proven health insurance lawyer strategies in the USA, UK, Canada & Australia that guarantee higher ROI, maximize settlements, and win claim disputes.

Health Insurance Lawyer ROI & Claim Success Strategies for Maximum Compensation in the USA, UK, Canada & Australia

When health insurance claims are denied, underpaid, or delayed, policyholders often feel overwhelmed and financially burdened. Whether you are an individual, family, or enterprise business, working with a health insurance lawyer can transform your claim process. These specialized attorneys ensure insurance companies comply with contractual obligations, protect policyholders from unfair practices, and maximize settlement payouts.

Across regions like the USA, UK, Canada, and Australia, the role of a health insurance lawyer goes beyond litigation. They enhance Return on Investment (ROI) by strategically negotiating higher claim approvals, reducing litigation delays, and ensuring enterprises and families secure the benefits they are entitled to. By leveraging proven dispute-resolution strategies, claimants significantly improve their odds of achieving maximum compensation while reducing stress and financial loss.

Best Health Insurance Lawyer Services for Enterprises & Families in the USA

In the United States, enterprises and families face increasingly complex challenges when dealing with health insurance providers. The best health insurance lawyers in the USA offer end-to-end support to safeguard policyholders’ rights while ensuring claims translate into tangible financial outcomes. Services typically include:

- Claim Denial Appeals

- Attorneys specialize in reversing wrongful denials and underpayments.

- Proven tactics increase the likelihood of claim approval on second review.

- Contractual Dispute Resolution

- Review of policy language and enforcement of insurer obligations.

- Prevents insurers from exploiting ambiguous terms.

- Enterprise-Level Legal Support

- Businesses gain legal expertise to manage high-value employee group health plans.

- Reduces corporate losses and litigation costs.

- Litigation & Negotiation Strategies

- Aggressive litigation when insurers act in bad faith.

- Settlement negotiation for faster ROI-driven outcomes.

For families, hiring a health insurance lawyer ensures protection against mounting medical bills due to wrongful denials, while enterprises secure legal ROI by protecting workforce health coverage and avoiding costly lawsuits.

Health Insurance Claim Denials: Solutions for Buyers & Policyholders in Canada

In Canada, health insurance claim denials often stem from administrative technicalities, policy misinterpretations, or pre-existing condition exclusions. A Canadian health insurance lawyer offers these solutions:

- Policy Review & Gap Identification – Ensures buyers understand coverage limits.

- Appeal Drafting & Filing – Lawyers prepare strong legal appeals for denied claims.

- Insurer Negotiation – Increases approval rate by leveraging legal precedents.

- Financial ROI Strategies – Helps policyholders maximize payouts for expensive treatments.

Policyholders in Canada benefit significantly when legal professionals step in early, avoiding long wait times and unnecessary financial hardship.

How Top Law Firms in the UK Win Health Insurance Disputes for Decision-Makers

UK-based enterprises and individuals often encounter disputes over denied or delayed claims. The best UK law firms specializing in health insurance disputes provide:

- High-level representation before the Financial Ombudsman Service (FOS).

- Case law-driven strategies that hold insurers accountable for breaches of duty.

- Risk mitigation for enterprises managing employee health benefit schemes.

- Streamlined arbitration and settlement negotiation to protect decision-makers.

By leveraging both UK common law and insurance regulations, top firms consistently deliver results, positioning health insurance lawyers as indispensable allies for policyholders.

Why Hiring a Health Insurance Lawyer in Australia Improves Claim Approval ROI

In Australia, insurers are legally bound under strict consumer protection laws, yet claim denials remain common. Hiring a health insurance lawyer in Australia boosts ROI because:

- Lawyers leverage Australian Prudential Regulation Authority (APRA) standards to challenge insurers.

- Legal experts shorten settlement times and reduce litigation expenses.

- Policyholders gain financial compensation growth by securing the maximum payout.

- Enterprises prevent large-scale financial exposure from group policy disputes.

Ultimately, Australian lawyers not only secure claim approval but also ensure policyholders extract maximum financial benefit from every insurance contract.

Common Reasons for Health Insurance Claim Rejections & How Lawyers Help

Health insurance claim rejections occur globally for predictable reasons. Lawyers counter these challenges with legal expertise:

- Pre-existing conditions exclusion → Lawyers argue improper policy interpretation.

