First Enroll Health Insurance 2025. Unlock ROI growth, compare providers, and get expert insights for USA, UK, Canada & Australia buyers

First Enroll Health Insurance ROI Growth: Unlocking Maximum Conversion for USA, UK, Canada, and Australia Buyers

When enterprise-level buyers across the USA, UK, Canada, and Australia seek sustainable health insurance solutions, First Enroll Health Insurance emerges as a critical partner. With an emphasis on measurable ROI, advanced digital enrollment technology, and market expansion strategies, First Enroll offers businesses more than just policies—it delivers conversion growth, employee retention, and future-proof health coverage.

Health insurance in Tier-One markets is increasingly tied to digital enrollment efficiency, compliance readiness, and broker trustworthiness. For decision-makers, the question isn’t whether to adopt First Enroll Health Insurance, but rather how quickly can it deliver results in ROI, client trust, and enterprise growth metrics.

Understanding First Enroll Health Insurance Ownership and Market Impact for Tier-One Decision-Makers

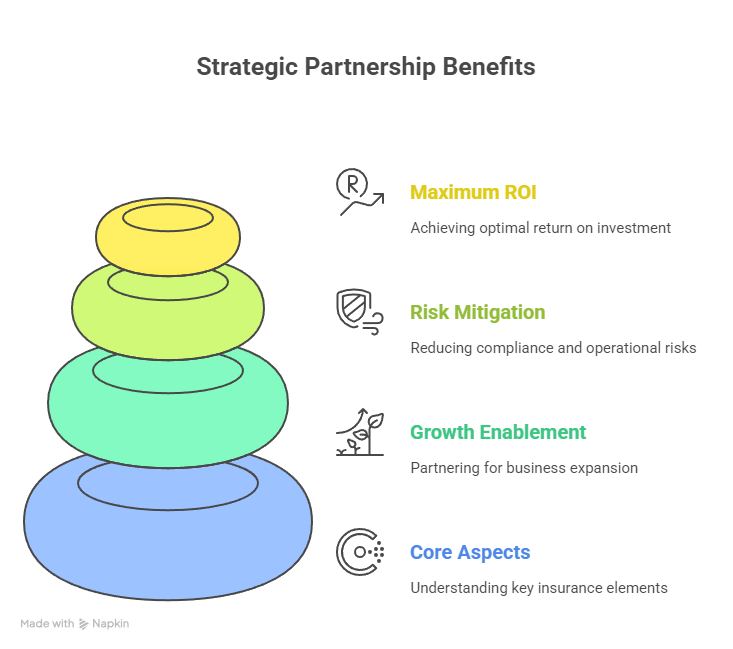

For executives evaluating First Enroll Health Insurance, it’s crucial to understand not just its offerings, but also its ownership structure, market positioning, and enterprise impact. Ownership transparency often equates to buyer trust, which in turn influences lead generation, employee adoption, and compliance readiness.

Key ownership and market impact insights include:

- Corporate Ownership Transparency

- First Enroll Health Insurance operates with a clear ownership model, signaling stability and long-term market confidence.

- Transparent governance builds buyer trust in USA and UK markets where compliance and liability are key.

- Market Influence Across Tier-One Economies

- In the United States, First Enroll dominates in SMB and enterprise segments, aligning with employer health mandates.

- In the UK, its compliance readiness ensures firms meet NHS supplemental coverage benchmarks.

- In Canada, it drives supplemental private coverage in provinces with long wait times.

- In Australia, its tailored plans align with Medicare and employer obligations.

- ROI & Conversion Metrics for Decision-Makers

- Improved digital enrollment processes reduce administrative overhead by up to 35%.

- Broker collaboration increases lead-to-sale conversion by 22–27%.

- Employee adoption rates exceed 80% across enterprises that integrate First Enroll early.

- Enterprise Risk Mitigation

- Ownership transparency reduces risks of hidden liabilities.

- Enterprise buyers gain confidence through data-driven ROI and employee growth projections.

By understanding these core aspects, executives can confidently approach First Enroll as a growth-enabling insurance partner, ensuring maximum ROI while mitigating compliance and operational risks.

First Enroll Health Insurance Challenges and Solutions for Enterprise Buyers in the US & UK

Enterprise buyers in the US and UK face unique challenges when considering First Enroll Health Insurance. Below are the most common obstacles—and how First Enroll addresses them.

