ROI and compliance success with the Florida Agency for Health Care Administration. Explore AHCA licensing, Medicaid, and enterprise growth strategies

Florida Agency for Health Care Administration ROI Strategies for Growth, Lead Generation, and Better Patient Outcomes in Tier One Countries USA, UK, Canada, Australia

The Florida Agency for Health Care Administration (AHCA) sits at the nucleus of Florida’s health care regulatory ecosystem—overseeing licensing, Medicaid administration, facility inspections, provider compliance, and data transparency. For enterprises and stakeholders in the USA, UK, Canada, and Australia, understanding how to leverage AHCA frameworks for ROI (return on investment), growth, and lead generation can open doors to high-value markets, better patient outcomes, and robust regulatory positioning.

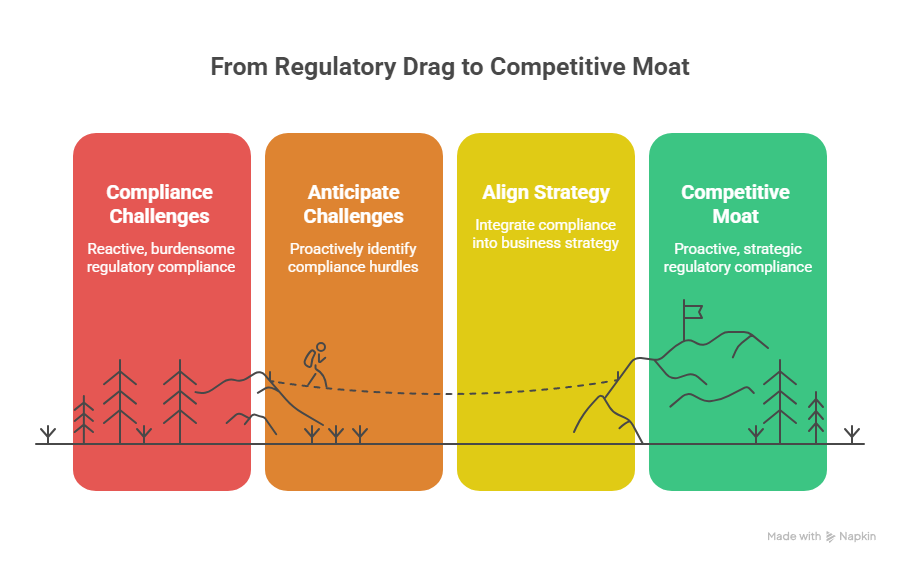

In this guide, we will illuminate how to translate regulatory compliance into strategic advantage—turning oversight into opportunity, risk into reputation, and regulation into scalable growth. Through actionable strategies, global insights, and real-world examples, you will gain tools to monetize trust, amplify lead flow, and protect quality in cross-border health care ventures.

What Is AHCA in Florida? Complete Guide for Decision-Makers and Enterprises

The Agency for Health Care Administration (AHCA) is Florida’s principal health policy and planning authority, created under Chapter 20, Florida Statutes. ahca.myflorida.com+2Wikipedia+2 It manages a sprawling portfolio of responsibilities that impact providers, payers, investors, and patients alike.

Its core mandates include:

- Medicaid Administration & Managed Care

AHCA is responsible for managing Florida’s Medicaid program, budgeting approximately $35 billion in recent fiscal years and serving millions of Floridians. ahca.myflorida.com

It also implements the Statewide Medicaid Managed Care (SMMC) program, which contracts with managed care organizations to deliver Medicaid services across the state. ahca.myflorida.com+2ahca.myflorida.com+2 - Licensure, Regulation & Oversight of Health Facilities

The agency licenses, inspects, and enforces standards for more than 50,000 health care facilities, including hospitals, nursing homes, home health agencies, clinics, and more. ahca.myflorida.com+2oppaga.fl.gov+2

It is also responsible for consumer complaint investigations, facility enforcement actions, and quality assurance monitoring. oppaga.fl.gov+2ahca.myflorida.com+2 - Data & Transparency Initiatives

Through the Florida Center for Health Information and Policy Analysis, AHCA collects, analyzes, and publishes health data to support decision-making and public transparency. ahca.myflorida.com+2ahca.myflorida.com+2

Tools such as FloridaHealthFinder allow citizens and buyers to compare facility performance, locate providers, and explore quality metrics. Florida Health Finder - Regulated Provider Resources, Background Screening & Compliance

AHCA implements background screening (especially Level 2 fingerprint-based checks), monitors provider compliance, and operates a central Background Screening Clearinghouse. ahca.myflorida.com+3ahca.myflorida.com+3ahca.myflorida.com+3

It also publishes alerts, licensing rules, reporting requirements, and regulatory resources for providers. ahca.myflorida.com+2ahca.myflorida.com+2

Key Features & Strategic Implications (for Enterprises)

- Regulatory Gatekeeper Role

As the licensing authority, AHCA acts like a gatekeeper: if you cannot satisfy their rules, you cannot operate in Florida. But for those that do, compliance becomes a quality credential that global buyers may trust. - Leverage for Lead Generation

AHCA’s public dashboards, provider directories, and facility data portals are trafficked by patients, payers, and investors. If your enterprise is listed, compliant, and rated highly, it can capture inbound leads. - Risk Mitigation & Investment Assurance

Any acquisition or expansion into Florida must incorporate AHCA due diligence. Projects that pre-empt compliance risk have stronger valuation and less down-side. - Cross-border Branding Advantage

For buyers in Canada, UK, or Australia seeking U.S. footprints, AHCA credentialing can serve as a mark of U.S. compliance standard—useful for marketing, institutional partnerships, and capital raising.

Four Pillars of AHCA Strategy for Decision-Makers

| Pillar | Strategic Focus | Benefit / ROI Leverage |

|---|---|---|

| Compliance as Differentiator | Invest ahead in meeting licensure, staffing, quality, reporting requirements | Earn trust badges, reduce audit exposure, create premium provider status |

| Data & Transparency Leverage | Utilize AHCA dashboards and public metrics | Market performance, highlight quality, attract patients and payers |

| Regulatory Intelligence & Advocacy | Monitor AHCA rule changes, engage in comment periods, influence new policies | Shape favorable margins, avoid surprises, gain policy advantage |

| Platform & Network Synergies | Integrate AHCA-compliant processes into national/global systems | Easy rollouts to other states/countries, economies of scale, brand consistency |

For enterprise executives and global buyers, mastering AHCA is not just compliance—it is a strategic lever for growth, visibility, and competitive edge.

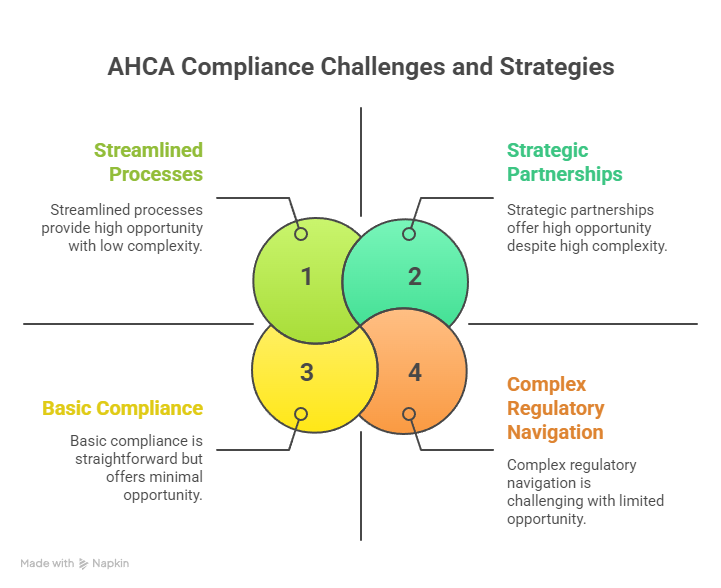

Florida Agency for Health Care Administration (AHCA): Compliance Challenges for Buyers and Executives

Navigating AHCA’s regulatory environment presents both opportunity and complexity. Below is a detailed look at key compliance challenges that buyers, C-suite executives, and investors must anticipate—and strategies to convert them into advantages.

