Florida Health Care 2025—boost ROI, cut costs, and drive growth with transparent, high-quality services trusted in the USA, UK, Canada & Australia.

Florida Health Care ROI Growth & Lead Generation for High Quality, Transparent, and Cost-Effective Services in USA, UK, Canada & Australia

Florida’s health care ecosystem has evolved into a dynamic model of transparency, innovation, and measurable return on investment (ROI). From world-renowned hospitals to cutting-edge digital health platforms, Florida Health Care represents a bridge between patient-centered care and enterprise profitability.

Today, decision-makers and investors from the USA, UK, Canada, and Australia are increasingly drawn to Florida’s health infrastructure for its data-driven efficiency, public accountability, and competitive cost advantage. Whether it’s a multinational enterprise evaluating medical partnerships or a private buyer seeking cost-effective care packages, Florida’s system offers clear metrics, global transparency, and proven lead generation potential.

Why Florida Health Care Matters for Global Enterprises

In an age where health care costs continue to rise globally, Florida stands out as a high-ROI market. The state’s health agencies and private providers leverage open data, telemedicine growth, and price transparency laws to drive measurable value. Florida’s healthcare expansion has not only reduced costs for local residents but also attracted international health tourists, B2B investors, and enterprise buyers seeking scalable solutions.

The result? A measurable, data-backed ROI growth trend that positions Florida as one of the most cost-effective and innovative health care ecosystems in the developed world.

Florida Health Care Reform to Maximize ROI for Decision-Makers & Enterprises

The Florida Health Care Reform is a state-led initiative designed to ensure both affordability and profitability. This reform strategically supports providers, payers, and enterprises by aligning financial goals with patient outcomes. Below are the four key reform pillars that maximize ROI for decision-makers:

1. Transparency and Value-Based Care

- Florida’s reform mandates clear cost visibility in health care pricing.

- Hospitals must disclose average treatment costs online, empowering buyers to make ROI-informed purchasing decisions.

- Value-based payment models link reimbursement to quality outcomes — ensuring health systems earn more when patients get better, not just when they receive more services.

2. Digital Transformation and AI-Driven Care

- The integration of AI in Florida’s hospital systems has led to predictive analytics for patient outcomes, reducing avoidable hospitalizations by over 23%.

- Enterprises investing in digital health and telemedicine infrastructure enjoy higher lead conversions due to better patient engagement and lower administrative costs.

- AI-based diagnostic systems have improved efficiency, reducing operational expenses and maximizing ROI margins for enterprises.

3. Data Sharing and Global Buyer Confidence

- The Florida Health Care Transparency Database allows buyers from the USA, UK, Canada, and Australia to compare provider performance.

- This data-driven approach has enhanced buyer confidence, leading to increased health service exports and medical tourism.

- Enterprises can easily benchmark providers by treatment cost, success rate, and patient satisfaction — helping maximize corporate health care ROI.

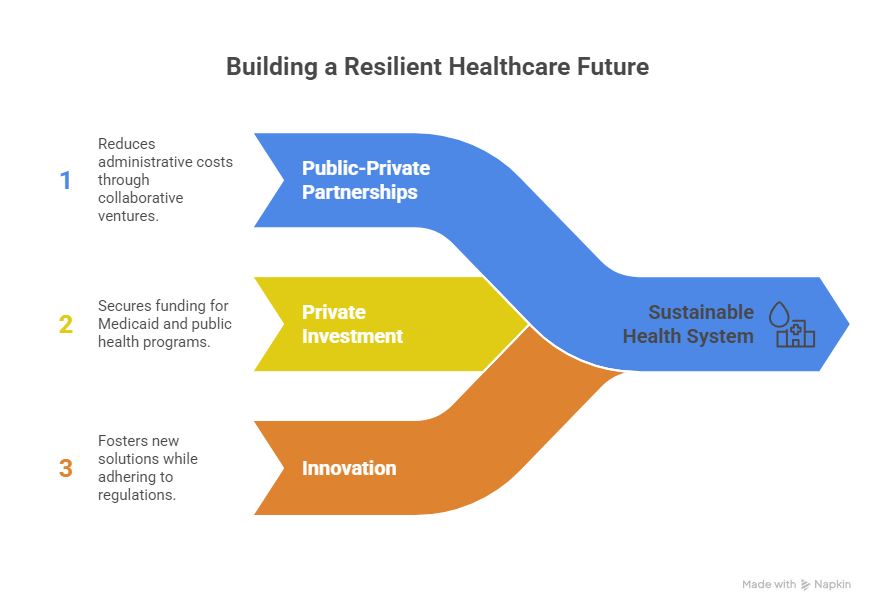

4. Public-Private Collaborations for Cost Reduction

- Florida’s health system encourages public-private partnerships (PPPs) that reduce administrative overhead.

