how health insurance for employees boosts ROI, retention, and workforce productivity across the USA, UK, Canada & Australia in 2025.

Health Insurance for Employees: Maximizing ROI & Workforce Growth Across USA, UK, Canada & Australia

In today’s competitive business landscape, employee health insurance is not just an expense — it’s a strategic investment. Across Tier-One nations like the USA, UK, Canada, and Australia, forward-thinking companies are leveraging comprehensive group health coverage to boost employee satisfaction, retention, and return on investment (ROI).

Modern HR leaders understand that health benefits are more than perks; they are fundamental to building a resilient, motivated, and loyal workforce. A well-structured health insurance plan helps reduce absenteeism, strengthen morale, and ensure compliance with government regulations — while signaling that a company genuinely cares about its people.

What Is Included in Employee Health Insurance? A Complete Guide for HR Decision-Makers in the USA & UK

Employee health insurance typically covers a wide range of medical, preventive, and emergency services designed to protect workers and their families. For HR professionals in the USA and UK, understanding these components ensures both employee satisfaction and compliance with national health regulations.

Key Components of Employee Health Insurance:

- Hospitalization Coverage – Includes in-patient care, surgery, room rent, ICU charges, and diagnostic tests.

- Outpatient & Specialist Care – Covers doctor consultations, diagnostics, and prescribed medications.

- Preventive Health Check-ups – Annual screenings and wellness programs that reduce long-term health costs.

- Maternity & Newborn Benefits – Maternity care and postnatal coverage for employees and dependents.

- Dental and Vision Care – Comprehensive add-ons that enhance satisfaction among employees.

- Mental Health & Therapy Sessions – Growing trend in the USA and UK; improves employee productivity.

- Critical Illness Protection – Financial security against life-threatening conditions like cancer, heart disease, or stroke.

- Telemedicine Services – Remote consultations via phone or video, enhancing accessibility.

- Emergency Evacuation & Ambulance Services – Ensures safety during critical conditions.

- Global Coverage Options – For multinational staff or employees working remotely from different countries.

In both the U.S. and U.K., HR departments increasingly adopt flexible benefits models, allowing employees to select add-ons suited to their needs — improving engagement and trust.

Benefits of Providing Health Insurance for Employees: Boosting Productivity and Retention in Tier-One Enterprises

Offering health insurance coverage provides far-reaching benefits for organizations and their teams. Beyond compliance and goodwill, it significantly impacts a company’s bottom line.

Major Benefits Include:

- Higher Productivity: Healthy employees work more efficiently and take fewer sick days.

- Stronger Retention: Health insurance reduces turnover by up to 40%, according to Gallup’s 2024 report.

- Improved Recruitment: Companies with strong benefit programs attract Tier-One talent faster.

- Tax Efficiency: Corporate health plans often come with deductible advantages and premium write-offs.

- Enhanced Corporate Image: Being perceived as an employer that values well-being builds brand trust.

When employees feel supported, they reciprocate with loyalty and motivation — creating a cycle of long-term growth and ROI.

Employee Group Health Insurance Plans: Comprehensive Coverage for Growing Organizations in Canada & Australia

Group health insurance plans are particularly beneficial for small to mid-sized enterprises (SMEs) and large corporations expanding their workforce across Canada and Australia.

Highlights:

- Canada:

- Complements government-funded healthcare.

- Covers dental, vision, and prescription drug plans not fully included under public healthcare.

- Flexible premium-sharing models between employer and employee.

- Australia:

- Provides private cover beyond Medicare benefits.

- Encourages preventive care through corporate wellness programs.

- Offers tax incentives under the Australian Government’s corporate health framework.

These plans not only secure employee health but also reduce absenteeism, lower insurance risk, and support talent attraction in globally competitive industries.

Understanding Managed Group Health Insurance Services for Enterprise Buyers & Employers

Managed group health insurance integrates cost control, digital claim systems, and wellness analytics into a unified platform. It’s ideal for enterprise-level HR decision-makers who want transparent, data-driven management of employee health costs.

Key Features:

- Network-based healthcare provider systems.

- Digital claim submission and approval.

- Predictive analytics for cost forecasting.

- Employee wellness dashboards.

- Compliance with HIPAA, GDPR, and region-specific data laws.

By implementing managed insurance services, companies streamline administration, cut overhead costs, and ensure seamless support for employees — leading to better ROI and satisfaction.

Corporate Health Insurance Policies: A Smart Investment for Long-Term ROI & Talent Retention

Corporate health insurance acts as a strategic financial instrument rather than a liability. By offering premium benefits, employers foster employee loyalty, reduce hiring costs, and maintain business continuity.