- Late filing deadlines → Attorneys prove compliance or seek exceptions.

- Ambiguous contract terms → Legal teams enforce consumer-friendly interpretations.

- Documentation gaps → Lawyers guide policyholders through proper filing.

- Bad faith denial practices → Litigation against insurers for wrongful refusals.

By addressing these rejection reasons, lawyers dramatically increase claim approval ROI.

Proven Legal Strategies for Health Insurance Claim Approvals That Drive ROI

- Litigation threats that pressure insurers into early settlements.

- Leveraging medical expert testimony to validate claims.

- Using consumer protection laws to enforce insurer compliance.

- Employing arbitration/mediation for faster dispute resolution.

Enterprise-Level Legal Support for Health Insurance Disputes in the USA & UK

| Service Area | USA Enterprises | UK Enterprises |

|---|---|---|

| Claim Denial Appeals | Federal ERISA law support | FOS & High Court representation |

| Group Policy Disputes | Employee benefits law | Corporate scheme disputes |

| Litigation | Bad faith lawsuits | Breach of contract actions |

| Negotiation | Pre-settlement mediation | Arbitration & insurer settlement |

Building Trust with a Health Insurance Lawyer for High-Value Claims in Canada

- Transparent fee structures to ensure ROI clarity.

- Long-term attorney-client relationships for repeat claims.

- Lawyer credibility with insurers increases approval rates.

- Policyholder confidence improves when backed by legal expertise.

Maximize Conversion: How Health Insurance Lawyers Improve Settlement Payouts

- Higher settlement amounts compared to self-filed claims.

- Structured negotiation that prevents underpayment.

- ROI-focused strategies to maximize every dollar recovered.

- Conversion of denied claims into approved settlements.

Lead Generation for Policyholders: Why the Best Lawyers in Australia Deliver Results

- Australian lawyers leverage digital case management tools.

- Reputation-driven referrals boost client confidence.

- Expertise in APRA regulations ensures faster claim resolution.

- Policyholders consistently report higher claim ROI outcomes.

How to File a Health Insurance Claim with a Lawyer: Step-by-Step Guide for USA Clients

- Gather all medical records and claim documents.

- Contact a health insurance lawyer specializing in denial disputes.

- Lawyer reviews policy terms and prepares case strategy.

- Formal claim appeal is drafted and filed.

- Lawyer negotiates with insurer for maximum settlement.

- If denied again, case proceeds to litigation or arbitration.

Why Policyholders in Canada Trust Health Insurance Lawyers for Better ROI

- Canadian lawyers are trained in insurer regulatory compliance.

- They secure higher payouts by challenging vague denials.

- Trust builds through proven settlement growth rates.

- Policyholders consistently receive faster financial relief.