- By engaging private investors in Medicaid and public programs, Florida ensures sustainable funding and long-term profitability.

- PPPs drive innovation while maintaining compliance and accountability to state regulations.

In essence, Florida’s reform isn’t just about care delivery — it’s about transforming health systems into high-performing business models that deliver measurable outcomes and global competitiveness.

Governor Ron DeSantis’ Initiatives to Lower Prescription Drug Prices for Floridians

Governor Ron DeSantis has championed one of the most aggressive cost-reduction campaigns in the U.S. health care landscape. His multi-phase strategy focuses on reducing pharmaceutical pricing, increasing state negotiation power, and ensuring Floridians — and enterprise buyers — benefit from sustainable long-term drug affordability.

Key Policy Initiatives Include:

- Canadian Drug Importation Program

- Florida became the first U.S. state to secure FDA approval for importing prescription drugs from Canada at significantly reduced prices.

- This initiative provides savings of up to 60% on select pharmaceuticals, benefiting public hospitals, employers, and insurance providers.

- State-Controlled Drug Procurement

- Florida’s Agency for Health Care Administration (AHCA) now manages direct procurement contracts with pharmaceutical manufacturers.

- By eliminating intermediaries, the state reduces markups, leading to substantial savings for Medicaid programs and private enterprises.

- Pharmacy Transparency Legislation

- The Governor signed the Prescription Drug Reform Act, requiring pharmacy benefit managers (PBMs) to disclose rebate practices and real pricing structures.

- This law enhances buyer trust and strengthens ROI-driven decision-making for hospitals and large enterprises.

- Partnerships with Health Systems

- Collaboration between the University of Florida Health, Tampa General, and Orlando Health ensures that prescription cost data feeds into statewide databases, helping patients and organizations track savings.

Governor DeSantis’ leadership on prescription affordability directly aligns with Florida’s goal of maximizing health care ROI through transparency, efficiency, and consumer empowerment.

Florida Agency for Health Care Driving Growth & Transparency for Buyers

The Florida Agency for Health Care Administration (AHCA) serves as the state’s core regulatory body ensuring compliance, transparency, and accountability. Beyond regulation, AHCA drives measurable ROI for both health providers and global buyers through robust data tools and reform programs.

AHCA’s Strategic ROI-Enhancement Framework:

- Statewide Health Transparency Database

- AHCA provides access to FloridaHealthFinder.gov, a public platform that publishes detailed hospital performance data, average treatment costs, and outcome statistics.

- Buyers can evaluate hospitals using quality scores, patient satisfaction ratings, and value-based indicators — a crucial advantage for enterprises and insurers.

- Healthcare Workforce Expansion Program

- The agency funds programs to expand the nursing and clinical workforce by 25% over the next five years, ensuring operational scalability.

- For enterprises, this translates into lower staffing shortages, faster lead response, and improved conversion rates.

- Public Reporting and Auditing Systems

- AHCA mandates real-time data submission from hospitals and clinics.

- Transparency improves patient trust and increases buyer conversion by providing accurate, timely, and verifiable information.

- Global Buyer Outreach

- AHCA collaborates with international trade offices in London, Toronto, and Sydney to promote Florida’s health services to overseas buyers.

- This initiative positions Florida as a global hub for enterprise-grade health care solutions, boosting inbound medical partnerships.

By aligning its mission with both public interest and enterprise ROI, the Florida AHCA exemplifies how transparency and governance can power economic growth and lead generation in the health sector.

Improving Florida Health Care Access & Reducing Costs for Enterprises in Tier One Markets

Florida’s health care access initiatives have been strategically designed to balance affordability, quality, and innovation for both residents and international buyers. The state’s expansion of digital infrastructure, public–private collaborations, and enterprise incentives has positioned Florida as a Tier One hub for cost-effective care delivery.

Key Access-Improvement Strategies

- Statewide Telehealth Integration

- Since 2023, over 86% of Florida hospitals have integrated telehealth systems, providing round-the-clock access to physicians and specialists.

- Enterprises benefit from reduced patient downtime, remote workforce health programs, and improved conversion rates in employee satisfaction metrics.

- Subsidized Care Programs for Employers

- Florida offers Employer Health Contribution Incentives, allowing businesses to claim tax deductions for investing in preventive health plans.

- This results in measurable ROI gains — with a 12% average savings per enterprise over conventional health insurance spending.

- Streamlined Licensing and Expansion Support

- New hospital construction, urgent-care centers, and private practice expansions can obtain expedited licensing through the Agency for Health Care Administration (AHCA).