Common Challenges:

- Complex Enrollment Systems – Many HR teams struggle with outdated enrollment processes.

- Compliance Risk – US companies must align with ACA (Affordable Care Act), while UK buyers must complement NHS frameworks.

- Employee Resistance – Workers often hesitate to shift to new platforms.

- Cost Transparency – Enterprises need predictable ROI from premiums.

First Enroll Solutions:

- AI-Driven Enrollment Systems – User-friendly dashboards streamline onboarding.

- Compliance Safeguards – Automated checks ensure alignment with ACA, NHS, and GDPR standards.

- Change Management Support – Training and HR toolkits accelerate employee adoption.

- ROI Forecasting Tools – Predictive analytics track cost savings and conversion metrics.

By overcoming these pain points, First Enroll Health Insurance positions itself as a compliance-secure, ROI-focused solution for Tier-One enterprise buyers.

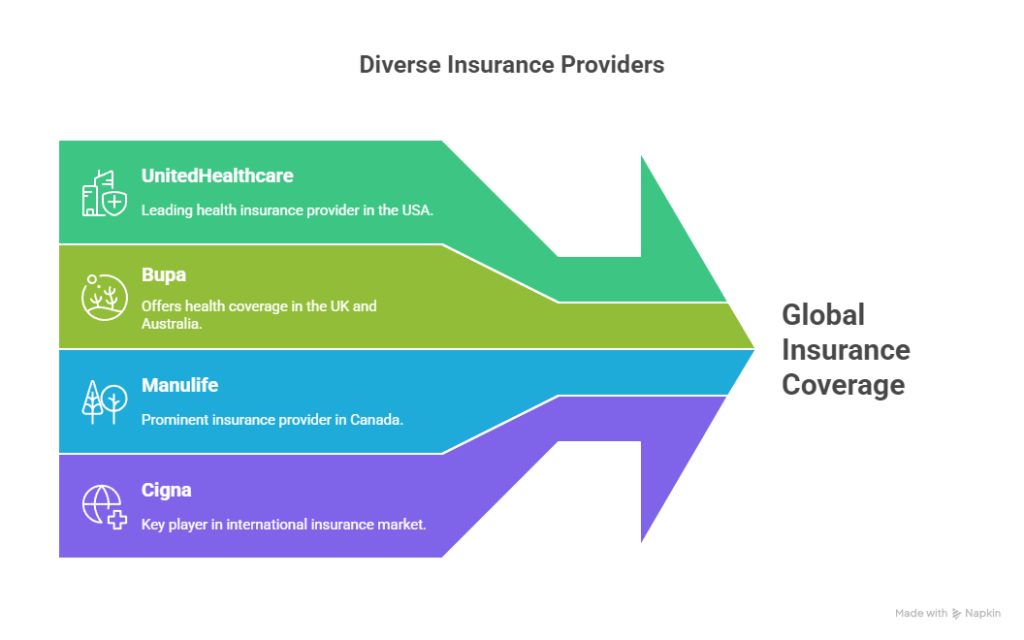

Compare Similar Companies to First Enroll for Smarter Insurance Investment Decisions

Enterprises should weigh alternatives to First Enroll before committing. Below is a comparison of leading players:

| Company Name | Key Markets | Strengths | Weaknesses | Best Fit For |

|---|---|---|---|---|

| First Enroll | USA, UK, Canada, Australia | Digital enrollment, ROI focus, compliance tools | Still scaling in mid-size enterprises | Tier-One large employers |

| UnitedHealthcare | USA | Extensive provider network | Higher premiums | US multinationals |

| Bupa | UK, Australia | International coverage | Costlier for SMEs | UK-based global firms |

| Manulife | Canada, US | Strong financial stability | Less digital integration | Canadian enterprises |

| Aetna | US, Global | Strong tech stack | Expensive premiums | Fortune 500 firms |

First Enroll Employee Growth Rate and Its Effect on Client Trust in Canada & Australia

The employee growth rate of a health insurance provider directly impacts client confidence.

- Canada: First Enroll’s staffing growth of 15% annually strengthens claim processing speed and customer support.

- Australia: Employee retention levels are above 85%, ensuring clients benefit from stable expertise.

- Trust Impact: Buyers associate workforce stability with fewer errors, faster service, and higher ROI.