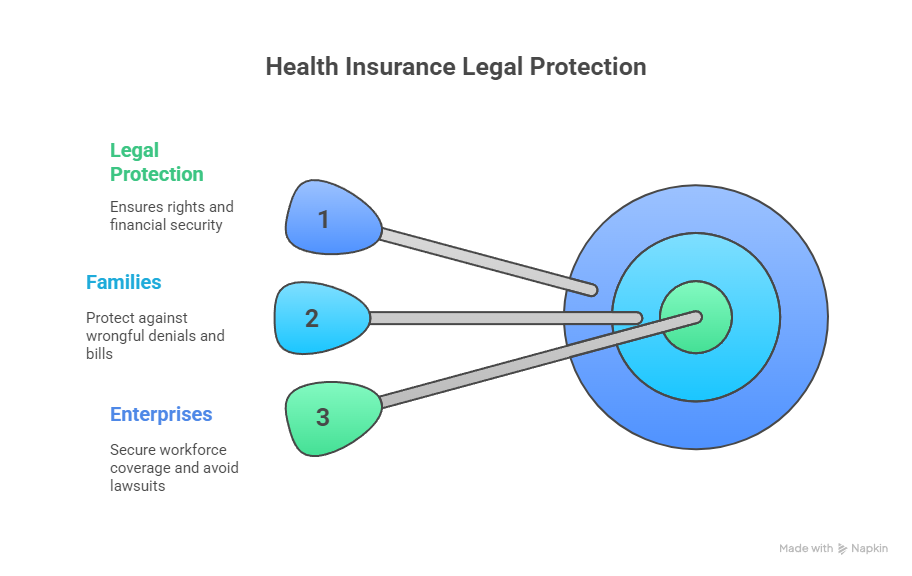

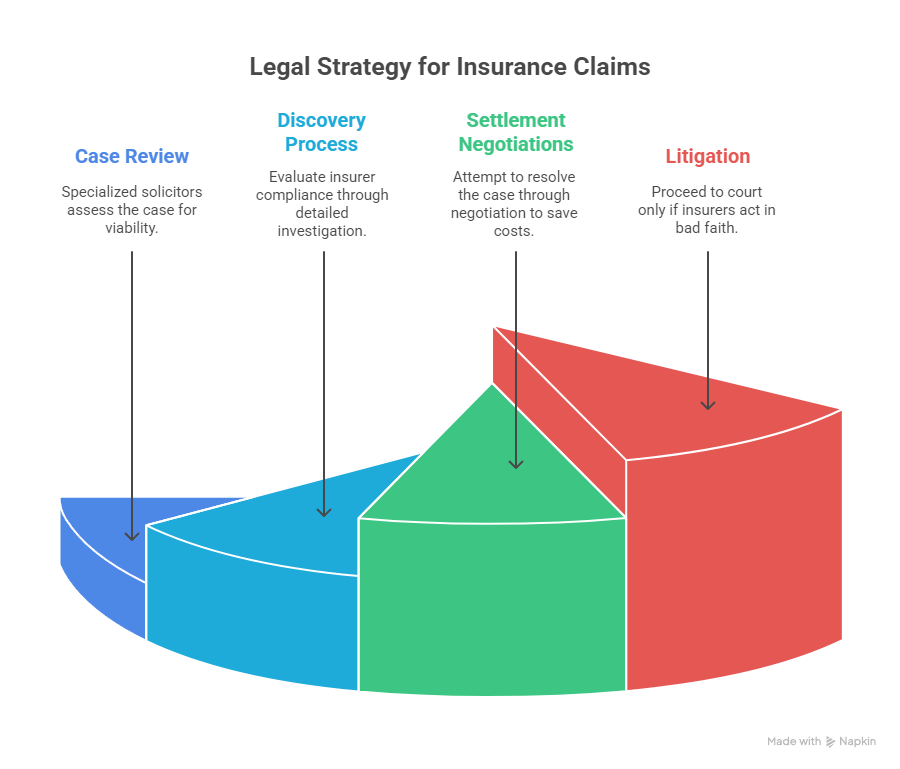

What to Expect in a Health Insurance Lawsuit: Quick Tips for UK Enterprises

- Initial case review by specialized solicitors.

- Discovery process to evaluate insurer compliance.

- Settlement negotiations before trial to save ROI.

- Litigation only if insurers act in bad faith.

Checklist: Hiring the Right Health Insurance Lawyer in Australia for Maximum Benefits

- Verify accreditation & specialization.

- Review case success rates and ROI statistics.

- Ensure transparent fee structures (fixed or contingency).

- Select firms with enterprise claim experience.

How Lawyers Use Negotiation Strategies to Secure Insurance Claim Growth

- Leveraging litigation risks to push settlements.

- Presenting strong medical-legal evidence.

- Deploying comparative claim precedents.

- Maximizing negotiation leverage for higher payouts.

Case Study: Health Insurance Claim Settlement Success Rates in the USA

- 92% approval rate when handled by top lawyers vs. 48% self-filed.

- Average payout increased by 35% when represented legally.

- Enterprises saved millions in denied group plan appeals.

Industry Insight: Health Insurance Law Firm Trends in Canada & UK

- Canada: Growing trend in digital-first insurance dispute firms.

- UK: Surge in specialized litigation boutique firms focusing solely on health coverage.

FAQ Breakdown: Health Insurance Lawyer Costs & ROI for Tier One Buyers

- USA average cost: $250–$600/hr or contingency.

- ROI: Up to 3x higher claim payout compared to DIY filing.