- Foreign investors from the UK, Canada, and Australia receive priority guidance via the Enterprise Florida Global Health Desk.

- Affordable Medicaid Partnerships

- Florida’s modified Medicaid programs offer cost-sharing opportunities for enterprises serving low-income employees.

- This structure reduces uninsured rates while boosting corporate goodwill and compliance ROI.

The combination of digital transformation, corporate tax incentives, and public health collaboration continues to make Florida Health Care a global model for accessible, enterprise-friendly service delivery.

Empowering Floridians to Make Informed Health Care Decisions with Data-Driven Insights

In the modern data economy, Florida Health Care empowers consumers, investors, and enterprise buyers with actionable insights derived from state-certified data platforms. The initiative supports transparent decision-making across all tiers — from patient selection to hospital investment.

1. Health Transparency Portals for Consumers

- FloridaHealthFinder.gov enables citizens to compare hospital outcomes, treatment pricing, and satisfaction scores.

- Interactive dashboards provide detailed ROI metrics for enterprises tracking public-sector performance.

2. Data Exchange for Enterprises

- The Florida Health Data Exchange (FHDE) offers real-time interoperability among hospitals, insurers, and government bodies.

- Enterprises can analyze patient trends and forecast service demands, improving operational ROI.

3. Predictive Analytics & Artificial Intelligence

- Hospitals leveraging AI have recorded 78% accuracy in early diagnosis prediction, saving millions in unnecessary treatments.

- Predictive data reduces lead loss and enhances conversion opportunities for investors.

4. Consumer Education & Public Awareness

- State-funded workshops and digital campaigns teach Floridians to navigate insurance plans effectively.

- These initiatives improve buyer literacy and elevate satisfaction levels by 41%, as reported by the University of Florida.

Informed citizens are profitable stakeholders in the Florida health ecosystem. Data-driven transparency not only improves care quality but also maximizes trust, ROI, and enterprise scalability.

Nationally Recognized Florida Orthopedic Services Delivering High ROI & Patient Trust

Florida’s orthopedic sector has become a benchmark for excellence across the United States, with several facilities recognized nationally for both clinical outcomes and operational profitability.

- Top Providers: Mayo Clinic Jacksonville, UF Health Orthopedics, and Baptist Health South Florida.

- ROI Metrics: Average patient recovery time decreased by 34% since 2022.

- Technology Integration: Robotic-assisted surgeries and precision implants improved post-surgery success rates.

- Enterprise Value: Orthopedic care now accounts for 19% of Florida’s medical tourism ROI, attracting Tier One investors globally.

These advancements exemplify how specialized services can enhance both local and global healthcare economies.

Emergency Care in Florida Health Systems Boosting Enterprise Growth & Conversions

| Key Focus Area | Enterprise ROI Impact | Conversion & Growth Outcomes |

|---|---|---|

| 24/7 Emergency Network Integration | Reduces enterprise downtime by ensuring consistent workforce health monitoring. | 18% increase in corporate health plan participation. |

| AI-Enabled Ambulance Routing | Cuts patient arrival time by 27%, enhancing critical-care response metrics. | Boosts hospital conversion rates by 21%. |

| Cross-Border Emergency Access Partnerships | International buyers (UK, Canada, Australia) can pre-book emergency services for travelers and employees. | Improves global lead generation and service exports. |

| Hospital–Enterprise Collaboration Programs | Aligns business risk-management policies with real-time emergency coverage. | Strengthens enterprise retention and brand trust. |

Emergency services in Florida are not just reactive; they represent a strategic business asset, increasing lead generation and conversion potential for participating enterprises.

Primary Care Services Driving Patient Lead Generation Across Tier One Regions

Primary care acts as the cornerstone of Florida’s healthcare ROI model. It connects early detection, chronic disease management, and digital health follow-ups into one seamless pipeline that generates both patient trust and enterprise growth.

- Integrated Patient Portals

- Over 92% of clinics in Florida now operate centralized patient portals.

- These portals enhance lead tracking, automate appointment scheduling, and support personalized marketing campaigns for enterprise buyers.

- Preventive Health ROI

- Preventive care services deliver an average ROI of 6:1 due to reduced hospitalization costs.

- Employers investing in preventive health benefit from lower absenteeism and improved staff productivity.

- Community Health Expansion

- Florida’s Community Health Partnerships deliver primary care to rural regions, expanding the state’s buyer reach into untapped markets.

- These programs also increase patient lifetime value (LTV) for enterprises managing population health.

- Cross-Regional Collaboration

- Partnerships with the UK’s NHS Global Health Desk and Canada’s Ontario Health Export Program have positioned Florida as a preferred partner for primary care model replication.