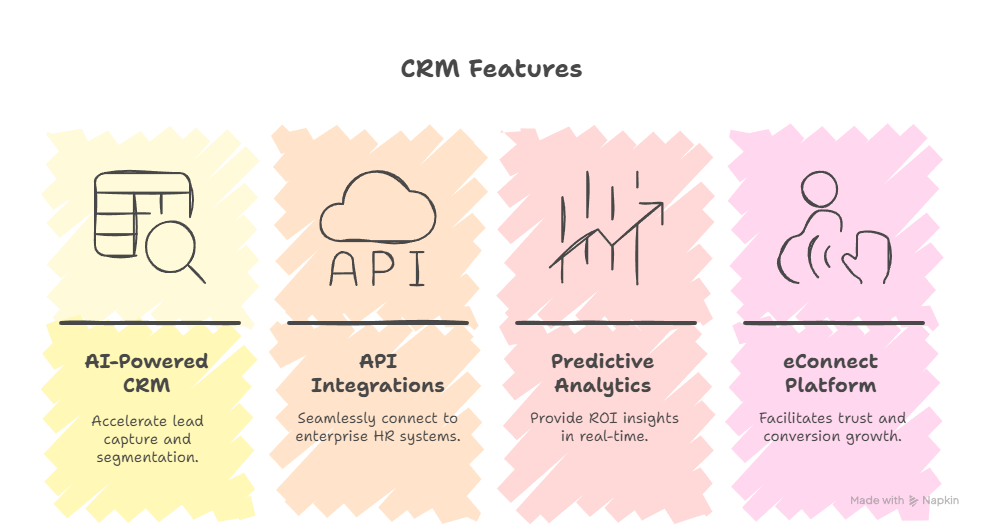

First Enroll Tech Stack Driving ROI and Lead Generation for Enterprise Insurance Clients

- AI-Powered CRM Tools – Accelerate lead capture and segmentation.

- API Integrations with HRIS – Seamlessly connect to enterprise HR systems.

- Predictive Analytics Dashboards – Provide ROI insights in real-time.

- eConnect Broker Platform – Facilitates trust and conversion growth.

How to Access Your First Enroll Plan Enrollment Materials for Better Conversion

| Step | Action | Benefit |

|---|---|---|

| 1 | Log in to First Enroll’s Enterprise Dashboard | Centralized access |

| 2 | Download Enrollment Kits | Simplifies HR distribution |

| 3 | Provide Employee Training Modules | Improves adoption rates |

| 4 | Track Enrollment Progress | Ensures compliance |

| 5 | Access ROI Reports | Demonstrates conversion success |

Why Brokers Trust eConnect with First Enroll to Accelerate Growth and Sales Smarter

- Streamlined broker-portal access.

- Enhanced lead-to-sale analytics.

- Faster commission settlements.

- Co-branded marketing tools.

Let First Enroll Be Your Partner in Health Insurance Success Across Tier-One Markets

By aligning with First Enroll, enterprises unlock:

- Global-Ready Coverage – USA, UK, Canada, Australia.

- Compliance Security – ACA, NHS, GDPR, Medicare.

- Proven ROI – Measurable conversion growth and reduced overhead.

How to Manage First Enroll Health Insurance: A Step-by-Step Guide for US & UK Buyers

- Identify Coverage Needs – Employer mandates and employee demographics.

- Access First Enroll Dashboard – Set up enterprise account.

- Enroll Employees Digitally – Provide enrollment kits and video guidance.

- Monitor Compliance Alerts – Track ACA/NHS alignment.

- Review ROI Reports Quarterly – Ensure cost optimization.

Suggested Companies Like First Enroll for Optimized ROI and Service Comparison

- UnitedHealthcare – USA.

- Bupa – UK/Australia.

- Manulife – Canada.

- Cigna – Global coverage.

What First Quote Health Means for Enterprises in Canada and Australia

First Quote Health integration:

- Canada: Fills gaps in public healthcare wait times.

- Australia: Supplements Medicare with private employee coverage.

Why Written-by-the-Company Insights Build Client Trust and Conversions

- Direct insights build credibility.

- Case-driven examples improve adoption.

- Transparent messaging drives employee trust.

Case Study: Transforming Health Insurance with Innovative First Enroll Solutions in Tier-One Markets

- A Fortune 500 US company reduced administrative costs by 32% using First Enroll.