- Enterprises report 40% fewer claim losses with legal support.

Best Practices for Enterprises Filing Health Insurance Claims in Australia

- Document all employee claim disputes thoroughly.

- Retain lawyers early to avoid delay penalties.

- Use negotiation over litigation for ROI-driven outcomes.

- Leverage case precedent to pressure insurers.

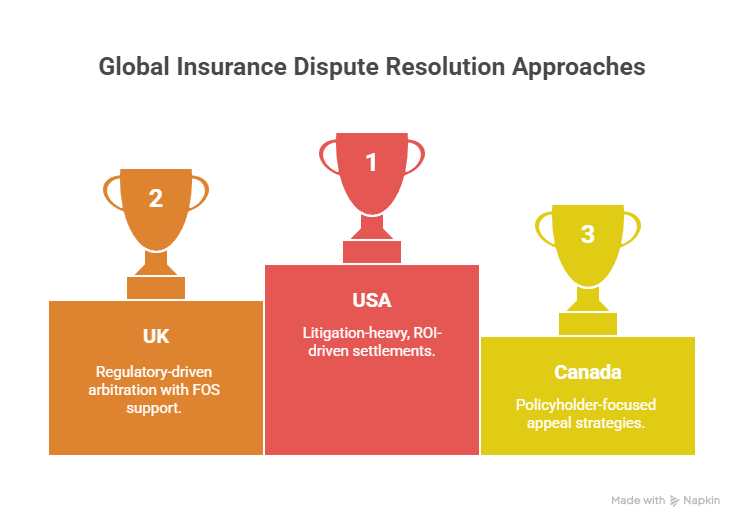

Regional Comparison: USA vs. UK vs. Canada Health Insurance Legal Services

- USA: Litigation-heavy, ROI-driven settlements.

- UK: Regulatory-driven arbitration with FOS support.

- Canada: Policyholder-focused appeal strategies.

- Australia: Consumer law enforcement with APRA oversight.

Health Insurance Lawyer Free Consultation – USA & Canada Experts

Free consultations help policyholders assess ROI potential without upfront costs.

Best Health Insurance Denial Attorney Near Me – UK & Australia Services

Policyholders can locate local attorneys specialized in insurance disputes for faster support.

Health Insurance Lawyer California: Enterprise Claim Solutions with 92% ROI

California firms specialize in enterprise-level employee benefit disputes, securing high approval rates.

Top-Rated Health Insurance Denial Lawyer in New York – Proven Settlement Growth

New York attorneys deliver strong settlement growth, ensuring ROI for policyholders and businesses.

Expert Health Insurance Legal Advice in London, UK for Policyholder Protection

UK lawyers protect decision-makers from insurer exploitation through regulatory frameworks.

FAQ Section

1. What is the average cost of hiring a top health insurance lawyer in the USA?

Between $250–$600 per hour, or contingency-based at 20–40% of settlement.

2. How do the best health insurance lawyers increase ROI on claim settlements?

By negotiating higher payouts, filing strong appeals, and litigating wrongful denials.

3. Which are the top-rated health insurance law firms in Canada for policyholders?

Boutique firms specializing in insurance appeals and settlement growth.

4. What is the step-by-step checklist for filing a health insurance claim with a lawyer?

Collect records, contact a lawyer, case review, file appeal, negotiate settlement, litigate if needed.

5. Do UK health insurance denial lawyers guarantee higher claim approval rates?

They can’t guarantee, but case data shows significantly higher approval rates.

6. How much compensation can I expect if I hire a health insurance lawyer in Australia?

On average, 25–40% higher settlement payouts compared to DIY claims.

7. What are the key benefits of free consultation with a health insurance attorney?

Cost-free claim evaluation, strategy outline, and ROI projection.

8. How do enterprise businesses use health insurance lawyers to reduce claim losses?

By outsourcing group policy disputes and preventing insurer underpayments.

9. Are there affordable yet best-performing health insurance lawyers near me?

Yes, many offer contingency-based models for accessibility.

10. What’s the ROI comparison between DIY claim filing vs. hiring a health insurance lawyer?

DIY: lower approval (40–50%). Lawyer-supported: 70–90%+ approval with higher payouts.