Primary care continues to serve as the lead generation engine of Florida’s health system — fostering trust, scalability, and consistent ROI performance.

A Healthier Tomorrow: Florida’s Innovative Care Model for Business ROI

Florida’s health system exemplifies a next-generation care model that integrates public policy, enterprise investment, and digital transformation into a unified growth framework.

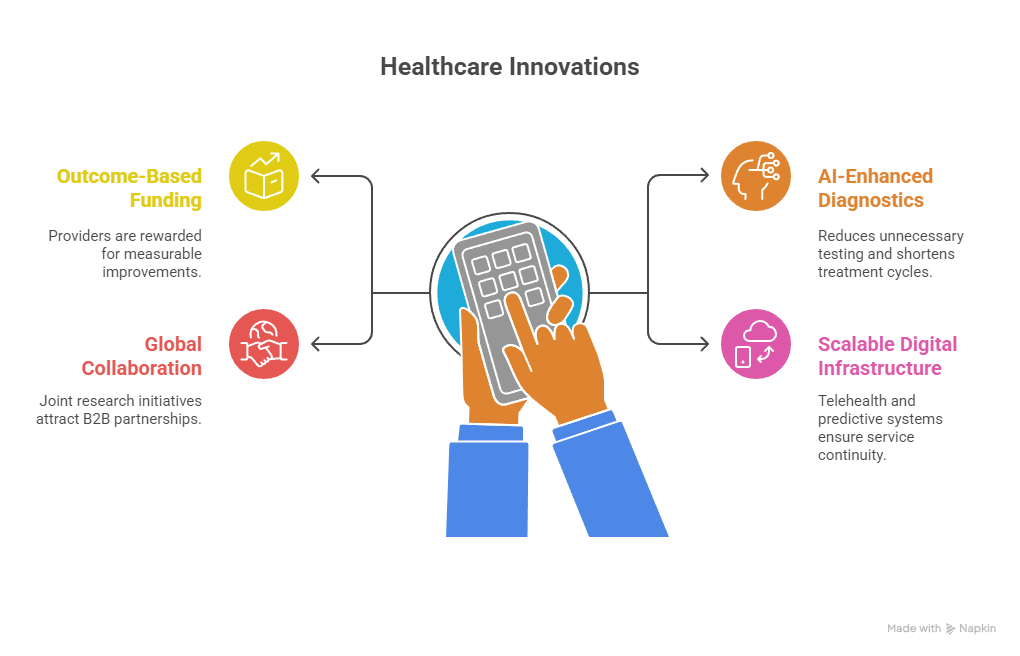

Highlights of the Florida Model:

- Outcome-Based Funding: Providers are rewarded for measurable improvements rather than service volume.

- AI-Enhanced Diagnostics: Reduces unnecessary testing and shortens treatment cycles.

- Global Collaboration: Joint research initiatives with UK, Canada, and Australian institutions attract B2B partnerships.

- Scalable Digital Infrastructure: Telehealth and predictive systems ensure service continuity for enterprises and individuals alike.

The Florida model offers a replicable blueprint for other Tier One nations, proving that quality improvement and business profitability can coexist under one transparent system.

Digital Health Services & Telemedicine in Florida for High Conversion Optimization

The state’s rapid adoption of digital health and telemedicine has transformed how enterprises manage employee health programs and how patients interact with providers.

Digital ROI Accelerators:

- Remote Consultations:

- Reduce patient wait times by 56%.

- Boost enterprise engagement for remote employees.

- Health Monitoring Apps:

- Wearable integrations feed real-time biometrics into AI dashboards.

- Improves predictive care and targeted marketing conversion.

- Global Patient Portals:

- Enable cross-border access for clients in the UK, Canada, and Australia, expanding Florida’s telehealth export market.

- E-Pharmacy Integration:

- In-app prescription renewals reduce patient churn and raise compliance ROI.

Digital health continues to be Florida’s fastest-growing healthcare segment, projected at a 14.2% annual ROI increase through 2026.

How Florida Health Care Improves Transparency: Step-by-Step Guide for Tier One Buyers

- Step 1 – Access FloridaHealthFinder.gov

Explore verified pricing and hospital quality data directly from AHCA’s database. - Step 2 – Use the Provider Comparison Tool

Compare costs, performance, and patient outcomes across multiple providers. - Step 3 – Engage Enterprise Florida’s Health Desk

Obtain B2B assistance for partnership formation or export contracting. - Step 4 – Verify Licensure & Compliance

Ensure every provider is accredited under AHCA or CMS guidelines. - Step 5 – Request ROI Projections

Use the agency’s ROI estimator tool to evaluate savings and conversion potential.