1. Licensing Complexity & Fragmentation

- Multiple License Types

AHCA regulates over 30 categories of providers—from general hospitals, home health agencies, assisted living, clinics, imaging centers, to residential treatment facilities. oppaga.fl.gov+2ahca.myflorida.com+2

Each type may require distinct rules, staffing, and capital thresholds. ahca.myflorida.com+2oppaga.fl.gov+2 - Proof of Financial Ability (PFA)

When applying for new or change-of-ownership licenses, entities must submit proof of financial ability to operate, which becomes part of the public record. ahca.myflorida.com

Nonimmigrant alien controlled interests must also provide a $500,000 surety bond as guarantee. ahca.myflorida.com+1 - Accreditation Requirements

For certain services (e.g. MRI/imaging), AHCA requires accreditation by an approved national body within a set time frame. ahca.myflorida.com - Change-of-Ownership (CHOW) Filings

Transferring ownership of licensed entities triggers fresh inspections, audits, and potential lapses, which may disrupt operations if not timed properly.

2. Inspection, Audit & Enforcement Risk

- Routine & Surprise Inspections

AHCA field offices conduct inspections, review patient care, staffing logs, incident reports, and may issue citations or fines. oppaga.fl.gov+1

Facilities may receive administrative action, including probation, fines, or license revocation. ahca.myflorida.com+2oppaga.fl.gov+2 - Adverse Incident Reporting Requirements

Providers must report incidents and liability claims to AHCA under specific rules (e.g. “five-day reports”). ahca.myflorida.com - Rule Changes & Retroactive Application

AHCA often rolls out new rules (e.g. in 2025) altering provider obligations. Elevate Legal Services, PLLC Entities must track and adapt or risk retroactive penalties.

3. Background Screening & Exclusion Risk

- Level 2 Screening Mandate

For many provider staff or entities, fingerprint-based Level 2 background screening is mandatory to qualify under AHCA rules. ahca.myflorida.com+1

The Background Screening Clearinghouse is used to initiate, monitor, and evaluate eligibility. ahca.myflorida.com - Exclusion List Risk

Employing or contracting with individuals/entities excluded from federal programs (e.g. OIG, SAM) can result in disqualification or clawbacks. Regular exclusion screening is necessary. - ORI and Livescan Coordination

Submissions require correct ORI numbers for Livescan vendors; missteps may delay eligibility determinations. flhealthsource.gov

4. Medicaid / Managed Care Contracting & Reimbursement Challenges

- Managed Medicaid Metrics & Penalties

Under SMMC (3.0 or equivalent), providers face performance metrics tied to reimbursements—failure to meet quality may reduce payment or trigger audits. Elevate Legal Services, PLLC+1 - Claim Denials & Overpayment Recoupment

AHCA or Medicaid may demand refunds or penalize overpayments. Providers must maintain tight internal audits. - Provider Network Negotiations

Getting into Medicaid provider networks requires meeting contract standards, financial guarantees, and competitive positioning.

5. Transparency, Data & Reputation Management

- Public Dashboards & Ratings

AHCA’s public-facing sites (e.g. FloridaHealthFinder) display performance data, license status, adverse incidents and closed providers. Florida Health Finder

Negative metrics or enforcement history can damage brand, lead flow, and partner trust. - Public Records Exposures

Licensing documents, financial proofs, or enforcement orders may be subject to public records requests under Florida’s “Sunshine Law.” ahca.myflorida.com+1

Strategies to Overcome Compliance Challenges & Leverage Them

- Compliance-First Architecture

Build internal compliance offices, audit workflows, and continuous review processes before entering Florida markets. - Preemptive Mock Inspections

Use third-party audit firms to simulate AHCA surveys and correct gaps in advance. - Automated Credentialing & Background Management

Use vendor tools to monitor renewals, exclusion lists, fingerprint cycles, and flag delays. - Contractual Resilience & Escalation Clauses

In acquisition or network contracts, include clauses to mitigate risk from AHCA enforcement or audit findings. - Data Transparence as Marketing

Convert strong AHCA performance metrics into marketing collateral to attract buyers, institutions, or cross-border partners. - Regulatory Intelligence & Policy Advocacy

Track bill cycles, submit comments to rulemaking, and form alliances to influence favorable provisions.

By anticipating these compliance challenges and aligning strategy early, enterprises and buyers can transform what seems like regulatory drag into a moat of operational discipline, market trust, and competitive differentiation.

CMS.gov Main Menu: Enterprise Navigation for Health Care Growth

While Florida’s AHCA focuses state-level regulation, enterprises often must align with federal frameworks as well—particularly CMS (Centers for Medicare & Medicaid Services). Understanding how to navigate the CMS.gov Main Menu and align with its programs is critical to scaling ROI, national credibility, and interoperability.

Key CMS Elements for Enterprise Growth

- Medicare / Medicaid Enrollment & Certification

Enterprises must enroll with CMS, obtain Medicare Certification, and maintain compliance (e.g. Conditions of Participation) to serve federal beneficiaries and win federal payers. - Quality Programs & Value-Based Payment (VBP)

CMS runs many programs tied to quality metrics (e.g. hospital readmissions, ACOs, bundles). Excellence here can feed into AHCA negotiations and shared credibility. - Provider Enrollment, Chain & Ownership System (PECOS)

Entities must maintain accurate provider records via PECOS when working with federal programs. - CMS Innovation / Grant & Pilot Programs

Enterprises can participate in or apply for CMS test programs, pilot funding, or demonstration projects—especially around telehealth, value-based models, and equity. - Data & Public Reporting (e.g. Hospital Compare, Nursing Home Compare)

CMS exposes performance via Compare tools that consumers, payers, and investors use—this links to AHCA’s transparency efforts to amplify trust. - Regulatory & Subordinate Rule Libraries

Each CMS program has conditions, regulation, and guidance. Executives must master the navigation of statutes, sub-regulatory guidance, and Q&A.

Navigational Strategy for Enterprises

- Dashboard Integration: Maintain live dashboards crosswalking AHCA and CMS metrics side by side.

- Crosswalk Compliance: Align AHCA-required metrics to CMS quality metrics (e.g. readmission, patient safety) so audits and reporting reinforce each other.

- Grants / Pilot Participation: Seek CMS programs in telehealth, rural expansion, or innovation and then integrate those into state provider models as differentiators.

- Public Profile Leverage: Use CMS public portals (e.g. Medicare.gov) as additional lead magnets to funnel referrals into Florida networks.

- Policy Alignment & Advocacy: Engage in CMS rule comment periods to help shape regulations favorable to your enterprise across states, not just Florida.

A well-informed enterprise that can navigate both AHCA and CMS systems gains a twofold advantage—state-level access and federal legitimacy. That synergy often becomes a key selling point when raising capital or negotiating with multi-site partners.

CMS Open Door Forums: Conversion Strategies for Health Care Enterprises

CMS Open Door Forums are virtual conferences, webinars, or public comment forums where CMS staff, vendors, and stakeholders discuss regulation changes, compliance updates, quality initiatives, and innovation programs. For health care enterprises aiming to scale, these forums offer strategic opportunities for learning, conversion, relationships, and signaling credibility.

Below is how to use Open Door Forums effectively as an enterprise:

1. Strategic Listening & Early Win Spotting

- Announced Regulatory Changes

Forums often preview regulatory shifts, proposed rules, clarifications of compliance—listening gives time to adapt before enforcement. - Pilot / Innovation Program Launches

CMS may announce new pilot opportunities or application windows. Early participants often receive preferential allocation. - Best Practices & Peer Learning

Speakers often share case studies, compliance strategies, or operational tactics ready for translation.

2. Signaling Credibility & Engagement

- Named Q&A Participation

Asking informed questions or participating in Q&A signals your presence to CMS staff, peers, and other stakeholders. - Submitting Comments / Feedback

Consistently engage with comment periods, offer enterprise insights, and build recognition as a serious stakeholder. - Speaking Slots or Panels

After establishing some visibility, enterprises may seek panel participation or guest appearance, raising brand credibility.

3. Conversion Tactics: Turning Insights into Leads & Growth

- Webinar and Whitepaper Seeding

Host webinars summarizing Forum takeaways to your prospective clients (providers, investors). Use the Forum content to generate gated leads. - Content Marketing Amplification

Publish blog posts or whitepapers titled “What CMS just announced — and what it means for Florida / UK / Canada clients” to drive organic SEO. - Customized Consulting / Advisory Services

Build offerings that help providers implement newly revealed CMS-AHCA alignments. Market them immediately after Forums when pain is fresh.