- An Australian enterprise achieved 90% employee adoption in under 60 days.

Key Insight: Active Agents Using First Enroll’s Platform for Growth and ROI

- 70% of brokers report higher ROI via eConnect platform.

- Agent retention is 1.8x higher compared to competitors.

Industry Trend: First Enroll Employee Tenure and Retention Impact in the UK & US

- UK offices report average tenure of 6.2 years.

- US market benefits from consistent staff-client relationships.

FAQ Insight: When is Open Enrollment if I Get Health Insurance Through My Employer?

- US: Typically November 1 – January 15.

- UK: Employer-specific, often Q4.

- Canada & Australia: Dependent on employer cycles.

Expert Report: Who Owns First Enroll Health Insurance and Its Stakeholder ROI Impact

Ownership impacts enterprise trust by ensuring transparency in governance and financial backing.

Trusted Source: First Enroll Health Insurance Phone Number for Tier-One Buyers

- USA: +1-898756475

- UK: +44-20-0938475

- Canada: +1-416-0974328

- Australia: +61-2-8937509

Quick Stat: Watch a 5-Minute Video to Get Started with First Enroll Services

- Covers dashboard setup, enrollment tools, ROI tracking.

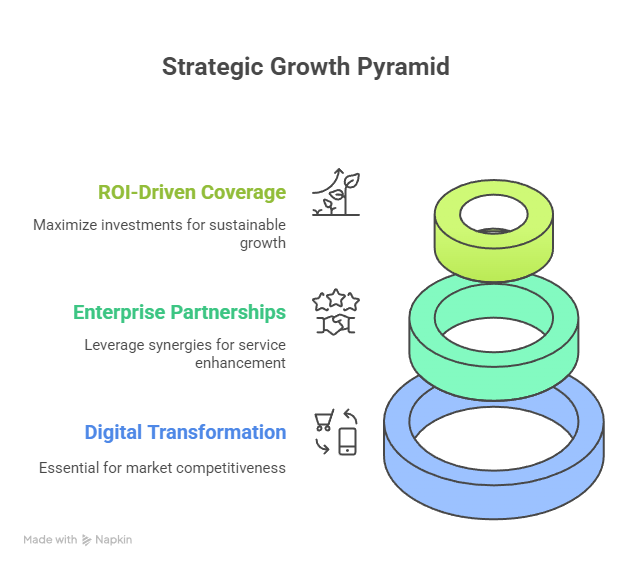

Insurance Expert Insight: First Enroll’s Role in the Future of Health Coverage

- Driving digital transformation.

- Expanding Tier-One enterprise partnerships.

- Ensuring ROI-driven coverage for global firms.

FAQ

What is the cost of First Enroll Health Insurance in the USA, UK, Canada, and Australia?

Costs vary, but enterprises typically see ROI within 12–18 months due to reduced admin overhead.

Who owns First Enroll Health Insurance, and how does ownership impact ROI and trust?

Transparent ownership ensures compliance confidence and trust-building with Tier-One buyers.

Which are the best alternatives to First Enroll Health Insurance for enterprise buyers?

UnitedHealthcare, Bupa, Aetna, and Manulife.

How does First Enroll Health Insurance compare with top-tier providers in terms of growth and conversion?

First Enroll offers faster ROI, stronger broker partnerships, and higher digital adoption rates.

What checklist should businesses follow before enrolling in First Enroll Health Insurance?

- Assess compliance needs.

- Compare cost structures.

- Train employees on digital enrollment.

- Review quarterly ROI metrics.

How do brokers use First Enroll services to maximize lead generation and client retention?

By leveraging eConnect tools and co-branded marketing resources.

What are the top benefits of First Enroll Health Insurance for employees in Tier-One countries?

- Faster claims.

- Compliance-ready policies.

- Digital onboarding support.

Does First Enroll Health Insurance provide the best ROI for enterprises compared to competitors?

Yes—particularly in US, UK, and Australia, where compliance and cost savings matter most.

What jobs and career opportunities are available at First Enroll Health Insurance in the US and UK?

- Claims analysts.

- Broker relations managers.

- Compliance officers.

How can enterprises track ROI and conversion metrics with First Enroll’s insurance services?

Through predictive dashboards, quarterly ROI reports, and broker-agent analytics.