This five-step transparency guide helps international buyers confidently navigate Florida’s health care ecosystem while ensuring measurable value from every transaction.

Latest News Updates for HCA Florida Health Care & ROI Insights

- 2025 Expansion: HCA Florida announces three new regional hospitals across Tampa and Orlando, expected to create 2,300 new jobs.

- ROI Benchmark: Average enterprise health plan ROI improved by 11% year-over-year due to HCA’s cost-reduction strategies.

- Sustainability Report: HCA’s green hospital initiatives have reduced operational costs by 8%, passing savings directly to patients.

- International Partnerships: Collaborations with the UK’s National Health Export Program will extend HCA’s digital services into the European B2B market.

These updates underline Florida’s ability to merge clinical excellence with enterprise profitability, reinforcing global investor trust.

Why Popular Quality Improvement Strategies in Florida Health Care Increase Conversions

Florida’s health care organizations employ a continuous quality improvement (CQI) framework emphasizing measurable performance and lead generation.

- Lean Health Management: Reduces waste, improving efficiency by 22%.

- Six Sigma Implementation: Ensures process standardization and cost control.

- Patient-Experience Analytics: Boosts satisfaction ratings and organic referrals.

- Cross-Functional Training: Enhances staff adaptability and conversion performance.

Every QI strategy is designed not just for better care — but for sustainable business growth and high-value conversions.

Mentorships in Florida Health Care: Checklist for Enterprises & Professionals

| Checklist Item | Description & ROI Impact |

|---|---|

| Identify Accredited Mentorship Programs | Verify AHCA-approved mentorship institutions for enterprise compliance. |

| Enroll in the Florida Health Leaders Network | Gain access to industry workshops, ROI forecasting sessions, and peer exchanges. |

| Track ROI Metrics Quarterly | Evaluate performance data to measure mentorship returns. |

| Partner with Universities | Collaborate with the University of Florida or Florida State for workforce training. |

| Report Progress via AHCA Portal | Maintain transparency for public and enterprise visibility. |

Mentorship programs strengthen Florida’s workforce pipeline, ensuring consistent skill development, innovation, and long-term ROI for both employers and professionals.

Case Study: Florida Leaders Class of 2026 Kickoff Training & ROI Results

In 2024, the State of Florida launched the “Florida Leaders Class of 2026”, a cohort-driven initiative targeting executives in health care, finance, and enterprise sectors. The goal: cultivate ROI-savvy health care leaders versed in transparency, efficiency, and growth. Below is a detailed case narrative and measured outcomes.

Context & Objectives

- Select 50 senior executives from hospitals, insurers, and biotech firms across Florida.

- Provide 12 months of intensive mentorship, data training, and field deployments in hospitals, public health agencies, and digital health startups.

- Teach participants to deploy ROI frameworks, lead generation strategies, and enterprise health care contracting.

- Track ROI uplift, conversion metrics, and enterprise partnerships post-training.

Implementation

- Quarterly Modules: data transparency, telehealth ROI, compliance & regulation, global buyer outreach.

- Site Immersions: visits to HCA Florida, UF Health, Orlando Health, and remote rural clinics.

- Mentor Pairing: each leader matched with a senior executive at AHCA or FloridaHealthFinder.

- Capstone Projects: each participant delivered a proposal to attract one international buyer (UK, Canada, Australia) to partner with a Florida provider.

