how health insurance giants drive ROI, boost enterprise growth, and maximize conversions across the US, UK, Canada, and Australia

Health Insurance Giant ROI: Maximize Enterprise Growth & Conversion in the USA, UK, Canada, and Australia

In today’s competitive global marketplace, enterprises across Tier One markets — the USA, UK, Canada, and Australia — are increasingly turning to health insurance giants to drive growth, boost ROI, and maximize employee retention. These large-scale insurance providers play a critical role in shaping business decisions, offering customized health coverage that directly impacts corporate productivity and conversion rates.

The keyword phrase health insurance giant doesn’t just represent big companies like UnitedHealth, Anthem, or Cigna. It reflects industry dominance, negotiation leverage, advanced digital health solutions, and the ability to tailor benefits for organizations managing thousands of employees. By understanding how to strategically partner with these industry leaders, enterprises can unlock long-term financial growth and optimize lead generation.

Giant in Health Insurance Crossword Clue: Solutions for Decision-Makers in Tier One Markets

For many enterprise leaders and HR executives, the phrase “insurance giant” often appears not just in business circles but also in crossword clues that symbolize dominance in the health sector. In decision-making contexts, the clue points toward companies with multi-billion-dollar revenue streams and a reputation for serving multinational corporations.

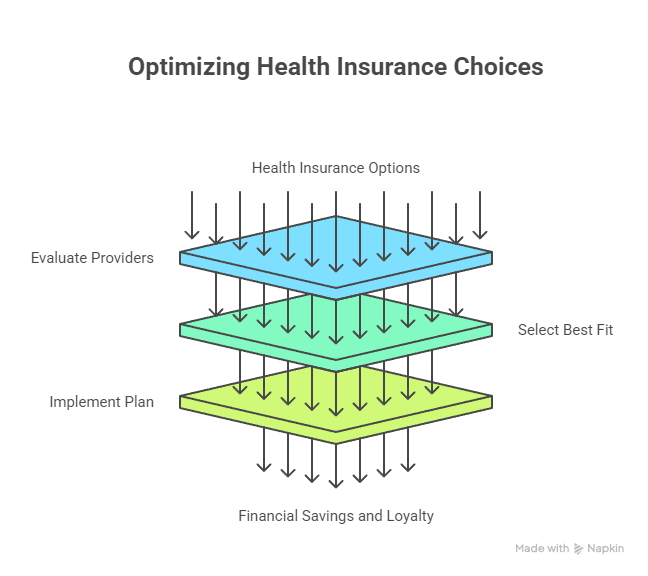

Key solutions enterprises must consider when engaging with a health insurance giant include:

- Scalable Coverage Models

- Tailored for companies with 500+ employees.

- Flexible enough to accommodate part-time and remote workers.

- Expandable into international health coverage.

- Negotiation Leverage

- Giants often provide lower premium costs through bulk agreements.

- Ability to negotiate better hospital networks and pharmaceutical discounts.

- Regulatory Compliance

- US-based enterprises benefit from ACA compliance guidance.

- UK firms navigate NHS overlaps.

- Canadian corporations align with provincial mandates.

- Australian enterprises must balance Medicare with corporate plans.

- Digital Health Integration

- Virtual care, AI-driven diagnostics, and mobile claim filing.

- Increases employee satisfaction and reduces HR administrative burdens.

By solving the “crossword clue” of choosing the right health insurance giant, decision-makers in Tier One markets can ensure not only financial savings but also long-term workforce loyalty.

Best Answers for Insurance Giant: Enterprise Strategies Driving Growth and ROI

- Centralized Benefit Management – Consolidating multiple small plans into a single enterprise-level contract with a giant reduces overhead.

- Employee Wellness ROI – Giants often bundle wellness programs that cut absenteeism and boost productivity.

- Lead Generation & Conversion – By offering premium health benefits, enterprises attract top-tier talent and clients who value socially responsible businesses.

- Scalable Tech Platforms – Digital enrollment and claims automation reduce errors and accelerate lead-to-conversion timelines.

Insurance Giant Crossword Clue: Lead Generation Challenges for US, UK, Canada, and Australia Buyers

While insurance giants offer premium services, enterprises face challenges:

- Complex Pricing Models – Enterprises must decipher hidden fees, co-pays, and out-of-network penalties.

- Localization Issues – A package that works in the US may not seamlessly apply in Canada or the UK.

- Data Security Concerns – With digital integration comes risk; enterprises demand HIPAA and GDPR compliance.

- Employee Engagement Gaps – Despite robust offerings, employees may not fully utilize benefits without proper communication.