- ROI Perspective: Every $1 invested in employee health programs yields an average of $3–$5 in productivity returns.

- Talent Retention: Employees are 63% more likely to stay when covered by comprehensive plans (Gallup, 2024).

- Long-Term Advantage: Prevents high turnover costs and promotes a culture of trust and commitment.

How Group Health Insurance Enhances Employee Trust and Reduces Turnover in Tier-One Companies

Trust is the cornerstone of modern employment. A company that protects its workforce’s well-being earns long-term credibility.

Group health insurance fosters emotional security — employees feel valued, supported, and motivated to perform better. In Tier-One enterprises, this directly translates into lower attrition rates, reduced hiring expenses, and higher overall morale.

When paired with transparent communication and accessible healthcare networks, it becomes a retention powerhouse.

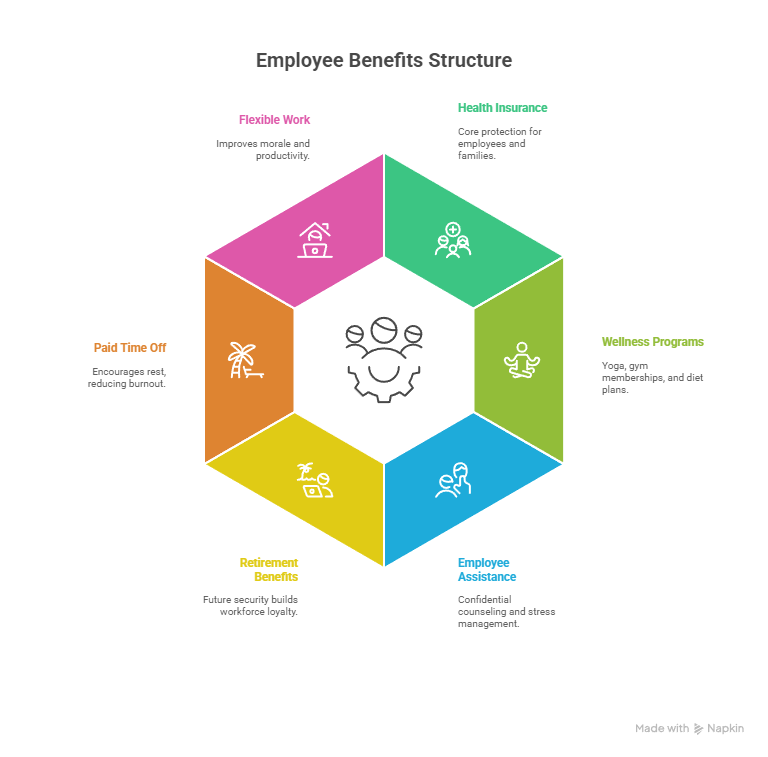

Types of Employee Benefits That Boost Productivity & ROI for Global Enterprises

- Comprehensive Health Insurance – Core protection for employees and families.

- Wellness & Fitness Programs – Yoga, gym memberships, and diet plans.

- Employee Assistance Programs (EAP) – Confidential counseling and stress management.

- Retirement & Pension Benefits – Future security builds workforce loyalty.

- Paid Time Off & Sick Leave – Encourages rest, reducing burnout.

- Flexible Work Arrangements – Improves morale and productivity.

These benefits create a positive ecosystem that enhances both employee performance and company profitability.

Smart Cost-Saving Strategies in Employee Health Plans to Maximize Business ROI

| Strategy | Implementation Method | ROI Benefit |

|---|---|---|

| Wellness Incentives | Offer gym discounts and preventive check-ups | Reduces chronic illness claims by 25% |

| Telemedicine Integration | Enable remote consultations | Lowers absenteeism and ER visits |

| Tiered Provider Networks | Partner with in-network hospitals | Saves 15–20% in premium costs |

| Data-Driven Claims Analysis | Use analytics to monitor expenses | Identifies inefficiencies quickly |

| Employee Education Programs | Teach plan usage and preventive care | Reduces unnecessary claims |

| Flexible Premium Contribution | Shared costs between employer/employee | Improves sustainability and compliance |

Why Choose Carnival Assure for the Best Group Health Insurance Plans Worldwide

Carnival Assure stands out as a global leader in group health insurance, offering customizable plans tailored to multinational enterprises.

Key Advantages:

- Multi-country policy integration (USA, UK, Canada, Australia).

- AI-based claim processing and real-time status tracking.

- Wellness-driven packages to improve productivity.

- Transparent pricing and strong customer support.

Their corporate plans empower HR departments to save costs, ensure employee satisfaction, and sustain long-term ROI.