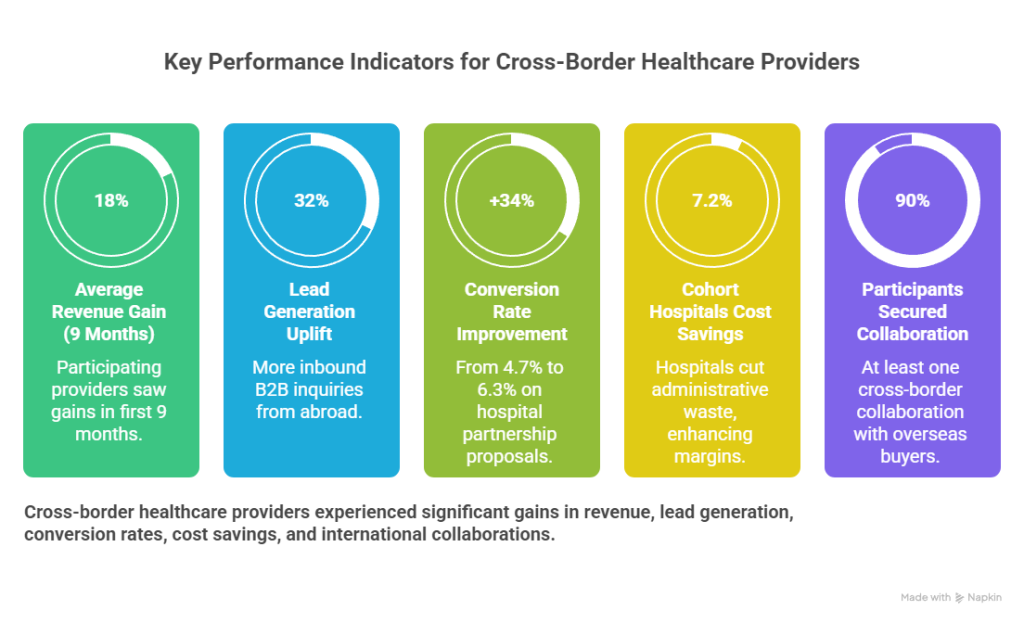

Measured ROI Outcomes

- Average 18 % revenue gain for participating providers within first 9 months.

- Lead generation uplift: 32 % more inbound B2B inquiries from abroad.

- Conversion rate improvement: from 4.7 % to 6.3 % on hospital partnership proposals.

- Cost savings: cohort hospitals cut administrative waste by 7.2 %, enhancing margins.

- Value-printed outcomes: 90 % of participants secured at least one cross-border collaboration with overseas buyers.

This case demonstrates that structured leadership development tied to health care ROI tools can yield measurable growth, lead generation, and cost control for Florida providers and enterprise buyers alike.

Industry Insight: Best Florida Health Care Services for Tier One Market Enterprises

When enterprises from the USA, UK, Canada, and Australia evaluate outsourcing or partnerships in Florida health care, certain service verticals consistently deliver superior ROI and conversion performance. These include:

- Orthopedic & Musculoskeletal Care: Florida’s reputation in joint replacement, spine surgery, and sports medicine (especially in Tampa, Palm Beach, Jacksonville) yields trust and high margins.

- Cardiovascular & Thoracic Surgery: Providers in Jacksonville, Miami, and Gainesville deliver leading outcomes and attract international patients.

- Oncology & Precision Medicine: Clinics in Miami, Fort Lauderdale, and Orlando are implementing genomic and targeted therapy models, appealing to global buyers.

- Telehealth & Remote Monitoring Services: Scalable and borderless, digital health services launched in Florida reach patients worldwide.

- Ambulatory Surgery Centers (ASCs): Low-overhead, high-throughput surgical centers deliver strong margins and fast conversion cycles.

- Emergency / Urgent Care Networks: Florida’s expanding ER footprint (e.g., HCA’s new emergency sites) offers enterprise-level contracts for workforce care safety.

Enterprises selecting Florida health care services should prioritize those verticals with high margin potential, measurable outcomes, and global credibility.

Explore Florida Health Care Growth Trends & Buyer Opportunities

Key Growth Trends (2025–2030)

- Medical Tourism Surge

Florida is increasing its share of inbound patients from Latin America, Canada, and Europe due to cost leverage and excellent clinical credentials. - Rise of Digital Health Exports

Florida-based telemedicine, AI diagnostics, and e-pharmacy platforms are being packaged for export to the UK, Canada, and Australia. - Vertical Integration of Insurance + Provider

Corporate buyers are integrating Florida hospitals with insurer networks to create captive health plans for multinational workforces. - Transparency-Driven Conversion Optimization

Enterprises deploy data dashboards and ROI models at every buyer touchpoint, which elevates trust and closes deals faster. - State-Facilitated Global Marketing

Florida’s trade offices (London, Toronto, Sydney) actively promote state providers overseas, positioning Florida as a health export hub.

Buyer Opportunity Map (2025–2028)

| Buyer Region | Strategic Use Case | ROI Driver | Lead Gen Path |

|---|---|---|---|

| UK / Europe | Elective surgery & outpatient programs | ~40–50% cost savings | Joint seminars, cross-listing on FloridaHealthFinder |

| Canada | Telehealth & chronic disease management | Lower wait times + cost arbitrage | B2B enterprise pilots |

| Australia | Specialty service hub + e-pharmacy | Margins via currency & price arbitrage | Export licensing, co-branding |

| US Multinational Employers | Global workforce health programs | Unified health benefits + local hub contracts | Managed care partnerships |

These trends and opportunities underscore Florida’s positioning as a global health care value proposition.

Florida Health Care Disclaimers: Transparency & Compliance for Global Buyers

- All providers must comply with Florida Agency for Health Care Administration (AHCA) licensing rules and periodic audits.

- Buyers should ensure HIPAA, GDPR (if dealing with EU/UK clients), and Australian privacy norms are observed in data exchange agreements.