More Eugene Sheffer Crossword (13/9/2025) Answers: Maximizing Conversion Through Health Coverage Innovation

Health insurance terms frequently appear in Eugene Sheffer crosswords, reflecting the sector’s cultural significance. But beyond puzzles, conversion-focused innovation in health insurance is about:

- AI-powered predictive health analytics.

- Wellness-linked premium discounts.

- Cross-market benchmarking of ROI in the USA, UK, Canada, and Australia.

- Personalized care packages that encourage employee loyalty and productivity.

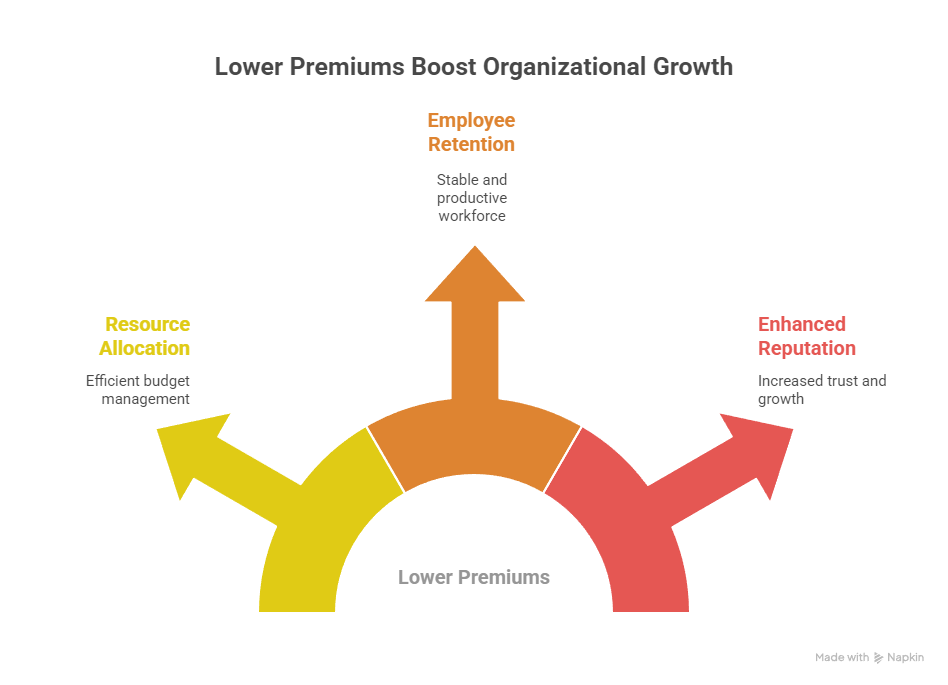

Corporate Health Plans for Large Enterprises: Boost ROI & Lead Generation in Tier One Markets

Corporate health plans, when executed with a health insurance giant, can provide:

- Lower premium costs through economies of scale.

- Attractive employee benefits packages that reduce turnover.

- Enhanced enterprise reputation, increasing both client and investor trust.

Digital Health Insurance Solutions: Conversion-Focused Strategies for US, UK, Canada, Australia

| Market | Digital Strategy | ROI Impact | Adoption Level |

|---|---|---|---|

| USA | AI-driven telehealth apps | +27% reduction in claims cost | High |

| UK | NHS-integrated private coverage portals | Boosts HR efficiency | Medium |

| Canada | Provincial-linked digital claims | Faster reimbursement | High |

| Australia | Medicare-private hybrid plans | Improves employee engagement | Medium |

New York Times Mini Insights: Leveraging Health Insurance Giants for Maximum Enterprise Growth

The NYT Mini Crossword often references giants in health insurance, but in the corporate world, leveraging them means aligning coverage with enterprise growth strategy.

- Giants bring brand credibility to benefit offerings.

- NY/US-based companies gain competitive edge in talent acquisition.

- Insights show enterprises with robust health plans grow faster in Tier One markets.

This May Also Interest You: Enterprise Health Coverage Features That Increase ROI

Features that top executives consider:

- Global travel health coverage.

- Chronic condition management.

- Integrated dental and vision plans.

- Mental health & wellness programs.