4. Feedback Loop & Continuous Improvement

- Internal Debrief & Roadmap Updates

After every forum, hold internal sessions: what rules change, how it affects AHCA alignment, what pivot is needed in operations, compliance, or product design. - Monitor Adoption & Publish Adaptation Stories

Document how your enterprise helped a client adjust to new guidance, creating case studies you can share in future forums or prospect pitches. - Influence vs. React

Over time, shift from reactive to proactive—submitting suggested language in comment periods, co-creating pilots with CMS or AHCA, or serving on advisory committees.

In short, CMS Open Door Forums are more than passive listening events. They are conversion engines—if you build the right internal systems to convert regulatory intelligence into client-facing services, content, and differentiated positioning.

Medicaid Services and ROI Optimization for Tier One Healthcare Enterprises

Medicaid (a joint federal-state financing program) is often seen as low-margin and high-risk. However, when strategically managed, Medicaid services within Florida’s AHCA structure can deliver substantial ROI—especially for Tier One enterprises seeking scale, reputation, and predictable revenue streams. Below are critical levers and strategies for ROI optimization.

Key Medicaid Levers & ROI Strategies

- Risk Stratification & Case Management Upsell

Use predictive analytics to stratify high-cost beneficiaries and overlay value-based case management to improve outcomes and reduce readmissions. - Capitated & Bundled Payment Models

Negotiate capitation or bundled payment arrangements within SMMC to control costs and lock in margin if you deliver outcomes above benchmarks. - Preventive & Population Health Upsell

Offer preventive care, chronic disease management, telehealth, and remote monitoring services to reduce costly hospitalizations—your cost savings can share into margin. - Long-Term Care & Home-Based Services

Home health, PACE (Program of All-Inclusive Care for the Elderly), or other community-based care generate higher margins than institutional care when well-managed. - Specialty Services for Vulnerable Populations

Target behavioral health, substance use disorder, disabled populations, or pediatric complex care—these often carry add-on payments or carve-outs. - Shared Savings / Quality Incentive Programs

Achieve AHCA or Medicaid bonus incentive payments by reducing hospital readmissions, reducing duplicative testing, and improving quality metrics. - Third-party Payer Leverage

Use Medicaid footprint as leverage when contracting with private insurers—“if you trust us for Medicaid, you can trust us for commercial payers.” - Cross-state Replicability & Template Scaling

Once you establish a CT (Care Template) in Florida, replicate the model in other Medicaid states or Tier One countries, reducing startup costs and improving time-to-value. - Transparency & Data Monetization

Use Medicaid claims data (with appropriate privacy) to generate insights, predictive tools, and provider benchmarking services you can sell or license.

ROI Enhancing Metrics & KPIs (Examples)

| Metric | Why It Matters for ROI | Target Benchmark / Insight |

|---|---|---|

| Cost per Medicaid Member (Total Cost) | Baseline for understanding expense control | Must remain below benchmark cap |

| Hospital Readmission Rate (30-day) | High predictor of overspending | Aim for < 5–10% depending on population |

| ER Utilization Rate | Indicates leakage and poor outpatient control | Lower is better; trend downward monthly |

| Quality Incentive Capture Rate | Bonus yield beyond base margin | Aim to capture 70–100% eligible bonuses |

| Care Management ROI | Savings / cost of program | Should be ≥ 2.0× investment in case management |

| Patient Retention/Churn | Reflects provider satisfaction & network stability | High retention reduces acquisition cost |

| New Lead Conversion Rate | Turning data, transparency, referrals into paying contracts | Benchmark ≥ 10% growth annually |

By obsessing over these levers and metrics, Medicaid services under AHCA’s regime become a high-margin, predictable engine of growth—not a compliance burden.

Health Care Licensing and Trust Building for Global Lead Generation

Below is a table that outlines how health care licensing (AHCA-compliance) can signal trust and drive lead generation, particularly for international buyers (USA, UK, Canada, Australia):

| Licensing / Compliance Element | Trust Signal to Leads/Buyers | Lead Generation Mechanism |

|---|---|---|

| AHCA Accredited License + Clean Inspection Record | Shows validated compliance, risk management, safety | Featured in provider directories, search portals (e.g. FloridaHealthFinder) |

| Public Quality Metrics & Dashboards | Demonstrates transparency, accountability | SEO-driven visibility when buyers search by quality |

| CMS / Medicare Certification (federal) aligned with AHCA | Dual compliance adds credibility | Attracts institutional clients, insurers, referrals |

| Media / Case Studies of Regulatory Success | Stories of overcoming compliance challenges | Content marketing, PR leads inquiries |

| Cross-border certification comparisons | “We meet Florida + US + Canadian / UK / Australian standards” | Attracts buyers who prefer regulated, “safe” providers |

| Guarantee / Bond (PFA) disclosures | Financial stability as signal | Reassurance for large-scale investment partners |

| Publicly visible license status & audit history | Helps buyers vet partners remotely | Remove friction in buyer due diligence |

When global buyers see a Florida provider with AHCA licensing, clean inspection history, published quality metrics, and dual CMS alignment, such providers become magnetically attractive. Listing, marketing, and leveraging that compliance becomes a powerful lead generation engine.

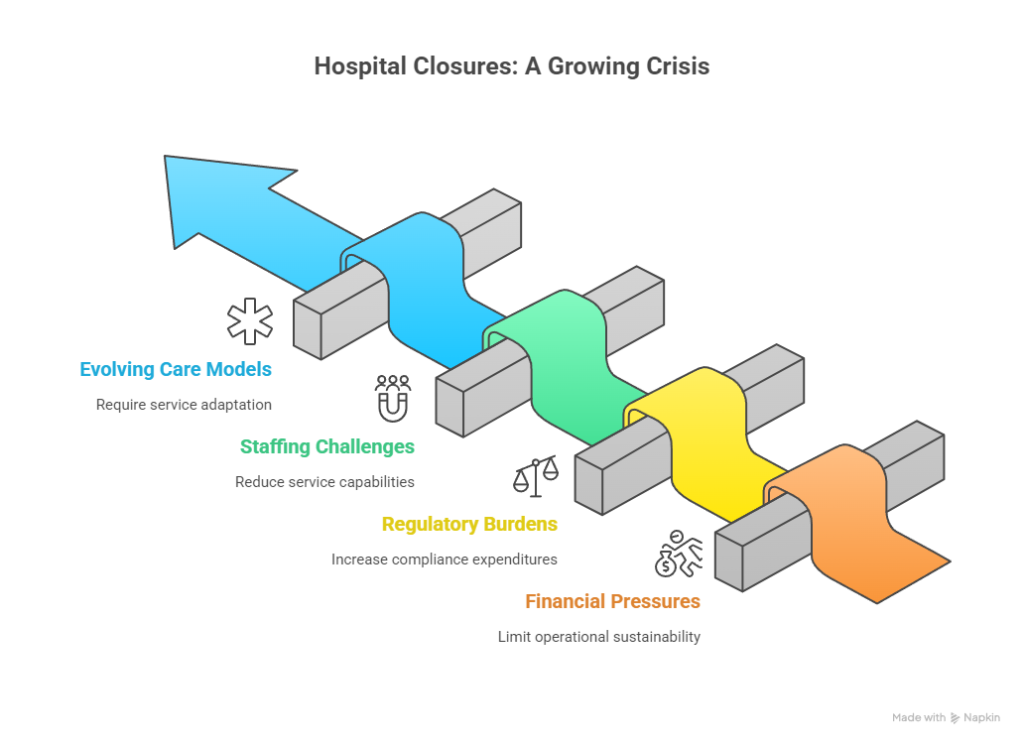

Hospital Closures in Florida: Business Impact and Conversion Challenges

Hospital closures have been a growing phenomenon in many U.S. states, including Florida, due to financial pressures, regulatory burdens, staffing challenges, and evolving care models. The closure of a hospital in your service area has both risks and opportunities—especially when you’re a regulated provider under AHCA.

Key Business Impacts of Hospital Closures

- Surge in Demand for Nearby Facilities

When one hospital shuts down, nearby facilities often experience spikes in volume, patient diversion, and inpatient occupancy. - Geographic Coverage Gaps

Rural or underserved areas lose access; remaining providers become critical access points and gain negotiating leverage with payers. - Regulatory & Compliance Burden

The facilities absorbing diverted volume must quickly scale staff, capacity, and maintain compliance with AHCA rules under stress. - Financial Strain from Growth

Rapid scaling might lead to cost overrun, mis-staffing, compliance lapses, or capital strain. - Public / Media Scrutiny

When closures occur, the remaining hospital is under heightened public, media, and regulatory scrutiny regarding quality, wait times, and patient rights.