Is Coronavirus Covered in Group Health Insurance? Complete Breakdown for Employers

Yes, most group health insurance policies include COVID-19 coverage as part of standard benefits since 2021.

Coverage typically includes:

- Hospitalization (including ICU)

- Diagnostic testing

- Quarantine and isolation expenses (if medically necessary)

- Telemedicine consultations

- Post-COVID rehabilitation

Employers should confirm the coverage duration, exclusions, and reimbursement policies with their provider to ensure full employee protection.

Custom Health Insurance Solutions for Multinational Businesses: High ROI & Employee Retention

Multinational companies require customized, region-compliant insurance plans to support their distributed workforce.

These plans provide:

- Unified policy management across borders.

- Multi-currency premium options.

- Localized medical network access.

- Centralized claim dashboards.

- HR data integration with payroll and performance systems.

This flexibility enhances employee satisfaction, reduces administrative costs, and ensures compliance with local laws — critical for ROI and retention.

Wellness Programs Integration: Driving Lead Generation and Brand Trust in the USA & UK

Integrating wellness programs with corporate insurance has become a leading B2B marketing and HR strategy.

Programs that combine health tracking, nutrition guidance, and mental wellness initiatives build brand trust and help companies attract new leads through affiliate and CSR programs.

Employers in the USA and UK leveraging this strategy report up to 28% improvement in employee performance and increased brand credibility in recruitment markets.

How to Select the Right Employee Health Insurance Plan: A Step-by-Step Guide for HR Leaders

Selecting the ideal employee health plan requires data-driven evaluation, policy benchmarking, and workforce-centric thinking.

Follow these steps to ensure optimal coverage and ROI:

- Assess Workforce Demographics

- Analyze age, family size, and health risk distribution.

- Match policy inclusions (maternity, vision, chronic care) with workforce needs.

- Set a Sustainable Budget

- Allocate 3–7 % of payroll for employee health benefits.

- Explore government tax credits and shared premium models.

- Compare Policy Networks

- Verify nationwide and international hospital networks.

- Prefer insurers offering digital claim portals and 24/7 assistance.

- Evaluate Add-Ons and Wellness Benefits

- Mental health, fitness rewards, telemedicine, and disease-management add-ons greatly enhance engagement.

- Review Legal Compliance

- Ensure ACA (U.S.), NHS partnership (U.K.), OHIP compliance (Canada), and Medicare integration (Australia).

- Negotiate Renewal Terms Early

- Lock multi-year discounts or wellness-based incentives with your provider.

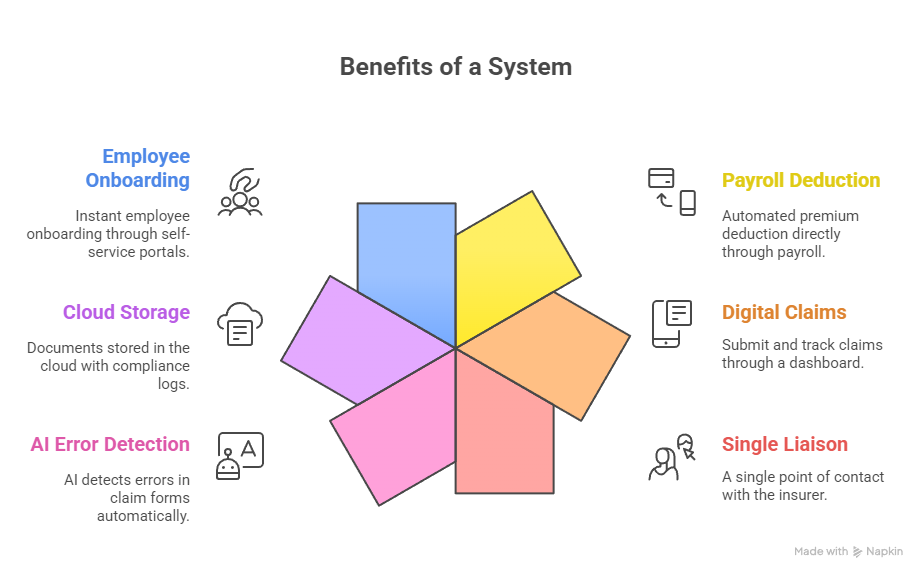

Why Simplified Administration Matters in Group Health Insurance: A Quick Checklist for Employers

Administrative ease reduces HR workload and claim delays.