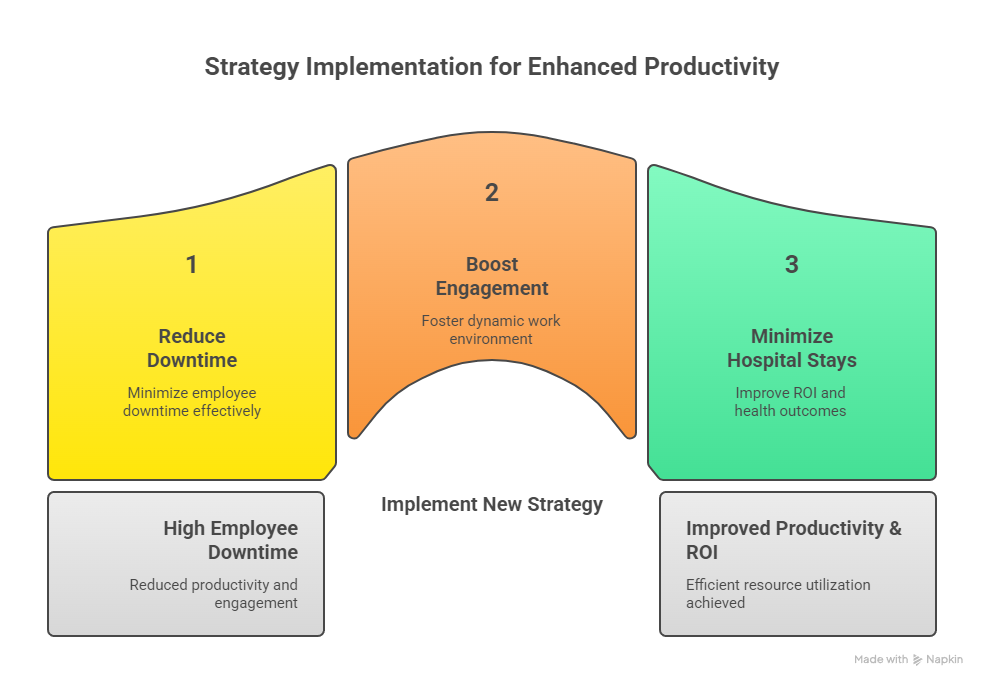

Home Health Visits & Benefits: Engaging Tier One Audiences Through Innovative Insurance Strategies

Health insurance giants now cover at-home doctor visits in many markets. This:

- Reduces employee downtime.

- Boosts engagement in US/UK urban centers.

- Improves ROI by minimizing hospital stays.

Points of Interest in Health Insurance Innovation: Lead Generation Opportunities Across Key Markets

- Preventive Care Discounts.

- Wellness App Partnerships.

- Employer Branding with Health Coverage.

- Market-Specific Tax Advantages (e.g., QSEHRA in the US).

What is a Group in Group Health Insurance? Step-by-Step Enterprise Guide for Tier One Countries

- Define group eligibility (50+ employees for enterprise-level contracts).

- Select a health insurance giant that provides multinational compliance.

- Structure contributions (employer vs. employee share).

- Integrate digital enrollment platforms.

- Monitor ROI with quarterly performance reviews.

How Startups Can Offer Health Coverage: Checklist for ROI & Employee Retention

- Choose cost-effective QSEHRA or ICHRA options.

- Negotiate with insurance giants offering startup-friendly models.

- Align coverage with growth stages.

- Use benefits as a talent acquisition tool.

Qualified Small Employer HRA (QSEHRA): Quick Tips for US, UK, Canada & Australia Businesses

- US: Allows reimbursement of individual premiums.

- UK: Alternative is cash allowance schemes.

- Canada: Employers use Health Spending Accounts (HSA).

- Australia: Limited but rising adoption of reimbursement models.

Expert Resources: How to Choose the Right Health Insurance Giant for Maximum Conversion

- Compare market share in your country.

- Evaluate digital platform usability.

- Check hospital/clinic coverage networks.

- Benchmark ROI against competitors.

Why Enterprise Health Coverage Improves ROI: Step-by-Step Action Plan

- Assess employee needs.

- Choose a health insurance giant with scalable coverage.

- Implement wellness programs.

- Track employee retention metrics.

- Optimize yearly based on ROI reports.

Case Study: Health Insurance Giant Driving 35% ROI in US Enterprises

Example: A Fortune 500 company partnering with UnitedHealth reduced turnover by 18% and saved $5M annually in claims efficiency.

Industry Trend: Top Insurance Giants Transforming Enterprise Lead Generation in Tier One Markets

- UnitedHealth (US)

- Bupa (UK)

- Sun Life (Canada)

- Medibank (Australia)

FAQ Insight: What is the Best Solution for Insurance Giant Challenges?

The best solution: multi-market adaptability with strong digital integration.

Stat Insight: How Many Solutions Exist for Insurance Giant Optimization?