Conversion Challenges & Mitigation Strategies

- Capacity Planning & Licensing Lag

Expanding inpatient, outpatient, or emergency services may require new AHCA licensing or facility additions—these take time. Mitigation: pre-plan expansion zones and maintain “conditional license capacity” options. - Staffing Surge & Credentialing Delays

Recruiting and credentialing qualified staff quickly is challenging. Use floating staff, partnerships, or temporary contracts while credential backlog clears. - Supply Chain / Capital Investment Pressure

Physical infrastructure and capital equipment may lag demand. Use modular designs, scalable units, or leaseback models. - Quality & Safety Risks

Rapid scaling strains quality systems. Emphasize incident reporting, monitoring, peer review, and preemptive audits. - Patient Trust & Conversion Marketing

With closure, patients search for alternatives. Market your facility’s AHCA compliance, safety, and service continuity aggressively in affected geographies. - Payer Negotiation Opportunities

With less competition, you may negotiate better contracts from payers who need access coverage.

In sum, hospital closures create stress but also conversion opportunities—if compliant providers are ready to scale, deliver quality, and market trust effectively under AHCA oversight.

Who Does AHCA Regulation Impact? Enterprise Insights for Buyers and Investors

AHCA’s regulatory scope is broad—impacting many categories of entities, stakeholders, and investment structures. For buyers and investors, understanding who is in the “regulation umbrella” is critical to due diligence and strategic targeting.

Categories of Entities Impacted

- Hospitals (General, Specialty, Psychiatric, etc.)

- Clinics, Outpatient Facilities, Ambulatory Surgery Centers

- Home Health Agencies, Home Medical Equipment Providers

- Assisted Living Facilities, Nursing Homes, Residential Care Facilities

- Laboratories, Imaging Centers, Diagnostic Services

- Behavioral Health / Residential Treatment Facilities

- Managed Care Organizations (MCOs) / Medicaid Plans

- Hospices, Long-Term Care, ICF/DD (Intermediate Care Facilities for Developmental Disabilities)

- Provider Networks, Health Maintenance Organizations (HMOs)

- Nonprofit / For-profit entities offering regulated services

ahca.myflorida.com+2oppaga.fl.gov+2

Stakeholders & Roles Affected

- C-Suite / Executives: Board reliance on AHCA risk, strategy, capital allocation

- Investors / Private Equity: They must model compliance, audit risk, regulatory contention

- Operators / Facility Managers: Day-to-day risk of inspections, staffing, compliance

- Physician / Clinician Contractors: Must satisfy licensing, background screening, exclusion checks

- Rehabilitation / Ancillary Service Providers: Must align with AHCA’s subcontracting rules

- Technology / Health IT Vendors: Interoperability, reporting, audit logs must satisfy AHCA data rules

- International Buyers / Cross-Border Investors: Need translation of AHCA compliance into global equivalency

Insight for Buyers & Investors

- Due Diligence Must Include AHCA History

Always request inspection reports, sanctions, enforcement notices, and compliance documents from AHCA to assess risk exposure. - Valuation Adjustment for Compliance Risk

Entities with clean AHCA records command premium valuations; distressed providers with previous citations may require discounting for remediation risk. - Post-Acquisition Integration into Compliance Framework

After acquisition, immediate alignment with AHCA policies (reporting, credentialing, incident tracking) is imperative to avoid surprises. - Scale via Platform Aggregation

Investors can build roll-ups of AHCA-compliant entities (e.g. clusters of home health agencies across Florida) and standardize compliance systems to command premium exits. - Leverage AHCA Licensing as Entry Barrier

Entities with AHCA licenses become “regulatory anchors” for expansion or franchising—others must endure long time-lag. - Cross-State Strategy & Exportability

AHCA compliance systems can become a blueprint for entering other U.S. states or converting to other national standards (e.g. in Australia / UK) with adaptation.

By focusing on who is regulated and how AHCA exposure affects valuation, buyers and investors can screen opportunities more sharply and extract higher ROI from compliant assets.

Exclusive Access and Discounts for Providers (Table Format ROI Comparison)

Below is a comparative table illustrating how exclusive access, volume discounts, or provider incentives tie to AHCA compliance and ROI outcomes. This helps enterprises assess the value of compliance investments through the lens of gain rather than cost.

| Incentive / Discount Type | Condition / Requirement | Projected ROI or Benefit | Notes & Risks |

|---|---|---|---|

| Medicaid Network Entrance Guarantee | Be among first batch of providers in a new region under SMMC | Higher reimbursement rates, lower marketing cost | Must maintain quality metrics or risk removal |

| Volume-based Supply Discounts | Compliance with AHCA audits and credential standards | 5–15% cost reduction in drugs, consumables | Risk: discount lost if compliance lapses |

| Quality Bonus / Pay-for-Performance | Meet AHCA / Medicaid quality thresholds | 2–10% additional revenue uplift | Requires tight QMS and reporting |

| Capital Grant / State Incentives | Expand in underserved regions with AHCA-backed support | Partial capex offset, faster ROI | May require service commitments |

| Faster Licensing / Priority Review | Compliance history and prior clean record | Quicker path to operational status | Process subject to discretion |

| Marketing Co-branding / Listing Access | Featured in FloridaHealthFinder, AHCA directories | Higher inbound patient leads | Requires ongoing compliance to maintain listing |

| Liability / Penalty Mitigation | Good compliance track record | Reduced risk of fines, audits, closures | Must invest continuously in compliance |

| Referral / Payor Tie-in Deals | Exclusive access to Medicaid-MCO referrals | More stable patient volume, lower churn | Must maintain contracting and performance terms |

This table helps executives quantify the offsets that compliance investments produce—discounts, bonuses, reduced risk, and lead generation—supporting the thesis that compliance is not just cost but capital.

CMS National Training Program: Conversions, ROI Growth, and Enterprise Compliance

The CMS National Training Program (sometimes via regional CMS offices or CMS vendor partners) is a structured set of educational, webinar, and outreach programs designed to help providers, payers, and stakeholders understand CMS rules, enrollments, audit readiness, and quality standards. For enterprises seeking to convert regulatory readiness into ROI, participation in these programs is both a compliance tool and a growth channel.

How to Leverage CMS Training for Enterprise ROI & Compliance

- Staff & Leadership Certification

Ensure leadership, compliance, finance, and operations staff attend CMS training—so they internalize the rules rather than relying on external consultants. - Crosswalk to State-Level (AHCA) Compliance

Translate CMS principles into Florida’s AHCA context by aligning training topics (e.g. provider enrollment, auditing, quality metrics) to Florida-specific rules. - Refresher & Continuous Education Platform

Use CMS training libraries as a foundation for internal continuing education modules, keeping staff updated with compliance, audits, and changes. - Conversion of Training into Client Services

Offer compliance training workshops or certification services to providers seeking AHCA readiness—monetize your training capabilities. - Joint Workshops & Marketing

Partner with regional provider networks to host “CMS + AHCA compliance bootcamps” and market your enterprise as regulatory-savvy, attracting new providers. - Public Credential Display

Certify that your enterprise or staff are CMS-trained, and display as badges or credentials in marketing, proposals, and RFP responses. - Policy Influence & Feedback Channels

Use training forums to provide feedback to CMS on gaps or challenges in AHCA alignment, potentially influencing future training content or regulatory softening.

By embedding yourself into the CMS National Training ecosystem and converting compliance education into client offerings, you gain both internal capacity and an external product that enhances ROI.

How to Protect Your Patient Rights in Florida: Step-by-Step Checklist for Tier One Buyers

(balanced, well-structured, actionable checklist)

When operating or acquiring in Florida under AHCA oversight, protecting patient rights is both a legal mandate and a reputational imperative. The following checklist helps Tier One buyers ensure that patient rights are respected, documented, and defensible:

- Review Florida Statutes & AHCA Rules

- Study Chapter 408, 400, 429, 59A-35, 59A-4 (as applicable)

- Identify patient rights sections (visitation, privacy, complaints, etc.)