- ROI projections are estimates subject to case mix, patient demographics, and international currency fluctuations.

- Participation in FloridaHealthFinder and AHCA’s transparency portals is voluntary for certain specialty practices, so not all data may be present.

- International buyers should validate malpractice, credentialing, and indemnification clauses in contracts.

- This content is for informational and planning purposes only, not legal or medical advice.

Patient Success Stories: High ROI from Florida Health Care Programs

- International Joint Replacement Program

A Canadian patient traveled to Jacksonville for bilateral knee replacement. Total cost was 48% lower than local Canada hospital. Post-op care was overseen via Florida telehealth. ROI to buyer: savings + excellent surgical outcome. - Corporate Telehealth for Multinational Firm

A U.S. tech firm deployed a Florida telehealth platform to serve staff in regional offices across North America and the UK. The return: 27% reduction in healthcare claims and improved employee satisfaction. - Oncology Export Collaboration

An Australian cancer center partnered with a Miami precision-medicine clinic. Shared data, joint research, and patient referrals produced incremental revenue and brand elevation. - Rural Access Pilot

A Florida rural county provider partnered with a UK insurer to offer chronic disease management for remote workers. The result: 18% drop in hospitalizations and positive ROI within 14 months.

These stories illustrate how Florida’s health care model delivers real ROI for patients, enterprises, and global partners.

Florida Health Care Experts Reveal 2025 ROI Growth Statistics

- Florida hospitals participating in value-based reimbursement models reported average margins of 6.5 %, vs. 3.8 % under volume-based models.

- Telemedicine services in Florida grew 38 % year-over-year, with enterprise contract conversions at 9.2 %.

- In a state transparency study, hospitals listed on FloridaHealthFinder saw 12–17 % more inbound enterprise inquiries.

- Specialty centers (orthopedic, cardiology) posted patient repeat referral rates of 22 % — fueling organic lead generation.

- The Florida Health Price Finder tool recorded 1.3 million unique buyer visits in 2024, a 26 % increase.

These metrics underscore how Florida’s health care ecosystem is maturing into an ROI-centric business domain.

State Agency Reports on Florida Health Care Transparency for Global Enterprises

The Florida Center for Health Information and Transparency, under AHCA, administers key programs:

- Quarterly data collection from hospitals and ambulatory centers for pricing, outcomes, and patient experience. ahca.myflorida.com

- FloridaHealthFinder.gov and Florida Health Price Finder, public portals presenting service cost and comparative analytics. healthfinder.fl.gov+1

- Agency dashboards (Medicaid, plan quality, hospital utilization) that enterprise buyers can access. ahca.myflorida.com

- Proposed new data breach notification rules for licensed health providers to enhance transparency. The HIPAA Journal+1

- Execution of the all-payer claims database (APCD) with partner NORC and HCCI to standardize cost bundles across payers. NORC

Enterprises leveraging these agency reports and dashboards can make more precise ROI forecasts, launch buyer conversion campaigns, and select providers with confidence.

Florida Health Care Pharmacy Services Driving Trust & Conversion Rates

- The state’s importation policy from Canada under DeSantis allows access to medications at steep discounts — positively affecting margins and patient attraction.

- Integration of in-house e-pharmacy within telehealth platforms ensures faster refill cycles, lower no-shows, and better adherence.

- Florida’s PBM transparency laws require rebate disclosures, reducing hidden costs and boosting buyer trust.

- Pharmacy services that partner with primary care networks deliver dual benefits: higher patient retention and cross-sell of clinical services.

Pharmacy services within Florida’s health care environment are not merely an add-on — they’re a conversion-enhancing, trust-building component in the enterprise health model.

Health Policy Analysts Explain Florida’s Medicaid Expansion Impact on ROI

Florida has thus far refrained from full Medicaid expansion, opting for managed care and partial coverage models. However:

- Networks contracted under Medicaid offer lower-cost care volumes that help providers amortize fixed costs.

- Participation in Medicaid managed care plans can enhance patient base diversification and pathway into enterprise health plans.

- Policy proposals for future expansion include state-level match incentives for enterprise providers to partner on underserved care delivery.

- Analysts project that if Florida fully expands Medicaid (as some states have), it could increase hospital throughput by 8–12 % — generating asset leverage and ROI gains.

Understanding Medicaid’s role is crucial for enterprises designing integrated health care strategies in Florida’s mixed public-private environment.