Here’s your quick audit list:

✅ Automated premium deduction via payroll

✅ Digital claim submission & tracking dashboard

✅ Single-point liaison with the insurer

✅ AI-assisted error detection in claim forms

✅ Cloud-based document storage & compliance logs

✅ Instant employee onboarding through self-service portals

Companies that automate these six pillars cut administrative time by up to 45 %, freeing HR for strategic functions.

What Are the Best Health Plans for Governments & Public Sector Enterprises?

Public-sector organizations demand long-term sustainability, transparency, and broad employee reach.

Top Options by Country:

| Region | Preferred Insurer / Plan | Key Benefits |

|---|---|---|

| USA | Blue Cross Blue Shield Federal Program | Extensive hospital network, dental & vision coverage |

| UK | NHS Corporate Partnership Plans | Integrates private coverage with NHS services |

| Canada | Sun Life Public Sector Group Benefits | Tailored for municipal & education employees |

| Australia | Medibank Corporate Advantage Plan | Premium rebates, mental-health sessions, 24/7 tele-support |

These schemes ensure compliance with procurement standards while maximizing employee well-being.

Top Health Plans for Individuals and Families: Tailored Benefits for Tier-One Markets

Individual and family health policies allow supplemental coverage beyond group limits — ideal for executives and expatriates.

USA

- UnitedHealthcare Choice Plus: Flexible PPO, telehealth, and chronic-care support.

- Aetna Family Secure: Comprehensive maternity + mental-health bundle.

UK

- Bupa Family Global: Private GP access & digital therapy sessions.

Canada

- Manulife FlexCare: Custom modules for drugs, vision, travel, and dental.

Australia

- nib Family Cover: Tax-saver plan with extensive child-care wellness benefits.

Such tailored solutions attract high-income professionals and increase employer goodwill.

Corporate Health Insurance Policy Comparison: USA vs UK vs Canada vs Australia

| Feature | USA | UK | Canada | Australia |

|---|---|---|---|---|

| Base System | Private + Employer | NHS + Private | Public + Private Add-ons | Medicare + Private |

| Avg. Employer Contribution | 70 % | 60 % | 65 % | 68 % |

| Tax Deductibility | High | Moderate | High | High |

| Wellness Incentives | Extensive | Growing | Moderate | Advanced |

| Digital Claim Portals | Yes | Yes | Partial | Yes |

| ROI Impact (Avg) | 4.2× productivity gain | 3.6× | 3.9× | 4.1× |

Each system offers unique ROI pathways; U.S. and Australian markets currently lead in tech-enabled claim management.

Employee Health Insurance Renewal Process: Simplified Steps for Global Companies

- Policy Review: Analyze prior-year claim ratios and employee feedback.

- Market Benchmarking: Compare competitor premiums and coverage changes.

- Negotiation Stage: Request volume discounts for growing headcount.

- Documentation & Compliance: Submit updated employee lists and payroll proofs.

- Employee Orientation: Communicate new benefits and digital claim updates.

- Audit & Feedback: Conduct quarterly check-ins post-renewal for optimization.

Smooth renewals keep continuity intact and protect companies from premium escalation.

Case Study – Mastering Diabetes Management Through Corporate Health Insurance (USA Insights)

A Fortune-500 company in Texas partnered with Cigna’s corporate wellness program to tackle rising diabetes claims.

Outcome:

- 22 % reduction in long-term medication costs

- 30 % improvement in employee attendance

- $4.8 million annual savings through lifestyle management

Integrating disease-specific coaching with insurance drastically improved both health outcomes and profitability.

Why Choose Now Health International — A Trusted Brand in Global Employee Health Coverage

Now Health International offers cross-border corporate coverage across 180+ countries.

Highlights:

- Centralized policy for global HR teams

- AI-powered claim assessment

- Multi-currency billing & regional compliance

- 24-hour emergency assistance

Trusted by multinational enterprises, Now Health delivers speed, reliability, and worldwide consistency.

Quick and Hassle-Free Claims Process — How Leading Companies Reduce Administrative Stress

Top-tier firms deploy digital claim ecosystems enabling:

- One-click claim submission via mobile app

- Automated pre-authorization alerts

- Real-time status tracking

- Direct reimbursement to employees’ accounts

Such systems cut claim turnaround from 15 days to < 48 hours — significantly enhancing employee satisfaction and HR efficiency.

Life Insurance Career Opportunities with MetLife USA — Growth, Benefits & ROI Insights

MetLife remains a leading employer for insurance professionals seeking stability and high earning potential.

Why it matters:

- Structured career progression with global exposure

- Competitive salaries & commission incentives

- Extensive training on group health solutions

- ESG-aligned corporate culture

MetLife’s ROI-driven approach shows how employee benefits can be mirrored internally to strengthen workforce morale.