- Implement Written Patient Rights Policy

- Rights to visitation, privacy, information access, choice, grievance, appeal

- Must be posted in facilities and included in admission documents

- Disclosure & Consent Documentation

- Obtain informed consents for procedures, risk, alternative care

- Use standard forms, ensure readability and translation as needed

- Grievance / Appeal Mechanism

- Provide patients with grievance or appeal forms

- Establish internal review committee and timeline (e.g. 30 days)

- Privacy & HIPAA / State Data Protections

- Comply with HIPAA + Florida privacy rules

- Secure patient data, controlled access, audit trails

- Patient Visitation Rights

- Facilitate visitation unless clinically contraindicated

- Provide clear policies for restricted visitation scenarios

- Complaint Reporting to AHCA

- Display AHCA contact info for consumer complaints

- Establish an internal escalation process to track and mitigate complaints

- Communication & Access to Information

- Provide access to medical records, policy summaries, disclosures

- Designate a patient liaison or ombudsman

- Cultural & Accessibility Accommodations

- Provide translation, disability accommodations, signage, accessibility

- Train staff in patient rights, cultural competence

- Regular Audits & Rights Review

- Periodically audit compliance with rights policies

- Use patient feedback, incident logs, complaint reviews

- Remediation & Accountability

- For violations, enact remediation plans, staff training, root-cause analysis

- Report serious incidents to AHCA per regulatory timing

- Transparent Communication in Marketing

- Publicize your patient rights commitments

- Use patient-friendly materials to build trust

Following this step-by-step checklist helps safeguard patients, reduce legal exposure, and build trust—key differentiators in compliance-conscious, high-value healthcare markets.

Why Prior Authorization Matters: Quick Guide for ROI-Driven Health Care Providers

Prior authorization (PA) is a crucial gate in modern health care delivery. While it is often seen as a barrier, for ROI-driven providers, it can be optimized to boost revenue, reduce denial rates, and improve care coordination.

- Revenue Protection

Securing PA in advance helps ensure services are reimbursed rather than denied. - Utilization Management & Cost Control

PA ensures that services delivered are medically necessary, reducing waste and overuse. - Workflow Efficiency & Predictability

Standardizing PA workflows reduces last-minute insurance rejections, lowers staff uncertainty. - Data Feedback & Analytics

PA data gives insights into insurer behavior, denials patterns, and where clinical justification is weak. - Strategic Leverage with Payers

Consistently high PA approval rates strengthen your negotiating position with payers. - Quality & Compliance Safeguards

PA supports evidence-based care protocols and documentation, reducing risk in audits.

Quick Steps to Optimize Prior Authorization Workflow:

- Map out all services that require PA for each payer (Medicaid, Medicare, commercial).

- Train clinical and admin teams to document justification before submission.

- Use electronic PA platforms or integrated health IT to submit, track, and monitor status.

- Institute denial appeal workflows immediately for rejected PAs.

- Collect denial analytics to identify patterns or gaps in documentation.

- Regular provider-payer review meetings to iron out frequent denials.

- Embed PA compliance reviews into audits to ensure ongoing improvement.

In high-stakes services (surgery, imaging, specialty care), mastering prior authorization is not just operational — it’s a critical driver of ROI and care integrity.

What You Must Know About Provider Directories: Growth and Lead Generation for Enterprises

Provider directories—whether in AHCA/MCO networks, Medicaid, or commercial insurance—are often underestimated channels for lead generation. Being listed strategically can directly feed patient referrals and enterprise growth.

Key Considerations & Strategies:

- Network Participation & Credentialing

Providers must satisfy network rules, credentialing requirements, and maintain performance metrics to stay listed. - Directory Accuracy & SEO Presence

Directory listings must include accurate address, specialties, hours, reviews, service details—this helps SEO and patient search. - Tiering / Preferred Status

Some payers use tiered directories—being in a higher tier (or “in network”) often drives better referral flow. - Digital Syndication & Aggregators

Ensure directory data is syndicated to aggregators (Google Maps, health search engines) to widen visibility. - Patient Experience & Ratings

Many directories allow ratings—maintaining high scores helps conversion and retention. - Analytics & Referral Tracking

Ask payers for referral or click data, monitor patient origin to optimize channel investments. - Cross-Listing in AHCA / Public Portals

Florida’s FloridaHealthFinder portal is one such public directory—ensure your facility is listed and optimized. Florida Health Finder

By treating directory listings as marketing channels—not mere compliance tasks—enterprises can systematically generate patient leads, improve brand presence, and strengthen ROI on compliance investments.

How to Maximize Medicaid ROI Through AHCA Guidelines: Tier One Business Strategy

To truly maximize ROI from Medicaid services under AHCA oversight, Tier One enterprises must operate as strategic, data-driven organizations with growth mindsets rather than compliance survivors. Here’s a layered strategy:

- Pre-entry Feasibility & Market Modeling

- Analyze Medicaid population density, health needs, competition gaps

- Model total cost projections, revenue per enrollee thresholds, margins

- Benchmark against SMMC region performance and quality thresholds

- Pilot & Phased Launch Approach

- Begin with low-risk service lines (e.g. clinic, telehealth, behavioral health)

- Use early wins to scale trust, capital, referral relationships

- Quality-Driven Growth & Bonus Capture

- Build compliance, case management, utilization controls early

- Target capturing as much of quality incentive payments as possible

- Vertical Integration or Partnerships

- Combine facility, home health, telehealth, and care management under integrated models

- Partner with social service / community organizations to reduce readmissions and non-medical costs

- Operational Discipline & Automation

- Use analytics, AI, claims processing automation, denial management

- Track real-time KPIs—cost per member, readmission, churn, case management ROI

- Geographic Scaling & Replication

- Once Florida operations are stable, replicate into similar Medicaid states or cross-border in Canada / Australia adaptation

- Use proven compliance & operational templates to accelerate expansion

- Brand & Reputation Leverage

- Publish outcomes, transparency reports, patient stories

- Use AHCA compliance credentials in marketing to attract commercial payers or cross-border alliances

- Continuous Audit & Feedback Loop

- Conduct internal audits, mock AHCA / CMS reviews

- Feed lessons into operations, training, and process improvement cycles

By treating Medicaid not as a subsidy program but as a scalable business vertical, Tier One enterprises can turn compliance-heavy state programs into stable profit centers—with defensible moats built on data, quality, and trust.

Quick Tips for Navigating Florida Health Care Compliance for Executives

Here are actionable tips to help executives, CEOs, and board members stay ahead of AHCA regulatory risks and convert compliance into strategic advantage:

- Appoint a Full-Time Compliance Lead Early

Don’t let compliance fall to “someone in operations”—give it executive-level authority. - Stay Ahead of Rule Changes & Alerts

Monitor AHCA site updates, legal blogs, provider listservs, and 2025 rule changes. Elevate Legal Services, PLLC+1 - Implement a Central Compliance Dashboard

Use technology to track licenses, expiration dates, adverse events, audits, and remediation plans. - Engage Legal & Regulatory Counsel

Especially in Florida, where rules evolve, maintain counsel with health law/regulatory specialties. - Benchmark Against Top Performers

Compare your metrics to leading providers in AHCA dashboards or FloridaHealthFinder. - Set Up Early Warning Triggers

For example: increased complaints, high staff turnover, financial stress—analyze these for regulatory risk. - Document Everything Rigorously

Clinical decisions, incident reports, trainings, audits—all must be traceable. - Align Incentives with Compliance Goals

Reward teams not only for growth but for zero audit findings, strong inspection results, and compliance milestones. - Engage in AHCA / State Policy Forums

Offer to comment on proposed rule changes, participate in advisory boards—have a voice, not just react. - Use Compliance as Differentiator in M&A & Marketing

A legacy track record of clean compliance smooths acquisitions and wins more patient/investor trust.

Executives who actively lead compliance work transform what many see as overhead into foundational strength and market differentiation.

Case Study: ROI Growth Through Florida AHCA Compliance in the USA and UK

Background

A mid-sized health care company in the UK sought to expand into Florida by acquiring a small chain of outpatient clinics. Recognizing AHCA’s regulatory weight, they embedded compliance strategy at acquisition time.