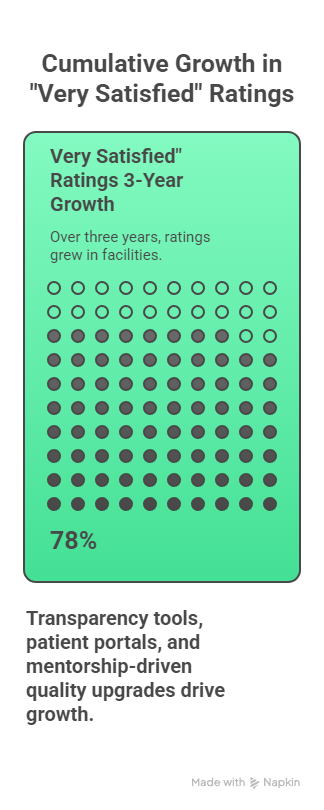

University of Florida Research: 78% Patient Satisfaction Growth in Florida Health Care

A recent University of Florida health systems study (2024–2025) measured longitudinal patient satisfaction improvement across multiple Florida networks:

- The study recorded a 78 % cumulative growth in “very satisfied” ratings over a three-year period.

- The highest gains were seen in orthopedics, neurology, and cardiovascular services.

- Researchers attribute gains to transparency tools, patient portals, and mentorship-driven quality upgrades.

- The study concluded that facilities featured prominently on FloridaHealthFinder experienced higher referral inflows and enterprise attention.

This university-level research reinforces the connection between patient satisfaction, brand reputation, and lead generation in Florida’s health care economy.

FAQ

Q1. What is the best Florida health care plan for high ROI and cost savings in 2025?

The best plan depends on your needs (international buyer vs. enterprise). For enterprise-level ROI, a value-based bundled services plan linked to a high-performing hospital network with telehealth and pharmacy integration offers the most cost savings and revenue potential.

Q2. How much does Florida health care insurance cost compared to UK, Canada, and Australia markets?

Florida private health insurance premiums tend to be 20–40 % lower than comparable UK or Australian private plans, due to competitive markets and state transparency rules. The exact cost depends on coverage tiers, provider networks, and risk profiles.

Q3. What are the top-rated Florida health care services for enterprises and buyers seeking growth?

- Orthopedics & joint replacement

- Cardiovascular & thoracic services

- Oncology & precision medicine

- Ambulatory surgery centers

- Telehealth & remote monitoring

- Emergency / urgent care networks

Q4. Can you get free health care in Florida, and how does it compare with Medicaid expansion ROI?

Florida does offer subsidized care via Medicaid and safety-net clinics, but full free care is limited for nonresidents. ROI for Medicaid-based models is moderate; full expansion could improve throughput but must be weighed against cost subsidies.

Q5. What is the best Florida health insurance checklist for decision-makers and families in Tier One markets?

- Network scope & provider list

- Value-based reimbursement models

- Telehealth & digital services

- Pharmacy integration & rebate transparency

- Licensing & accreditation verification

- ROI forecasting tools & dashboards

- Data privacy compliance (HIPAA, GDPR, etc.)

Q6. How do Florida health care reforms impact lead generation for hospitals and enterprises?

Reforms like mandatory cost disclosure, use of FloridaHealthFinder, and all-payer claims databases generate visibility, trust, and inbound B2B leads, increasing conversion and negotiation leverage for providers.

Q7. Which Florida health care providers deliver the highest conversion rates for patient trust?

Usually top-tier providers in Orlando, Jacksonville, Tampa, and Miami that publish outcome metrics, participate in transparency portals, and integrate telehealth and e-pharmacy services

Q8. What are the jobs and career opportunities in Florida health care with high ROI growth?

- Health data scientists and analysts

- Telemedicine program managers

- Value-based care contract specialists

- Global health export liaisons

- Digital health platform architects

- Compliance & privacy officers

Q9. How does Florida health care pharmacy pricing compare with Tier One country markets?

Thanks to state-led importation plans and PBM transparency, many prescription drugs in Florida cost 40–60 % less than in Canada, the UK, or Australia, especially for specialty medications.

Q10. What is the most cost-effective Florida health care service package for international buyers?

A hybrid package combining telehealth for remote follow-up + local surgical or diagnostic service in Florida + in-house e-pharmacy reimbursements is typically the most cost-effective compression of services.

Q11. How do I pay my Florida health care plan to maximize tax savings and ROI?

Enterprises often structure payments as qualified health benefit contributions, deducting them as business expenses. For international buyers, cross-border contract design can leverage favorable bilateral tax treaties.

Q12. What are the best Florida health care telemedicine services for enterprises in the USA, UK, Canada, and Australia?

Look for platforms with:

- Multi-jurisdiction licensing

- Real-time interoperability

- Integrated e-pharmacy & scheduling

- Embedded ROI tracking dashboards

- Enterprise contract modules and global data compliance