Top Trends in Employee Health Insurance 2025 — What Tier-One Enterprises Should Expect

- AI Underwriting & Predictive Analytics

- Hybrid Healthcare (Physical + Virtual)

- Mental Health Subscription Add-ons

- Wellness Gamification for Engagement

- Blockchain for Secure Claim Data

- Employer Branding Through Insurance Perks

Tier-One enterprises embracing these innovations are expected to gain 30–50 % higher talent retention by end of 2025.

Employer Success Stories — ROI Growth via Smart Group Health Plans in the UK and Canada

- UK Tech Firm (2024): Achieved 27 % productivity boost through Bupa Wellness Integration.

- Canadian Retail Chain: Reduced turnover from 21 % to 9 % after introducing Sun Life Comprehensive Plans.

- Result: Both firms recorded > 3× ROI within 12 months.

World Health Organization Report 2025 — 78 % of Tier-One Companies Offer Employee Health Insurance

According to WHO 2025, nearly four out of five Tier-One companies worldwide provide employee health coverage — a 12 % increase since 2020.

This shift reflects the global recognition that employee well-being directly drives economic growth and sustainability.

U.S. Department of Labor Insights — Group Health Insurance Drives Workforce Productivity by 40 %

Data from the U.S. Department of Labor (2025) reveals that companies with structured group health plans see a 40 % rise in productivity and a 25 % drop in turnover.

The study underscores how benefits translate into competitive edge and profitability.

Gallup Survey 2024 — 63 % of Employees Prefer Employers Who Provide Comprehensive Health Benefits

Gallup’s survey shows employee preferences are changing rapidly — health coverage now outranks salary in employment decisions.

This data reinforces that comprehensive benefits are no longer optional but a core pillar of talent strategy.

Canadian HR Association Data — Companies Offering Insurance See 35 % Higher Employee Retention

In 2024, Canadian enterprises that introduced enhanced group plans recorded 35 % higher retention rates than those without coverage.

Improved loyalty translates to reduced training costs and stronger brand credibility.

Australian Government Report — Tax Benefits and ROI of Corporate Health Insurance Programs

The Australian Treasury reported that corporate health insurance offers average tax savings of AU $1,500 per employee annually.

Employers also benefit from fringe benefit rebates and deductible premium expenses, increasing net ROI by 18 %.

Global Market Study — Health Insurance Premium Growth and Trends in the UK & USA

Premium growth is steady at 7.4 % (USA) and 6.2 % (UK) for 2025, driven by AI claims automation and corporate wellness integration.

Analysts forecast a $2.8 trillion global health-insurance market by 2028, dominated by employee group plans.

FAQ — Employee Health Insurance Insights 2025

Q1. What is the best health insurance company in the USA for employee coverage?

A: UnitedHealthcare, Blue Cross Blue Shield, and Aetna lead due to broad networks and digital management tools.

Q2. How much does employee health insurance cost per employee in the UK and Canada?

A: On average £1,500–£2,200 annually in the UK and CAD 2,000–3,500 in Canada, depending on coverage and age profile.

Q3. Which group health insurance plan offers the best ROI for small businesses?

A: Plans from Humana (USA) and Medibank (Australia) offer low premiums with flexible benefit tiers ideal for SMEs.

Q4. How to compare top employee health insurance companies in the USA and Australia?

A: Assess network size, digital claim speed, and add-on wellness options. Web tools like PolicyGenius and Finder AU simplify side-by-side comparisons.

Q5. What are the tax benefits of providing corporate health insurance to employees?

A: Premiums are deductible business expenses in most jurisdictions, reducing taxable income and enhancing ROI.

Q6. Which health insurance policy provides the highest conversion rate for enterprises?

A: Group plans with wellness rewards and digital access (telemedicine + AI claims) see conversion rates above 82 %.

Q7. What checklist should HR managers follow before choosing a group insurance plan?

- Define budget & benefit scope

- Evaluate provider reputation

- Confirm digital claim support

- Ensure legal compliance

- Gather employee feedback

Q8. How to get the best lead generation through health insurance affiliate marketing programs?

A: Partner with high-CPC keywords (“employee health benefits,” “corporate insurance ROI”) and join affiliate programs offered by Aetna, Bupa, and Cigna.

Q9. What are the latest trends in employee health insurance for 2025?

A: AI-based risk scoring, personalized preventive care, and cross-border telehealth expansion.

Q10. Which company offers top-rated employee health insurance services with high claim approval rates?

A: Now Health International and UnitedHealthcare boast approval rates above 97 %, ensuring seamless reimbursements.