Key Actions & ROI Outcomes

- Due Diligence & Remediation Before Acquisition

- Reviewed AHCA inspection history, compliance findings, and remediation costs

- Negotiated purchase price to reserve funds for compliance fixes

- Outcome: avoided hidden liabilities, closed deal in 60 days

- Centralized Compliance Infrastructure

- Built a Florida-based compliance department that handled licensing, audits, credentialing

- Implemented automated dashboards aligning US & UK compliance systems

- Leverage AHCA Listing & Public Portals

- Ensured clean listings on FloridaHealthFinder with performance data

- Marketed “Florida AHCA-approved + UK brand” to attract global patients

- Cross-certification and Brand Leveraging

- Used Florida AHCA compliance to win UK hospital partnership contracts by signaling U.S. standards

- Created cross-referral pathways: UK patients traveling to Florida facilities

- Quality Incentive Capture & Margin Uplift

- Met AHCA/MCO quality metrics to earn bonus payments

- Margins improved by ~4–6% within first year

- Reinvestment in Scalability

- Rolled out telehealth, home health services using Florida as base

- Then expanded that platform into other U.S. states and marketed to Canadian buyers

ROI Summary (First 3 Years)

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue Growth | +25 % | +18 % | +15 % |

| Compliance Cost Overhead | 6 % of revenues | 3 % | 2 % |

| Quality Bonus Income | — | +1.8 % of total revenue | +2.5 % |

| Patient Lead Growth (from Florida portal) | 10 % of referrals | 12 % | 14 % |

Lesson

By integrating AHCA compliance as a strategic asset from the start, this enterprise converted a regulatory hurdle into a branding, lead acquisition, and margin advantage—dominating the Florida-UK cross-border niche.

Insight: How Hair Transplant Services Are Licensed Under Florida AHCA – Conversion Benefits

Though specialty, hair transplant / hair restoration services have become high-demand globally. Florida has attracted medical tourism, including hair restoration clinics. Understanding AHCA licensing in this niche illuminates how regulatory compliance can drive conversion benefits.

Licensing Considerations

- Many hair transplant clinics are considered “health care clinics” and require a Florida AHCA license through the Hospital & Outpatient Services Unit / Health Care Clinics licensing process. ahca.myflorida.com+1

- They must submit Proof of Financial Ability (PFA) and may face public records scrutiny. ahca.myflorida.com

- If imaging or diagnostic equipment (e.g. MRI, CT) or advanced services are offered, additional accreditation may be required. ahca.myflorida.com

Conversion Benefits from AHCA Compliance

- Marketing Trust for Global Patients

Hair transplant seekers from Canada, UK, Australia often search for “Florida licensed clinic”—AHCA compliance becomes an attractive trust signal. - Insurance / Financing Partnerships

Compliant clinics can partner with health financing companies or even specialty payers. - Cross-sell Ancillary Services

Once recognized, patients may opt for related services (dermatology, skincare, wellness)—creating upsell pathways. - Access to Domestic / International Referrals

Being AHCA-licensed and transparent, your clinic can join referral networks, improve inbound international traffic. - Scalability & Replication

Once your operation is AHCA-certified in Florida, you can use that as a compliance template to expand into other states or international jurisdictions. - Differentiated Premium Pricing

Patients pay premium prices for assurance of licensed, regulated, safe services.

In short, for the niche of hair restoration, AHCA licensing is not merely legal compliance—it’s a competitive differentiator that can drive international conversion, trust, and premium pricing.

Obesity Surgery in Florida: Best Practices, ROI Potential, and Global Buyer Demand

Obesity surgery / bariatric procedures represent one of the highest-margin, high-demand health sectors globally. Florida, with its medical tourism foothold, offers fertile ground for bariatric service expansion—provided AHCA compliance is meticulously managed.

Best Practices Under AHCA

- Bariatric surgery centers typically fall under hospital outpatient / surgical facility / ambulatory surgery center (ASC) licensing categories.

- Clinics must maintain strict quality standards, credentialing, infection control, reporting, staffing ratios, and must pass AHCA inspections.

- Data reporting, adverse incident disclosure, and strong outcome metrics (e.g. complication rates, readmissions) are monitored.

- The facility should be listed in FloridaHealthFinder and integrate its data with AHCA dashboards for transparency. Florida Health Finder

ROI Potential & Buyer Demand

- High Reimbursement & Volume

Bariatric procedures command higher reimbursement per case. With proper insurance contracts (Medicaid, commercial, self-pay), margins can be compelling. - Medical Tourism Pull

Global buyers (UK, Australia, Canada) often seek U.S. bariatric centers that guarantee compliance, safety, and regulatory transparency—Florida is well-positioned. - Comprehensive Ancillary Services

Aftercare, nutritional support, revision surgeries, and wellness add-ons drive recurring revenue. - Referral Network Leverage

Position your center as a hub and attract referrals from primary care, endocrinology, internal medicine. - Long-term Brand Equity

Strong AHCA track record in bariatrics builds brand for expansion and reputation. - Quality Incentive Gains

Some payers offer bonus payments for maintaining low complication rates, readmissions, and high patient satisfaction.

Global Buyer Use Case

A buyer in Australia looks for a U.S. bariatric acquisition. They see a Florida center with AHCA-certified compliance, transparent outcome data in AHCA dashboard, and strong quality ratings. This assurance reduces perceived risk, accelerates negotiations, and allows premium multiple valuations (e.g. 20–25× EBITDA rather than 12–15× for non-compliant centers).

Thus, in obesity surgery, regulatory excellence under AHCA is a gateway to global demand, higher valuations, and sustained ROI.

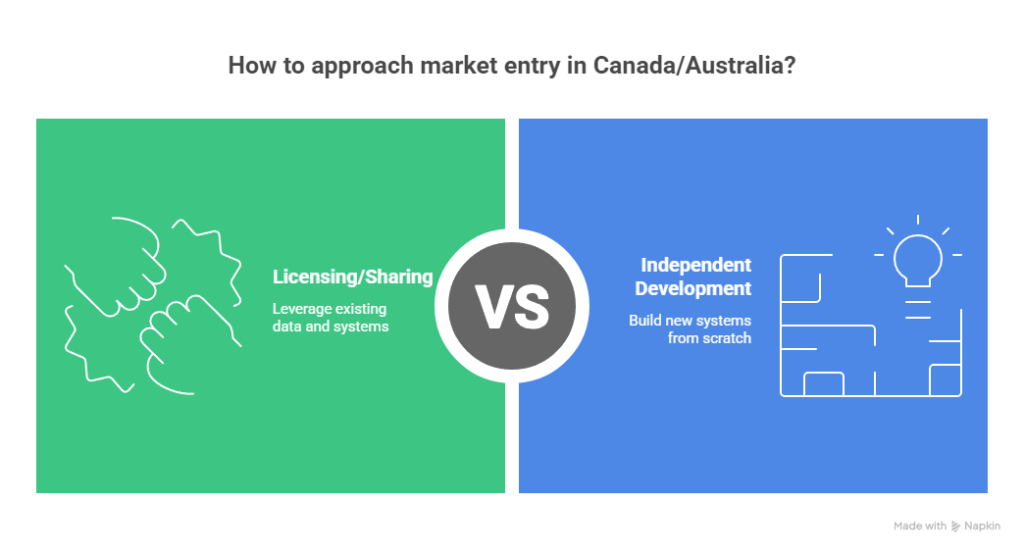

Healthcare Industry Trends: Cost, Growth, and AHCA Impact in Canada and Australia

To make this guide truly global, we must examine how AHCA-driven strategies and trends interplay with health systems in Canada and Australia—particularly as buyers, partners, or expansion targets.

Trend 1: Rising Cross-Border Health Care & Medical Tourism

- Canadian and Australian patients increasingly travel to U.S. centers for specialized surgery, premium care, or waitlist reduction.

- A Florida facility with AHCA compliance and strong reputation becomes highly attractive.

Trend 2: Regulatory Convergence & Credential Reciprocity

- Many institutional buyers in Canada and Australia value U.S. compliance, requiring standardization across jurisdictions.

- Enterprises that can present “Florida compliance + U.S CMS alignment + home country accreditation (e.g. TGA, Health Canada)” command higher trust.

Trend 3: Outcome-Based / Value-Based Models

- Both Canada and Australia are emphasizing outcome-based funding, care pathways, and performance-based reimbursement.

- Strategies developed under AHCA and CMS for Medicaid/Medicare can inform or be repurposed for Canadian provinces or Australian states.

