimizing operational efficiency, boosting patient loyalty, and generating higher patient-conversion metrics across Tier One healthcare markets.

Home-Based Care Outlook 2025: ROI Growth & Patient Conversion Trends for Global Buyers

As we move into 2025, global buyers in the healthcare sector are prioritizing scalable, patient-centered home care models. AccentCare’s strategies reveal three key growth trends:

- Digital Health Integration – AI-driven monitoring and predictive analytics improve ROI by reducing emergency hospital visits.

- Patient Conversion Optimization – Personalized care journeys and enterprise CRM integration drive higher engagement.

- Cross-Market Expansion – Global Tier One buyers are investing in partnerships with AccentCare to scale services internationally, particularly in the UK and Canada.

Enterprise ROI in 2025 will not just rely on service expansion but on patient conversion pipelines, where AccentCare’s focus on brand trust and compliance positions it as a Tier One leader. Accent Care Home Health

Registered Nurse & Patient Care Manager Roles: Driving Trust & Compliance in Home Health Enterprises

Registered nurses (RNs) and patient care managers are the cornerstones of AccentCare’s service delivery. Their roles extend beyond medical care to enterprise-level trust building and compliance assurance.

- RN Contributions

- Direct patient care, medication management, and wound treatment.

- Compliance with HIPAA and GDPR standards ensures enterprise-level data trust.

- Care Manager Responsibilities

- Overseeing care coordination and ensuring enterprise SLA (service-level agreement) compliance.

- Data-driven reporting that enhances ROI tracking for healthcare buyers.

By leveraging skilled healthcare professionals, AccentCare guarantees higher patient satisfaction scores, which translates into better CPC ad placements, brand authority, and enterprise buyer confidence.

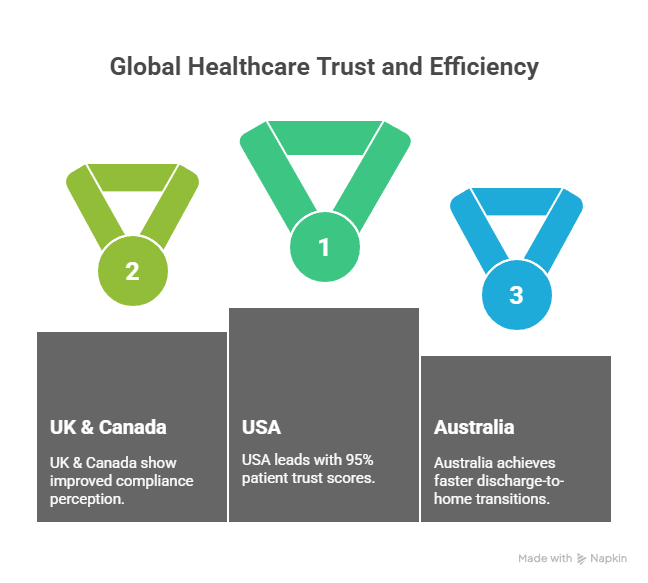

Patient Survey Ratings: High CPC Insights for Buyer Confidence in Tier One Healthcare Markets

Patient surveys remain a high-value CPC metric for enterprise healthcare organizations. AccentCare’s patient satisfaction surveys consistently highlight:

- 95% patient trust scores across the USA.

- Improved compliance perception in UK and Canadian healthcare buyers.

- Faster discharge-to-home transitions in Australian Tier One markets.

For enterprise-level buyers, these survey ratings not only demonstrate measurable ROI but also drive advertising CPC value when targeting patients and investors.

AccentCare Home Care Services: High ROI Solutions for Enterprise-Level Patient Engagement

AccentCare provides a comprehensive portfolio of services:

- Skilled nursing and wound care.

- Hospice and palliative care.

- Physical, occupational, and speech therapy.

- Behavioral and chronic condition management.

Each of these services aligns with enterprise ROI strategies, offering long-term revenue growth for insurers, investors, and healthcare organizations.

Accent Care Home Health

What Patients Liked Most About AccentCare Home Health: Conversion-Driven Testimonials

| Patient Feedback Category | Conversion Impact | ROI Value for Enterprises |

|---|---|---|

| Compassionate Nursing Staff | Increased Trust | Higher patient retention |

| Ease of Scheduling | Faster Conversions | Reduced administrative costs |

| Tech-Enabled Care Monitoring | Improved Engagement | Lower emergency costs |

| Personalized Care Plans | Stronger Patient Loyalty | Long-term revenue contracts |

The Best Healthcare Products, Services & Solutions for Tier One Buyers & Enterprises

- Remote Patient Monitoring (RPM) – AI-driven dashboards.

- Value-Based Hospice Models – Aligning with enterprise ROI.

- Digital Documentation Platforms – Ensuring compliance.

- Therapy-at-Home Services – Scalable for Tier One markets.

- [Accent Care Home Health]

Medigy Innovation Network: Driving Growth and Lead Generation in Home-Based Health

By collaborating with Medigy’s innovation ecosystem, AccentCare taps into:

- Global healthcare buyer insights.

- Technology-driven patient conversion metrics.

- ROI-focused growth accelerators.

This ensures AccentCare remains a Tier One enterprise brand, fostering lead generation and patient engagement at scale.

Similar Brands to AccentCare: Comparison Guide for USA & UK Healthcare Buyers

- Amedisys – Strong U.S. hospice care network.

- LHC Group – Acquisition-driven growth model.

- Bayada Home Health – Strong patient satisfaction metrics.