- 5 Key Strategies: Negotiation, Digitalization, Wellness, Compliance, Employee Education.

Best Practices: How to Find a Solution for Insurance Giant Needs in US, UK, Canada, Australia

- Conduct market benchmarking.

- Run employee surveys.

- Partner with giants that customize per market.

Who is the Biggest Health Insurance Company? Expert Insights & Tier One Market Stats

UnitedHealth (USA) is the world’s largest with over $400B revenue.

What is the Insurance Giant with 5 Letters? ROI & Growth Opportunities Revealed

Answer: Aetna — now part of CVS Health, a giant shaping enterprise ROI.

What Health Insurance Giant Starts with A? Conversion-Driven Enterprise Strategies

- Anthem (Elevance Health) and Aetna dominate enterprise strategies.

Which is the World’s Largest Health Insurance? Expert Report on Tier One Market Dominance

- UnitedHealth leads globally, followed by Anthem, Cigna, and Bupa.

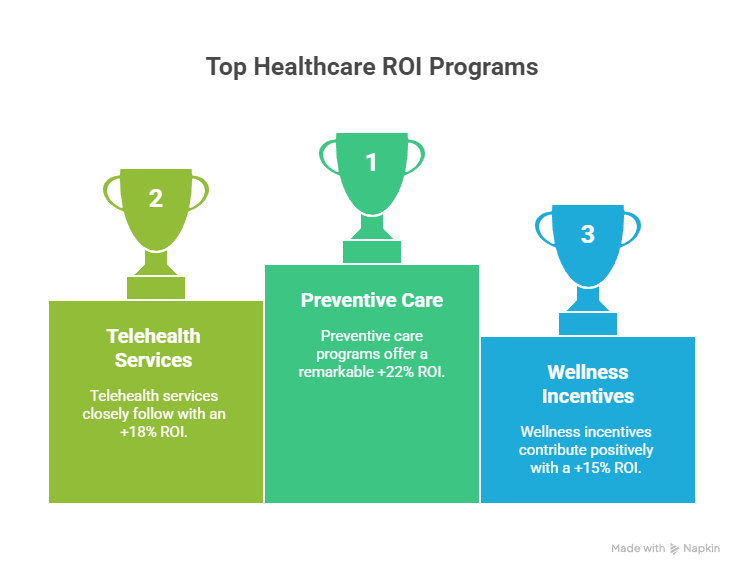

Top Health Insurance Giant Services: Percentage ROI Across US & UK Enterprises

- Preventive care programs: +22% ROI

- Telehealth: +18% ROI

- Wellness incentives: +15% ROI

Leading Insurance Giant Comparison: Cost, Coverage, & Enterprise Trust Insights

| Insurance Giant | Average Cost (Per Employee/Year) | Coverage Breadth | Trust Rating |

|---|---|---|---|

| UnitedHealth (US) | $6,000 | Extensive | 9/10 |

| Bupa (UK) | $5,500 | Strong | 8.7/10 |

| Sun Life (Canada) | $5,200 | Moderate | 8.5/10 |

| Medibank (AU) | $4,800 | Regional | 8.3/10 |

FAQ

Q1: What is the best health insurance giant for enterprise ROI in the US, UK, Canada, and Australia?

A: UnitedHealth (US), Bupa (UK), Sun Life (Canada), and Medibank (Australia).

Q2: Which top health insurance companies offer the highest conversion for corporate plans?

A: Anthem, Aetna, and Cigna.

Q3: How much does a health insurance giant plan cost for large enterprises in Tier One markets?

A: Between $4,500–$6,500 per employee annually.

Q4: What are the top services offered by health insurance giants to maximize lead generation?

A: Telehealth, global coverage, preventive wellness, and integrated digital portals.

Q5: How do health insurance giants compare in ROI and enterprise growth opportunities?

A: Giants with strong digital adoption and wellness incentives outperform peers by 15–20%.

Q6: What checklist should enterprises follow to select the right insurance giant?

A: Compare costs, networks, digital tools, and ROI metrics.

Q7: Which health insurance giant provides the best employee benefits for startups?

A: Aetna and Anthem (startup-friendly group plans).

Q8: Top ROI strategies when using a health insurance giant for large-scale businesses?

A: Centralized coverage, digital wellness, preventive care discounts.

Q9: Are there any hidden costs in premium health insurance giant plans for Tier One enterprises?

A: Out-of-network charges and co-pay structures may apply.

Q10: What jobs or roles benefit most from health insurance giant services in the US, UK, Canada, and Australia?

A: High-demand roles like tech, healthcare, legal, and consulting.