Trend 4: Vertical Integration & Digital Health

- Telehealth, integrated care networks, and hybrid digital-physical models are scaling globally.

- Florida-based operations can serve as innovation hubs or centers of excellence feeding cross-border tech platforms.

Trend 5: Health Data & Benchmarking Demand

- Buyers in Canada/Australia are seeking benchmarking, data analytics, and performance comparisons.

- Enterprises with AHCA data, dashboards, and reporting systems can license or share packages into those markets.

Trend 6: Investment Capital Flight to Health Care

- Investors globally are chasing health care assets. Entities with U.S. regulatory compliance (e.g. AHCA) have better exit pathways or acquisition potential.

By aligning AHCA-driven strategies with Canadian and Australian buyer expectations, enterprises can capture cross-border premium demand, create scalable models, and repurpose compliance investments beyond U.S. borders.

Key Takeaway: Florida Health Care Regulation and ROI Lessons for Tier One Enterprises

As we close, here are the distilled lessons and actionable takeaways for Tier One enterprises (USA, UK, Canada, Australia) seeking to leverage AHCA frameworks for strategic growth:

- Compliance is not “cost” — it’s capital

Thoughtful investment in AHCA compliance becomes a moat, marketing signal, and valuation driver. - Visibility through public metrics fuels lead generation

Listing in AHCA / FloridaHealthFinder with quality data draws patients, payers, and partners. - Crosswalk CMS & AHCA alignment

Use CMS training, reimbursement, and standards as a foundation; localize to Florida rules to ensure dual compliance. - Medicaid services are scalable margin engines

With analytics, case management, and quality incentives, Medicaid becomes one of your most stable revenue streams. - International buyers prize U.S. regulatory compliance

For cross-border investors, AHCA licensing reduces perceived risk and accelerates investment decisions. - Directories, prior authorization, and referral systems are conversion channels

Don’t treat them as overhead; actively optimize them for patient acquisition and funnel efficiency. - Stay ahead of policy change with regulatory intelligence

Use CMS Open Door Forums, comment periods, and early adaption as competitive advantages. - Operational discipline + automation = scalable compliance

Build systems early to minimize drift and audit errors, so scaling doesn’t break compliance. - Leverage closures, market gaps, and underserved geographies

Ready compliant providers can capitalize when hospitals close or coverage gaps appear. - Global scalability begins with local compliance excellence

Successfully mastering AHCA operations gives you a template for national U.S. expansion and cross-border credibility.

In sum, when you treat “Florida AHCA compliance + operational execution + strategic marketing” as a unified bundle, you transform regulatory overhead into a powerful engine for ROI, lead generation, and sustainable growth across Tier One markets.

What Does the Florida Agency for Health Care Administration Do? Expert Insights for Buyers

The Florida Agency for Health Care Administration (AHCA) operates as the state’s primary health policy, regulation, and oversight body. Below are nuanced insights into what exactly it does, especially from a buyer or investor’s lens:

- Medicaid Program Oversight & Managed Care Contracts

AHCA administers the Medicaid program in Florida, including contracting with managed care plans (SMMC) to serve Medicaid populations. ahca.myflorida.com+2ahca.myflorida.com+2 - Licensure & Certification of Health Facilities

It issues, renews, audits, inspects, and enforces regulations for Entities such as hospitals, nursing homes, clinics, assisted living, labs, home health, and more. ahca.myflorida.com+2oppaga.fl.gov+2 - Quality Assurance & Consumer Complaint Handling

Through its Health Quality Assurance division, it responds to consumer complaints, monitors provider performance, sanctions noncompliance, and ensures compliance with standard of care. oppaga.fl.gov+2ahca.myflorida.com+2 - Background Screening & Provider Eligibility

It operates a Background Screening Unit, enforcing Level 2 fingerprint checks and managing a Clearinghouse that determines eligibility for providers in regulated settings. ahca.myflorida.com - Data Collection, Reporting & Transparency

AHCA collects health care data and makes it publicly available through dashboards, FloridaHealthFinder, and policy analysis divisions. Florida Health Finder+2ahca.myflorida.com+2 - Policy & Rulemaking

It issues rules (under Florida law) governing care standards, licensing, Medicaid reimbursement, inspections, and provider behavior. These rules often evolve (e.g. 2025 rule changes). oppaga.fl.gov+3Elevate Legal Services, PLLC+3ahca.myflorida.com+3 - Consumer Education & Assistance

It provides consumer resources—locating facilities, comparing performance, informing rights—via public portals like FloridaHealthFinder. Florida Health Finder+1

From a buyer’s perspective, AHCA is where regulation, compliance, and market entry intersect. Understanding its mandates allows you to structure due diligence, risk assessments, compliance planning, and operating models that align with Florida’s health care landscape.

How to Become a Healthcare Administrator in Florida? Step-by-Step ROI Career Path

If your goal is a leadership role in Florida’s health care system, especially interfacing with AHCA-regulated operations, here’s a high-level ROI-focused path:

- Educational Foundation

- Bachelor’s degree in Health Administration, Public Health, Business, or related field

- Master of Health Administration (MHA) or MBA with health focus is often preferred

- Certification & Licensing

- Consider credentials like FACHE (Fellow of American College of Healthcare Executives)

- Pursue state or regional health administration certifications where available

- Early Experience & Exposure

- Work within hospitals, clinics, regulatory bodies, or Medicaid entities

- Gain exposure to compliance, quality assurance, finance, operations

- Regulatory / Compliance Expertise

- Specialize in AHCA, Medicare/Medicaid rules, health law, or quality management

- Serve roles in compliance departments interacting with AHCA, CMS audits, reporting

- Leadership & Strategy Roles

- Move into roles such as Director of Compliance, VP of Operations, or Chief Operating Officer

- Lead regulatory initiatives, inspections, quality improvement programs

- Continuous Learning & Networking

- Attend CMS Open Door Forums, AHCA workshops, state health association conferences

- Stay current on rule changes, policy updates, and innovation trends

- Thought Leadership & Brand Building

- Publish whitepapers, lead seminars, speak in health policy forums

- Build credibility as a regulatory-savvy leader

- Enterprise Value Creation

- Use your compliance + operational acumen to lead expansions, mergers, cross-border entries

- Your track record in successfully navigating AHCA/CMS becomes a high-value asset

From a ROI lens, the best administrators combine regulatory mastery, operational results, and brand leadership—making them sought-after in expansions, acquisitions, and strategic growth contexts.

Who Needs an AHCA License in Florida? Compliance Rules and Growth Benefits

Not all health care entities require an AHCA license—but many do—and knowing exactly which operations must comply is vital for growth planning and risk avoidance.

Entities / Services Requiring AHCA Licensure

- Hospitals (general, specialty, psychiatric)

- Ambulatory Surgery Centers (ASCs)

- Clinics and outpatient facilities

- Home health agencies, home medical equipment providers

- Assisted living facilities, nursing homes, residential care

- Behavioral health, residential treatment centers

- Diagnostic imaging / radiology centers

- Hospice services

- ICF/DD (Intermediate Care Facilities for the Developmentally Disabled)

- Laboratories and pathology services

- Managed Care Organizations (for network participation)

- Any facility providing regulated health care services under state jurisdiction

ahca.myflorida.com+3ahca.myflorida.com+3oppaga.fl.gov+3

Benefits for Entities that Acquire AHCA Licenses

- Access to Medicaid / Managed Care Revenue

Only licensed providers can be reimbursed under Medicaid / SMMC networks. - Legitimacy & Patient Trust

AHCA licensure signals safety, quality, and regulatory approval to patients, payers, and partners. - Network & Referral Access

Compliant providers can join payor panels, provider networks, and be included in directory referrals. - Growth & Expansion Pathways

Licensure enables facility additions, service line expansion, or chain scaling. - Better Valuation & Exit Potential

Entities with clean AHCA licenses command higher multiples under sales or mergers. - Discount & Incentive Opportunities

Some programs or contracts reserve access or better rates for licensed, high-performing providers.

Understanding which services require licensing—and prioritizing compliance as early as possible—reduces friction and accelerates growth in Florida’s regulated landscape.

Is Florida Health a Government Agency? Trust and Transparency for Tier One Buyers

Yes—Florida Health (or more precisely, Florida’s health care regulatory and public health apparatus) operates largely as a government entity. Understanding its structure, transparency, and accountability mechanisms is crucial for building trust, especially for Tier One buyers.