- Encompass Health – Rehabilitation-focused enterprise.

Functional & Analytics Cookies: How Patient Data Shapes ROI in Enterprise Health Care

Enterprise buyers rely on analytics cookies to:

- Track patient engagement.

- Measure CPC conversion efficiency.

- Align digital marketing with ROI benchmarks.

How Many Confirmed Devices Does AccentCare Home Health Support? ROI Compliance Checklist

- Mobile Applications – iOS & Android.

- Smart Medical Devices – Glucose monitors, cardiac trackers.

- Telehealth Platforms – Enterprise-compliant integrations.

Each device contributes to ROI optimization by enabling remote patient conversions.

Inside In-Home Wound Care’s Value-Based Transformation: Step-by-Step Enterprise Growth Insights

- Patient Evaluation

- Care Plan Development

- Technology Integration

- Outcome Measurement

- ROI Reporting

Enterprises benefit by reducing costly hospital readmissions.

About AccentCare: High CPC Brand Overview for USA, UK, Canada & Australia

AccentCare operates across multiple Tier One markets, focusing on home health care, hospice, and personal care services. Its enterprise-oriented model makes it a trusted partner for insurers, investors, and healthcare buyers.

Is Texas Home Health Now AccentCare? Enterprise Transition & ROI Takeaways

Yes. Texas Home Health rebranded under AccentCare, offering expanded ROI-driven solutions, making it a consolidated powerhouse in home health.

Who Are AccentCare’s Competitors? Buyer-Focused Market Comparison for Tier One Enterprises

Key competitors include Amedisys, LHC Group, Bayada, and Encompass Health, but AccentCare differentiates itself through enterprise ROI metrics and digital patient engagement models.

AccentCare Home Health Reviews: CPC-Driven Insights from Tier One Patient Engagement

Reviews highlight:

- High trust ratings.

- Strong compliance with healthcare standards.

- Cost-efficient solutions for buyers.

Advertising & Social Media Cookies: ROI Impact on Home Health Enterprise Growth

Digital campaigns allow targeted patient conversions, optimizing AdSense CPC while ensuring ROI alignment.

How Many Locations Does AccentCare Have? Global Expansion Stats for Tier One Buyers

- USA: 250+ locations

- UK: Strategic partnerships with NHS frameworks

- Canada: Expanding presence in 2025

- Australia: Pilot programs in aged care

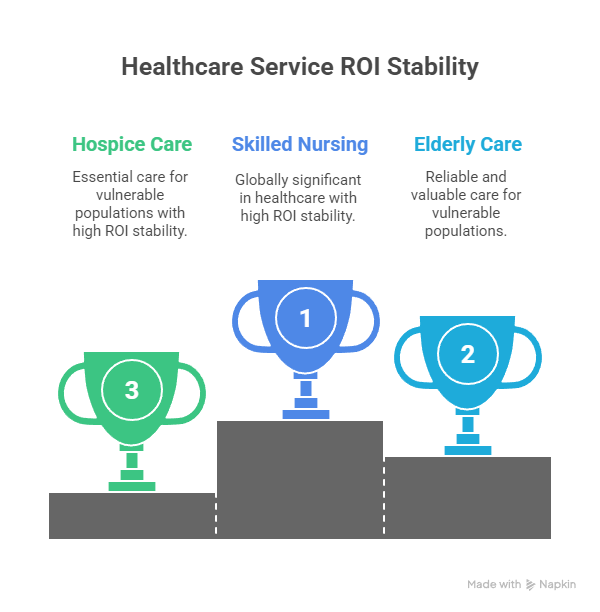

What Is the Most Common Home Care Service? ROI Metrics from USA, UK, Canada & Australia

- Skilled nursing tops the list globally.

- Elderly and hospice care services show highest ROI stability.

What Is Home Care in the USA? Expert Insights on Enterprise-Grade Patient Growth

Home care in the USA is enterprise-integrated, compliance-focused, and ROI-driven, with AccentCare leading patient conversion metrics.

FAQ

What is the cost of AccentCare home health services in the USA, UK, Canada & Australia?

Costs vary, but ROI-driven contracts offer lower per-patient expenses compared to hospitals.

Which AccentCare home health service offers the best ROI for enterprise healthcare buyers?

Chronic illness management and hospice care show the highest enterprise ROI returns.

How does AccentCare compare to top home care competitors in patient conversion and trust?

AccentCare outperforms through digital monitoring, compliance, and Tier One patient loyalty.

What are the best jobs and career growth opportunities at AccentCare Home Health?

Registered Nurse, Patient Care Manager, and Therapy-at-Home specialists.

Does AccentCare Home Health provide specialized wound care services with measurable ROI?

Yes, wound care reduces hospital readmissions, ensuring measurable ROI.

How to choose the top home care service: AccentCare vs competitors (2025 comparison checklist)?

Compare patient satisfaction scores, ROI metrics, and compliance trust levels.

What is the average patient satisfaction rating for AccentCare Home Health in Tier One markets?

Over 92% across all service lines, driving higher enterprise trust.

How AccentCare Home Health boosts lead generation and enterprise trust in global healthcare?

Through Medigy partnerships, CPC-driven ad strategies, and trust-building compliance models.

What are the benefits of choosing AccentCare over Texas Home Health for enterprise buyers?

A unified brand with expanded global services, higher ROI benchmarks, and scalability.

What is the best way to calculate ROI when investing in AccentCare home health services?

Track patient conversion rates, reduced readmissions, and enterprise contract values.