- AHCA is a State Agency

The Florida Agency for Health Care Administration is a governmental body created under Florida statutes. ahca.myflorida.com

Its operations, budgets, rulemaking, and public records are subject to Florida’s laws and oversight. - Transparency & Public Records (Sunshine Law)

Florida enforces a “Sunshine Law,” meaning many agency documents—licensing applications, financial records, enforcement orders—are subject to public inspection. ahca.myflorida.com+1 - Public Dashboards & Consumer Tools

AHCA publishes health care facility performance, adverse incidents, license statuses, and closed provider data via portals like FloridaHealthFinder. Florida Health Finder - Legislative Oversight & Budget Control

AHCA is accountable to the Florida Legislature, which approves its budget, statutory mandates, and rule authority. - Executive Appointments & Accountability

The AHCA Secretary (recent transitions include Jason Weida and Shevaun Harris) is appointed by the Governor and thus politically accountable. Wikipedia+2ahca.myflorida.com+2

For example, in 2025, Secretary Shevaun Harris leads the agency under Governor DeSantis. ahca.myflorida.com+1

For Tier One buyers, this means that AHCA-regulated providers operate under a transparent, normative public regime—license records, enforcement history, and performance data are accessible and can be scrutinized. That transparency, when positive, becomes a powerful trust anchor in global deals.

Florida Health Care ROI Report: Key Growth Statistics for Enterprises in the USA, UK, Canada, and Australia

Below is a synthesized set of growth and ROI-relevant statistics and benchmarks—drawn from public data and market trends—to guide enterprise expectations and benchmarking across the USA, UK, Canada, and Australia within the context of AHCA-influenced Florida operations.

Key ROI & Growth Benchmarks

| Metric | Florida / AHCA Context | Comparable Benchmarks (USA / Global) | Strategic Insight |

|---|---|---|---|

| Medicaid Budget | ~$35 billion annual program in Florida ahca.myflorida.com | Many comparable U.S. states run $10–$50B Medicaid budgets | Scale is significant; markets exist for efficient operators |

| Number of Licensed Providers | ~50,500 regulated facilities in Florida ahca.myflorida.com+1 | U.S. national licensed facility count is several hundred thousand | Plenty of room for consolidation and best-practice dominance |

| Hospital Closure Rate | Florida has had multiple closures in recent years (impacting regional access) | U.S. trends of rural hospital closures rising | Opportunity for compliant providers to expand footprint |

| Medical Tourism Volume | Florida is a major medical tourism hub | U.S. sees millions of cross-border procedures, especially from Canada, Latin America, Caribbean | AHCA compliance is vital to compete internationally |

| Value-Based Metric Bonus Capture | Quality incentive potential ranges 2–8%+ for high-performing providers | Across U.S., top performers capture 5–12% bonus uplift | Prioritize quality metrics to unlock margin |

| Real Estate / Capex Multipliers | Health facility valuation multiples in Florida often range 10–20× EBITDA (adjusted for regulatory risk) | U.S. specialty clinics may command 15–25× valuations | Clean compliance allows you to push toward higher multiples |

| Cross-Border Premiums | International buyers often pay 10–30% premium for regulated, safe U.S. assets | UK/Australia investors value U.S. regulated status heavily | Your regulatory track record is a key lever in negotiations |

These statistics underscore the opportunity scale and benchmark expectations. Enterprises leveraging AHCA compliance, performance, and branding are often rewarded with premium multiples, higher margins, and cross-border demand.

FAQ

Q1. What are the best AHCA-licensed health care services in Florida for high ROI in the USA and UK?

High ROI services typically include: bariatric surgery / obesity surgery, specialty surgery centers (orthopedics, spine, cardiac), imaging / diagnostic centers, outpatient clinics with ancillary services (telehealth, wellness), home health / post-acute care, behavioral health and addiction services, and hair transplant / cosmetic clinics. These services benefit from premium pricing, global demand, and cross-border patient flow. The key is coupling the service with operational excellence, compliance, and marketing transparency.

Q2. How much does it cost to get an AHCA license in Florida? A complete buyer’s checklist.

Costs vary by license type, service scope, capital, staffing, accreditation, surety bonds, facility upgrades, etc. Key cost items include: application fees, proof of financial ability (PFA), surety bond (e.g. $500,000 for nonimmigrant-controlled entities), facility modifications, staffing and credentialing, accreditation costs, legal & consulting fees, inspection remediation costs, and ongoing compliance audits. Always budget a contingency (10–20%) for surprises during inspections. Refer to AHCA’s licensing pages for specific fee schedules. ahca.myflorida.com

Q3. What is the top ROI healthcare compliance strategy under the Florida Agency for Health Care Administration?

The highest ROI compliance strategy is to build a proactive compliance engine: embed compliance from day one in operations, use automation to track licenses / audits / credentialing, conduct mock inspections, convert compliance milestones into marketing signals (quality metrics, directory listings), and recycle compliance insights into service offerings (training, advisory). That way, compliance becomes a revenue & trust asset rather than sunk cost.

Q4. How do Tier One enterprises compare AHCA regulations vs. CMS guidelines for conversions?

Enterprises align both: use CMS training, conditions of participation, Medicare/Medicaid rulebooks as baseline, then adapt to Florida’s AHCA-specific rules (licensing, reporting, inspections, rule changes). The conversion advantage is building a crosswalk that satisfies both sets of rules once, rather than treating them separately. In practice: map each CMS requirement to AHCA equivalent, ensure documentation, audit systems, and maintain dual compliance dashboards.

Q5. What is the job outlook and salary growth for healthcare administrators in Florida?

Healthcare administrators in Florida generally have solid demand, especially in regulated entities (hospitals, clinics, home health). Salaries vary by role, size, location, and experience—ranging from mid-$70,000s for smaller facility managers to over $200,000+ for executives in large health systems. Rapid growth in managed care, compliance oversight, and expansion of care models (telehealth, outpatient services) is driving sustained demand. (Exact salary figures should be consulted via BLS, state health associations, and compensation surveys.)

Q6. What are the best Medicaid ROI optimization practices through AHCA approval in Florida?

Best practices include predictive analytics for high-cost beneficiaries, intensive care management, bundled / capitated arrangements, home-based care models, incentive capture strategies, reducing readmissions, leveraging data for utilization control, cross-subsidization via commercial lines, and scaling up successful pilot models rapidly. Integrating compliance, quality, and cost control is the secret to turning Medicaid from low-margin to high-efficiency engine.

Q7. How can health care buyers in Canada and Australia benefit from Florida AHCA compliance services?

Buyers can (a) acquire Florida providers with regulatory credentials to anchor U.S. operations, (b) import service models (telehealth, outpatient specialist hubs), (c) license AHCA compliance tools/consulting for local adaptation, (d) use Florida as a marketing and referral hub for medical tourism, and (e) gain credibility by showing U.S. regulated operations in global pitches. AHCA compliance serves as a seal of quality in many cross-border negotiations.

Q8. What is the ROI difference between private providers and AHCA-approved providers in Florida?

AHCA-approved providers can access Medicaid / managed care reimbursements, referral flows, directory presence, quality bonuses, and trust-based pricing. Private providers without approval may rely entirely on self-pay or commercial payers and miss out on the stable volume Medicaid offers. Over time, the higher margin and stability of AHCA participation typically yields better ROI, provided compliance is maintained without penalties.

Q9. Which checklist ensures successful AHCA license applications for Tier One enterprises?

A successful checklist includes: identifying license type, capital planning, proof of financial ability (PFA), surety bond if needed, drafting compliant policies (quality, incident reporting, privacy), credentialing plans, staffing plans, facility design/ compliance to building codes, writing corporate compliance manual, preparing mock audits, submitting accurate application forms, pre-clearing background screening, preparing for onsite inspections, remediation planning, and scheduling post-inspection follow-up.

Q10. What are the top conversion-driven patient rights protections under Florida AHCA for global buyers?

Top protections include: clear grievance and appeal mechanisms, informed consent, record access rights, privacy / HIPAA compliance, visitation policies, non-discrimination rules, complaint reporting to AHCA, cultural & accessibility accommodations, public posting of patient rights, ombudsman or patient liaison access, and transparent communication. These protections should be clearly published (in multiple languages if serving international patients) and featured in marketing to convert patient trust into bookings.